In a hospital where patient care and treatment are the top priorities, billing errors can often create unnecessary complications. These errors, from incorrect coding to confusion over insurance details, can lead to delays and financial disputes that affect both the hospital and patients. A patient might receive a bill that doesn’t align with the services they received, or a hospital might struggle with delayed payments due to billing inaccuracies. These issues highlight a serious challenge in healthcare administration.

However, with the advent of Payment Service Providers (PSPs), hospitals now have a powerful solution to address these billing issues. PSPs help hospitals reduce errors by automating payment processes, enhancing transparency, and ensuring compliance with industry standards. In this blog, we will discuss how PSPs are helping hospitals improve their billing systems and reduce errors, resulting in smoother operations and a better experience for both patients and healthcare providers.

Table of Contents

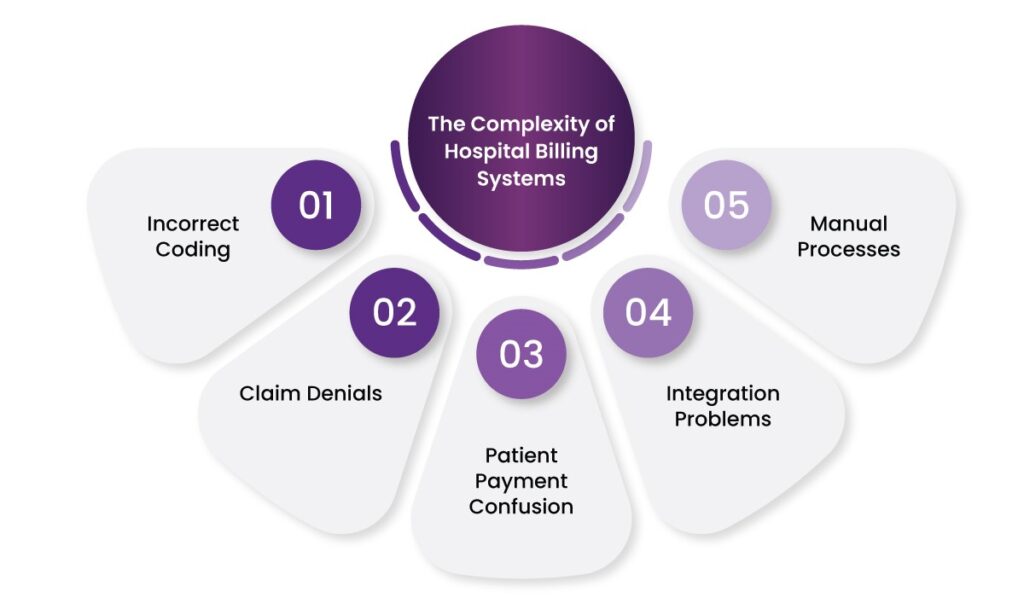

The Complexity of Hospital Billing Systems

Before understanding how PSPs can help reduce billing errors, it’s important to understand the key challenges that hospitals face in their billing systems. The U.S. healthcare system relies on a multi-payer model, where payments come from a variety of sources, including private insurance, government programs like Medicare and Medicaid, and out-of-pocket payments from patients. This complexity often leads to issues such as:

- Incorrect Coding: Hospitals use a coding system (CPT, ICD-10) to describe services, procedures, and diagnoses. Incorrect coding, whether due to human error, outdated codes, or misunderstanding, can lead to denied claims and delayed reimbursements.

- Claim Denials: Insurers often deny claims for reasons such as incorrect or incomplete information, non-covered services, or technical errors. These denials require appeals, which add to administrative costs and delays.

- Patient Payment Confusion: Patients may struggle to understand their medical bills due to unclear or overly complex charges, leading to delayed or missed payments.

- Integration Problems: Billing systems often have difficulty integrating with hospital management software and Electronic Health Record (EHR) systems, which can lead to inconsistent billing and payment errors.

- Manual Processes: Many hospitals still rely on manual methods to verify insurance details, submit claims, and process payments. This not only increases the risk of errors but also takes up valuable time and resources.

Given the many touchpoints involved in hospital billing, it’s easy to see why errors are so common. However, Payment Service Providers can be the solution to reduce these challenges.

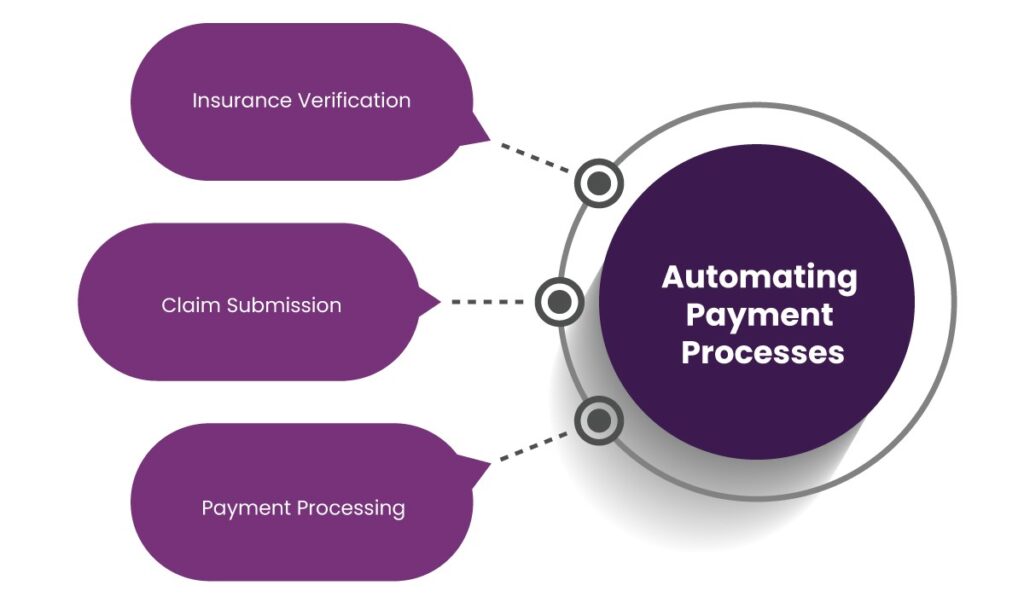

1. Automating Payment Processes

One of the primary ways in which PSPs can help hospitals reduce billing errors is by automating payment processes. Manual entry of payment information, insurance claims, and coding increases the likelihood of human error. PSPs integrate with hospital billing systems, automating many of these tasks, such as:

- Insurance Verification: PSPs can instantly verify insurance coverage through their systems, ensuring that the hospital knows which services will be covered by the insurer before treatment is provided. This reduces the chances of submitting claims for services that are not covered or getting the wrong insurance information.

- Claim Submission: PSPs can automate the submission of claims to insurance companies, reducing the chance of submission errors such as incorrect codes or incomplete information.

- Payment Processing: PSPs offer the ability to process payments from a variety of methods—credit cards, digital wallets, bank transfers, and more—automatically linking payments with the corresponding accounts. This reduces the likelihood of manual errors during payment reconciliation.

For example, PayNova allows healthcare providers to process payments directly from patients. You can integrate effortlessly with hospital management platforms to automatically process claims and payments, reducing errors from manual data entry.

By automating these tasks, hospitals can save time, reduce administrative costs, and significantly lower the chances of human error.

2. Real-Time Insurance Verification

Incorrect insurance verification is one of the most common reasons for billing errors and claim denials. Without accurate insurance information at the time of service, hospitals may submit claims that are denied or delayed, affecting both cash flow and patient satisfaction.

PSPs can help by integrating real-time insurance verification into the billing process. This technology automatically checks a patient’s insurance details before or during service delivery, ensuring that the coverage is valid and that the correct information is used. By integrating this with the hospital’s EHR and Practice Management System (PMS), PSPs make sure that the patient’s insurance details are accurate, reducing the risk of claim rejections due to outdated or incorrect data.

In addition, real-time insurance verification allows hospitals to manage patient financial responsibilities upfront. With accurate coverage details, hospitals can calculate patient co-pays, deductibles, and any out-of-pocket costs, making it easier to inform patients about their responsibilities and collect payments in a timely manner.

Paynova, for example, offers advanced tools for real-time verification and payment collection, reducing errors from manual insurance checks and enhancing the overall payment experience.

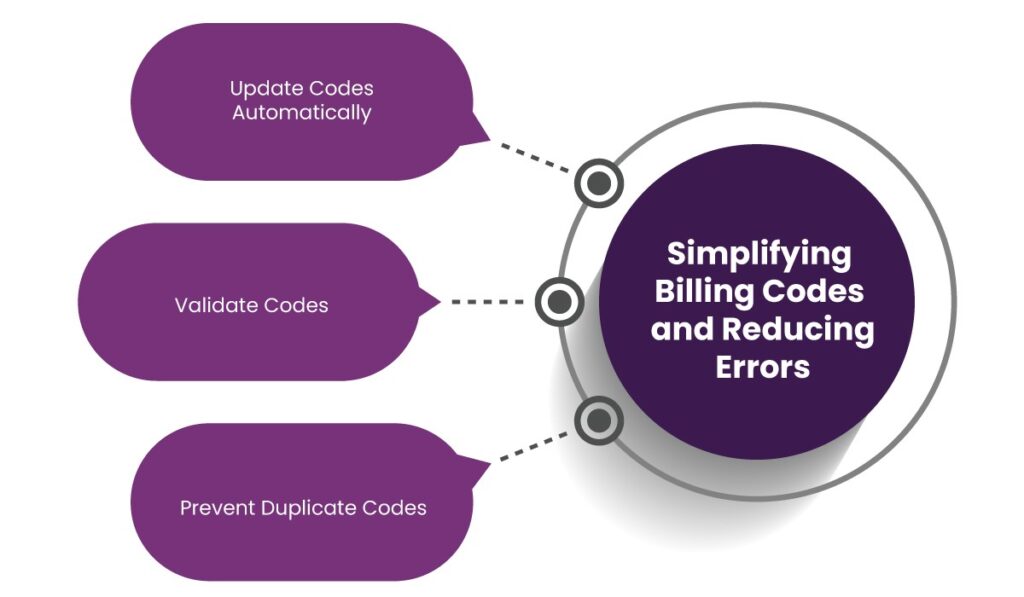

3. Simplifying Billing Codes and Reducing Errors

Hospitals rely on a complex system of codes (CPT and ICD-10 codes) to describe medical diagnoses and services provided. These codes must be accurate and up-to-date to ensure that insurance companies reimburse hospitals appropriately. Mistakes in coding are one of the leading causes of denied claims and delayed payments.

PSPs can integrate with the hospital’s coding and billing systems to minimize errors. With a dedicated payment gateway, hospitals can:

- Update Codes Automatically: PSPs ensure that coding systems are updated in real-time, reducing the risk of outdated codes causing claim rejections.

- Validate Codes: Payment systems can validate the codes before submission to ensure accuracy, automatically identifying discrepancies or issues with codes.

- Prevent Duplicate Codes: By keeping track of previously submitted codes, PSPs help prevent hospitals from submitting duplicate codes that may lead to unnecessary errors and denials.

For instance, ZirMed integrates coding validation within its platform to flag potential coding errors before submission, allowing the hospital’s billing team to correct mistakes prior to sending claims.

By simplifying the coding process and providing validation at each step, PSPs reduce the risk of errors that can lead to significant billing problems.

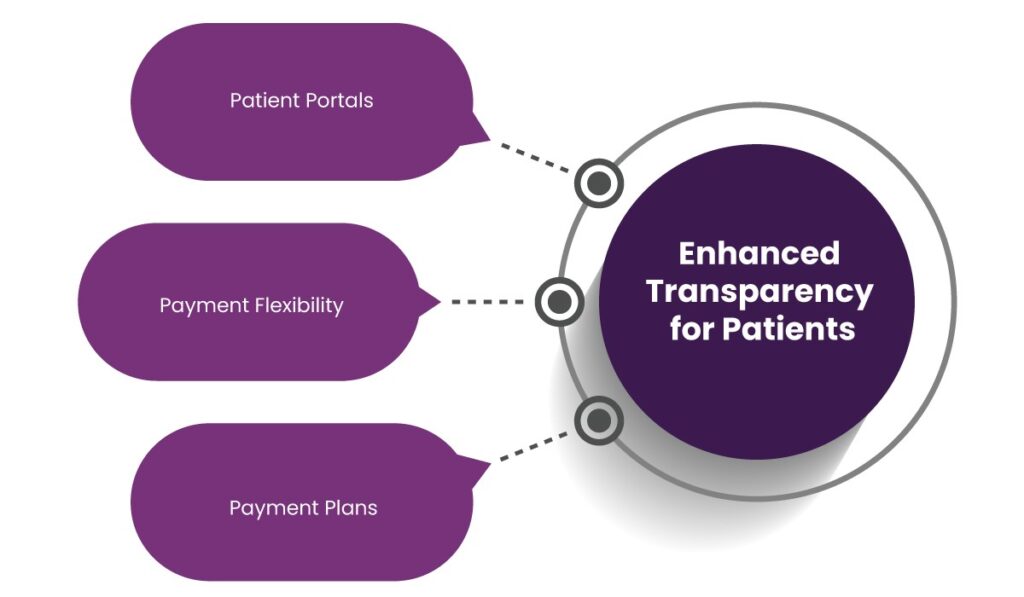

4. Enhanced Transparency for Patients

One of the most frustrating aspects of healthcare billing is the lack of transparency. Patients often receive complex medical bills that they may not fully understand, leading to confusion and delayed payments. When patients are unsure about their charges, they are less likely to pay promptly, which can result in financial difficulties for hospitals.

PSPs can improve transparency by offering:

- Patient Portals: PSPs often come with integrated patient portals that allow patients to view their bills, understand charges, and make payments online. With a clear and itemized breakdown of services, patients can see exactly what they are being billed for, reducing confusion and frustration.

- Payment Flexibility: PSPs offer various payment methods such as credit/debit cards, digital wallets, and bank transfers. By providing multiple payment options, hospitals make it easier for patients to pay their bills promptly, reducing the chances of missed payments.

- Payment Plans: For larger medical bills, Payment service providers can help hospitals set up flexible payment plans. This helps patients manage their financial responsibility over time while ensuring hospitals receive payments without delays.

Paynova excels in providing flexible payment solutions, including the ability to offer tailored payment plans and clear, detailed billing information through their platform. This enables patients to understand and manage their financial obligations, thereby reducing confusion and billing errors.

By offering better transparency and flexibility in payments, payment service providers can improve the overall patient experience and reduce errors that stem from payment confusion.

5. Ensuring Compliance and Data Security

In the healthcare sector, compliance is crucial. Hospitals are required to follow strict regulations like HIPAA (Health Insurance Portability and Accountability Act) to protect patient data and ensure that payments are securely processed. Compliance errors can result in significant penalties, data breaches, and loss of patient trust.

Payment Service Providers are equipped with advanced security features, such as end-to-end encryption, tokenization, and secure payment processing, to ensure that sensitive patient information is protected throughout the payment process. Additionally, PSPs are designed to comply with key healthcare regulations, including:

- HIPAA Compliance: PSPs ensure that patient financial data is handled according to HIPAA guidelines, ensuring the confidentiality and privacy of patient information.

- PCI-DSS Compliance: Payment Service Providers also comply with the Payment Card Industry Data Security Standards (PCI-DSS), which regulate how payment card data should be securely processed and stored.

By integrating a PSP that prioritizes security and compliance, hospitals can protect both their patients’ data and their own reputation while reducing errors related to data breaches or non-compliance.

6. Advanced Analytics and Reporting

Billing errors often arise from a lack of visibility into the billing process. Hospitals that don’t have detailed insights into their payment systems may miss issues that could lead to errors or inefficiencies. PSPs offer advanced analytics and reporting features that allow hospitals to track and monitor their billing performance in real-time.

PSPs provide:

- Detailed Reporting: Hospitals can access detailed reports on claims, payments, denials, outstanding balances, and payment histories, allowing them to track trends and identify areas for improvement.

- Financial Insights: With real-time financial data, hospitals can analyze their revenue cycle and cash flow more effectively, allowing them to make informed decisions to optimize billing processes.

- Error Detection: Through data analysis, PSPs can help detect recurring billing errors, claim denials, or payment delays, enabling hospitals to take proactive measures to prevent them.

Paynova is particularly useful here, offering robust reporting features that allow hospitals to track billing and payment trends, spot errors early, and make adjustments to improve accuracy.

By leveraging the reporting and analytics provided by PSPs, hospitals can ensure that billing processes are running smoothly and take immediate action to address any issues before they lead to larger problems.

Conclusion

Billing errors in hospitals are not only costly but can also undermine patient trust and hinder financial stability. Payment Service Providers offer hospitals the tools they need to reduce these errors and streamline their payment systems. Through automation, real-time insurance verification, improved transparency for patients, and advanced analytics, PSPs can help hospitals improve billing accuracy, reduce administrative costs, and enhance patient satisfaction. By integrating PSP technology into their payment systems, hospitals can ensure that their billing processes are more efficient, accurate, and secure—ultimately benefiting both the hospital and its patients.

Paynova, with its real-time insurance verification, flexible payment solutions, automated billing processes, and strong reporting features, is an excellent example of how a PSP can significantly reduce billing errors. By adopting such technology, hospitals can streamline their operations, reduce costly errors, and improve the overall patient experience.

Frequently Asked Questions (FAQs):

- How can Payment Service Providers (PSPs) help reduce billing errors in hospitals?

PSPs automate payment processes, verify insurance details in real time, and simplify billing codes, minimizing human errors and improving accuracy in billing.

- What are the common billing errors in hospitals?

Common errors include incorrect coding, claim denials, patient payment confusion, and integration problems between billing and hospital management systems.

- How do PSPs automate the billing process?

PSPs integrate with hospital systems to automate insurance verification, claim submission, and payment processing, reducing manual errors and saving time.

- What is real-time insurance verification, and why is it important?

Real-time insurance verification checks a patient’s insurance details instantly, ensuring accurate coverage and reducing the risk of claim denials or delayed payments.

- How do PSPs simplify coding and billing errors?

PSPs update codes automatically, validate coding accuracy, and track submissions to prevent duplicate codes, reducing coding errors and claim rejections.

- What benefits do patients get from using PSPs for billing?

PSPs offer clear billing breakdowns, multiple payment options, and flexible payment plans, improving transparency and reducing confusion for patients.

- Are PSPs compliant with healthcare regulations?

Yes, PSPs comply with HIPAA and PCI-DSS standards, ensuring patient data security and safeguarding against compliance errors.

8 How do PSPs use analytics to reduce billing errors?

- PSPs provide advanced reporting tools to track billing performance, detect recurring errors, and offer insights to optimize hospital revenue cycles and payment processes.