Managing insurance payments in healthcare can be a nightmare. Between complex billing codes, claim denials, and long reimbursement delays, healthcare providers and patients often struggle with inefficiencies that slow down payments and increase costs. But what if you could streamline the process and boost approval rates by up to 30%?

Automation is the key. By integrating advanced payment solutions, providers can reduce errors, speed up claim processing, and improve cash flow. In this blog, we’ll explore the biggest challenges in insurance payments and how automation—especially with solutions like Paynova—can simplify the system and ensure faster, hassle-free transactions.

Table of Contents

Understanding the Healthcare Payment System

Overview of Insurance and Patient Payments

Paying for healthcare in the U.S. can be confusing because multiple parties are involved—patients, insurance companies, and healthcare providers. Here’s how it works in a nutshell: You visit a doctor or hospital for treatment. The provider then sends a bill, called a claim, to your insurance company. The insurance company reviews the claim to check if your plan covers the service and if all the information is correct.

If everything checks out, the insurance company pays its share to the provider. However, if there are any mistakes or missing details, they might delay or deny the claim, leading to payment problems. After insurance pays, you’re responsible for any remaining costs, like deductibles or co-pays. While this process sounds straightforward, it often involves long delays, claim rejections, and errors that make payments stressful for both patients and providers.

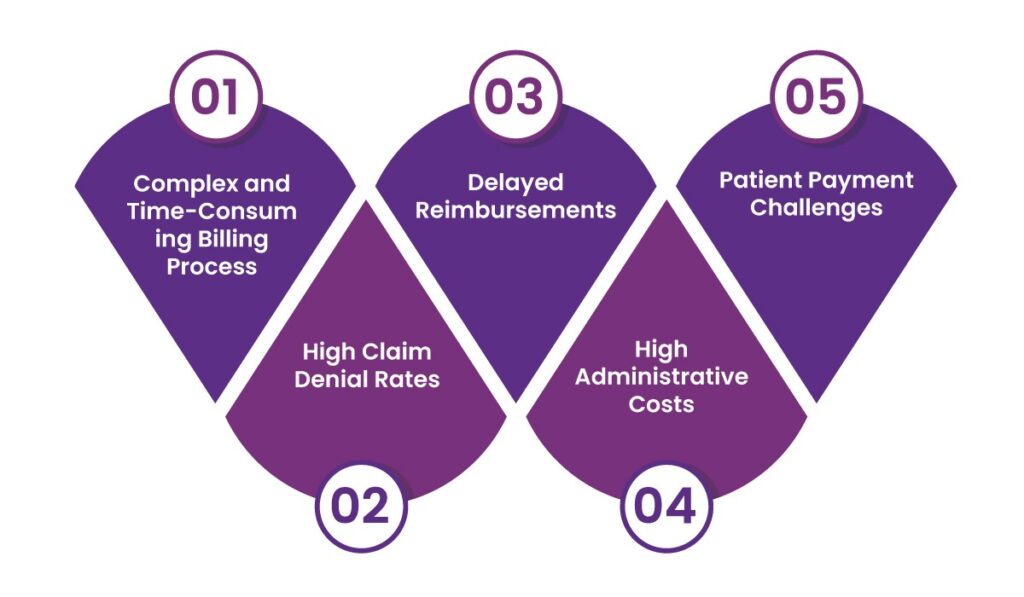

Challenges in Insurance Payments

1. Complex and Time-Consuming Billing Process

Medical billing is a complicated process involving different insurance companies, coverage policies, and coding systems. Each medical service is assigned specific codes, such as ICD-10 for diagnoses and CPT for procedures. Even a small mistake in these codes can result in claim denials or delays in payment. Healthcare providers must also ensure that all patient details are accurate before submitting a claim.

Additionally, each insurance provider has unique rules and guidelines, making the process even more challenging. Claims must be verified, approved, and processed, which takes time. If a mistake is found, the claim may need to be resubmitted, causing further delays. This complexity increases the workload for hospitals and clinics, requiring dedicated staff to manage billing and insurance claims. As a result, providers spend more time handling administrative tasks instead of focusing on patient care.

2. High Claim Denial Rates

Many insurance claims are denied due to various reasons, creating financial stress for healthcare providers. Common causes of claim denials include missing or incorrect patient details, expired insurance policies, errors in medical coding, and lack of prior authorization. Sometimes, insurers reject claims because they believe the treatment was not medically necessary. When a claim is denied, providers must go through an appeals process, which involves correcting errors, gathering additional documentation, and resubmitting the claim. This process takes time and effort, leading to delayed payments.

Additionally, some claims may still be rejected even after appeals, forcing healthcare providers to absorb the costs or pass them on to patients. High claim denial rates also increase administrative work, requiring more staff to manage claim processing and follow-ups. This situation makes it difficult for healthcare providers to maintain steady revenue and continue offering quality medical services.

3. Delayed Reimbursements

Insurance companies often take weeks or even months to process claims, creating serious cash flow issues for healthcare providers. Once a claim is submitted, it goes through a verification and approval process. If there are errors in the claim, it may be rejected, requiring corrections and resubmission. This back-and-forth process further delays reimbursements. Providers rely on timely payments to cover operational costs such as staff salaries, medical supplies, and facility maintenance.

When payments are delayed, providers may struggle to meet financial obligations, affecting overall service quality. In some cases, smaller healthcare facilities may even face financial instability due to prolonged waiting times for reimbursements. The administrative burden of tracking and following up on claims adds additional costs and workload. To speed up the process, many providers use electronic billing systems, but delays remain a major issue in the insurance payment system.

4. High Administrative Costs

Processing insurance claims manually is costly and time-consuming. Healthcare providers must hire dedicated staff to handle billing, track claim status, and communicate with insurance companies. Each claim requires verification, submission, follow-ups, and appeals if denied. This administrative burden increases overhead expenses, reducing overall profitability. Small and mid-sized healthcare facilities, in particular, struggle with high administrative costs, as they have fewer resources to manage the complex billing system. The need to constantly check unpaid bills and resolve claim issues diverts attention from patient care.

Many providers have started using automated billing software to reduce manual errors and speed up claim processing. However, even with technology, human intervention is still required to manage claim disputes and insurance negotiations. High administrative costs not only affect healthcare providers but also contribute to rising medical expenses, as providers may increase treatment charges to cover these expenses.

5. Patient Payment Challenges

Many patients face difficulties in understanding and paying their medical bills. Out-of-pocket expenses, such as deductibles, copayments, and uncovered services, can be overwhelming, leading to delayed or missed payments. Some patients may not be aware of their insurance coverage details, resulting in unexpected bills.

Additionally, limited payment options make it harder for patients to settle their bills on time. Many healthcare facilities do not offer flexible payment plans or financial assistance programs, leaving patients with no option but to postpone or avoid payments. This creates financial problems for both patients and providers. Healthcare providers must dedicate staff to follow up on unpaid bills, adding to administrative costs. To improve the situation, many providers now offer online payment options, installment plans, and better patient education about medical costs. However, patient payment challenges remain a major issue in the healthcare industry, affecting both financial stability and access to care.

How Automation Can Solve These Challenges

Automating insurance payments streamlines workflows, reduces errors, and accelerates payment processing. Key benefits include:

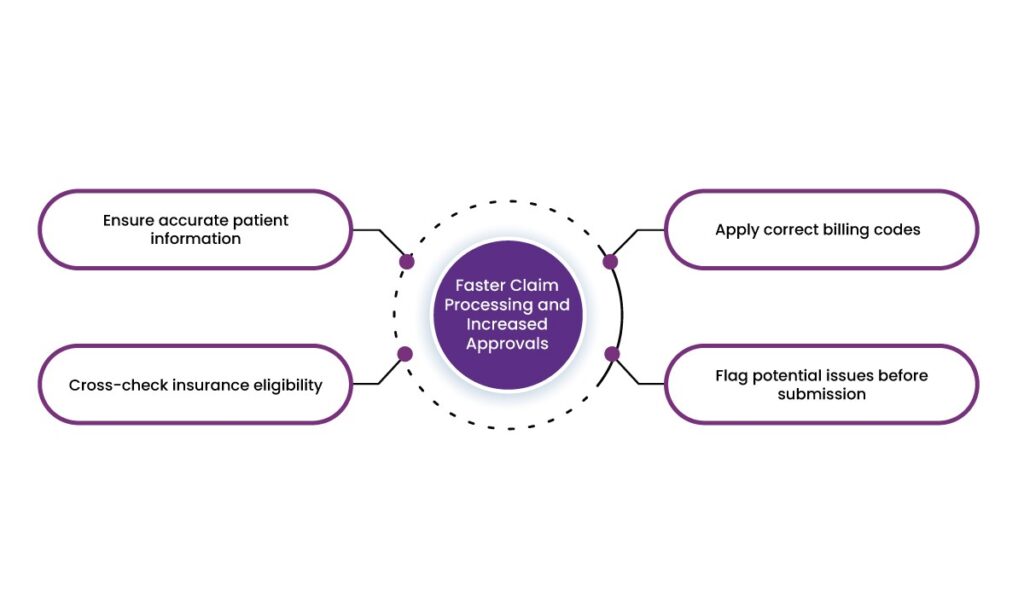

1. Faster Claim Processing and Increased Approvals

Automated billing systems verify insurance details in real time, reducing claim rejection rates. By integrating with Electronic Health Records (EHRs), these systems:

- Ensure accurate patient information

- Cross-check insurance eligibility

- Apply correct billing codes

- Flag potential issues before submission

These measures reduce claim denials and increase approval rates by up to 30%.

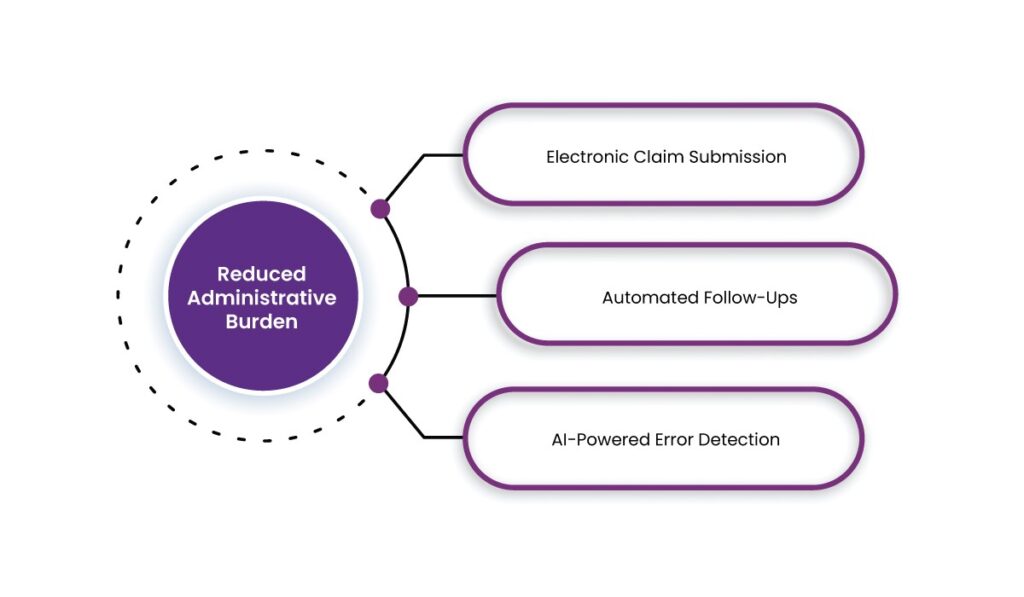

2. Reduced Administrative Burden

Automated systems handle tasks such as claim submission, tracking, and follow-ups, freeing up staff for patient care. Key automation features include:

- Electronic Claim Submission: Speeds up processing compared to paper-based methods.

- Automated Follow-Ups: Tracks unpaid claims and resubmits automatically if needed.

- AI-Powered Error Detection: Identifies missing information or discrepancies before submission.

3. Improved Cash Flow and Faster Reimbursements

By minimizing claim denials and processing errors, automated systems ensure quicker reimbursements. Additionally, Electronic Funds Transfer (EFT) enables direct deposits from insurers, reducing payment wait times.

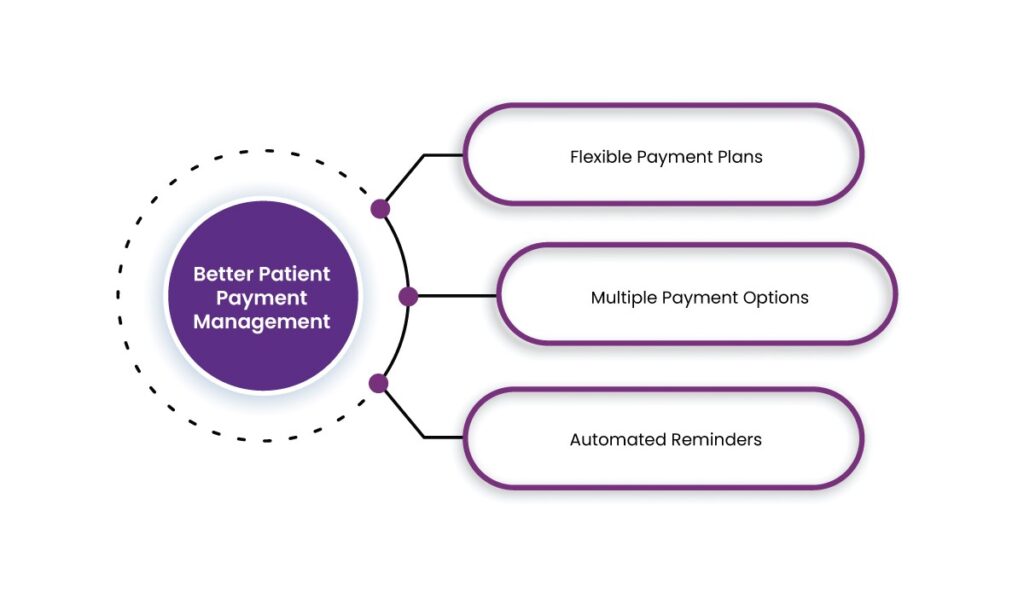

4. Better Patient Payment Management

Automation improves patient payment collections through:

- Flexible Payment Plans: Patients can set up automatic installments for large bills.

- Multiple Payment Options: Credit/debit cards, mobile wallets, and online payments reduce friction.

- Automated Reminders: Patients receive SMS/email reminders about due payments, minimizing missed deadlines.

5. Enhanced Security and Compliance

Automated payment gateways adhere to HIPAA and PCI-DSS standards, ensuring secure transactions and protecting patient data. This reduces the risk of fraud and non-compliance penalties.

6. Real-Time Financial Insights

Automation provides real-time analytics and reporting, allowing healthcare providers to:

- Monitor revenue cycle performance

- Identify trends in claim denials

- Optimize financial decision-making

Implementing a Dedicated Payment Gateway for Automation

A dedicated payment gateway is a crucial tool in automating insurance payments. It integrates with healthcare systems to streamline payments, improve cash flow, and enhance patient experience.

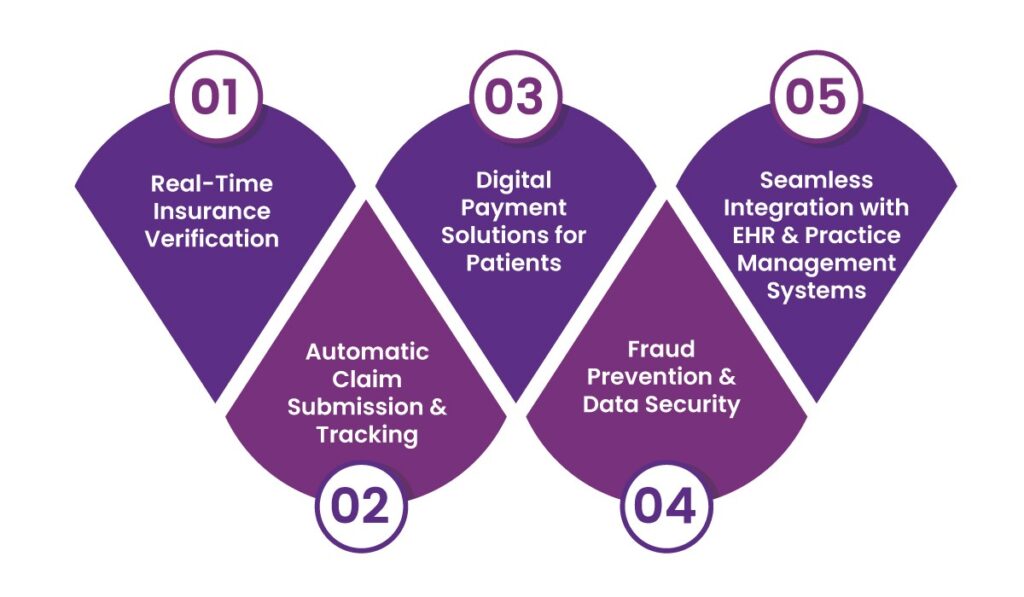

Key Features of a Payment Gateway:

1. Real-Time Insurance Verification

- Checks patient eligibility and coverage instantly

- Reduces claim denials due to incorrect information

2. Automatic Claim Submission & Tracking

- Submits claims electronically with minimal manual intervention

- Provides real-time updates on claim status

3. Digital Payment Solutions for Patients

- Enables online bill payments via secure portals

- Offers recurring payment options for large medical bills

4. Fraud Prevention & Data Security

- Encrypts sensitive data to prevent unauthorized access

- Detects fraudulent transactions through AI algorithms

5. Seamless Integration with EHR & Practice Management Systems

- Ensures smooth billing workflows

- Reduces duplicate data entry and human errors

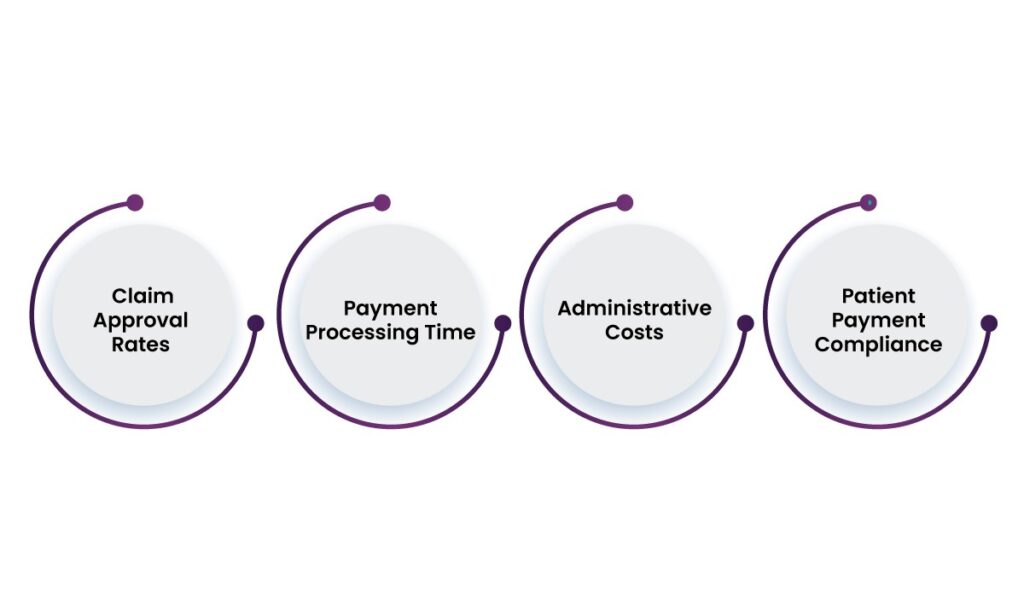

Case Study: How Automation Increased Approval Rates by 30%

A large healthcare provider implemented an automated insurance payment system and achieved the following results:

- Claim Approval Rates: Increased from 65% to 95%

- Payment Processing Time: Reduced from 21 days to 5 days

- Administrative Costs: Decreased by 40%

- Patient Payment Compliance: Improved with automated reminders and digital payment options

These improvements led to higher revenue, reduced claim denials, and an enhanced patient experience.

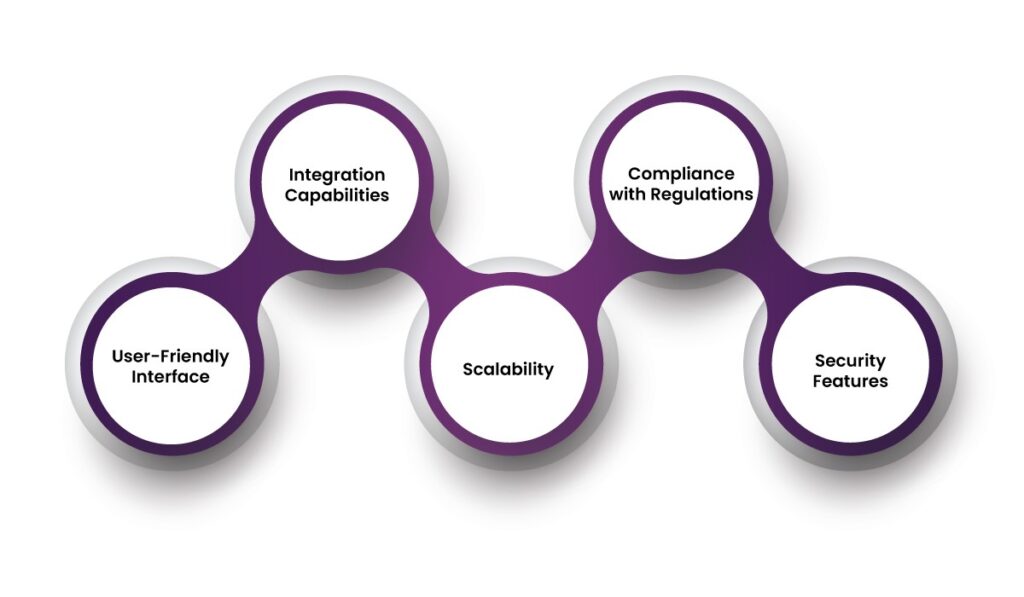

Choosing the Right Automation Solution

When selecting an automated payment solution, consider:

- Integration Capabilities: Must work with existing billing and EHR systems

- Compliance with Regulations: Ensure HIPAA and PCI-DSS compliance

- User-Friendly Interface: Both patients and staff should find it easy to use

- Scalability: The system should support future growth and additional integrations

- Security Features: Look for encryption, fraud detection, and secure data storage

How does Paynova automate insurance payments?

Paynova streamlines insurance payments by integrating automated billing, claim processing, and secure transactions into a seamless system. It helps healthcare providers manage multiple payers, including private insurers, Medicare, and Medicaid, while ensuring compliance with HIPAA and PCI-DSS regulations.

Features Available for Insurance Payments in Paynova:

1. Automated Billing & Claim Processing

- Automatically submits claims to insurance providers.

- Reduces manual errors in coding and documentation.

- Speeds up claim approvals and reimbursements.

2. Insurance Preauthorization & Verification

- Checks patient insurance coverage in real-time.

- Ensures preauthorization before service delivery.

- Prevents claim denials due to outdated or incorrect information.

3. Seamless Integration with EHR & PMS

- Connects with Electronic Health Records (EHR) and Practice Management Systems (PMS).

- Pulls patient details, medical history, and billing codes automatically.

4. Multi-Payer Processing

- Handles primary, secondary, and tertiary insurance claims.

- Calculates co-pays, deductibles, and patient out-of-pocket costs.

5. Secure & Compliant Transactions

- Ensures HIPAA-compliant data protection.

- Adheres to PCI-DSS standards for secure payment processing.

6. Automated Patient Billing & Payment Plans

- Sends automated patient invoices post-insurance adjustments.

- Allows installment-based payments for high out-of-pocket costs.

7. Real-Time Payment Tracking & Reporting

- Provides real-time updates on claim status and payments.

- Generates financial reports for revenue cycle management.

By integrating these features, Paynova simplifies the healthcare payment ecosystem, reducing administrative burdens, improving cash flow, and enhancing patient experience.

Final thoughts

Automating insurance payments is a game-changer for healthcare providers, reducing claim denials, speeding up reimbursements, and cutting administrative costs. With a platform like Paynova, providers can streamline billing, verify insurance in real-time, and ensure secure, compliant transactions. By integrating with EHRs and automating patient payments, Paynova helps healthcare facilities improve cash flow and focus more on patient care.

If you’re looking to boost approval rates by up to 30% and simplify the complex world of insurance payments, automation is the way forward. Ready to transform your payment process? Paynova makes it easy, secure, and hassle-free.

Frequently asked question

1. Why do insurance payments take so long to process in healthcare?

Insurance payments often face delays due to manual processing, paperwork errors, claim denials, and lengthy approval procedures by insurers. Traditional systems require multiple steps, from claim submission to verification and payment, which adds to the delay.

2. How can automation help reduce claim denials and rejections?

Automation ensures accuracy by verifying patient information, policy details, and billing codes before submission. This reduces errors, minimizes rework, and increases the chances of claims being accepted on the first attempt.

3. What are the biggest challenges healthcare providers face with insurance payments?

Common challenges include claim rejections due to incorrect information, slow processing times, complex reimbursement policies, and administrative burdens. These inefficiencies can lead to delayed payments and financial strain.

4. How does an automated payment solution like Paynova work?

Paynova automates claim processing by integrating with healthcare systems, verifying patient insurance coverage, reducing manual data entry, and ensuring faster claim approval and reimbursement.

5. Can automation improve cash flow for healthcare providers?

Yes, automation accelerates claim approvals and payments, reducing outstanding receivables. This steady cash flow helps healthcare providers manage operations efficiently and invest in better patient care.

6. Is it difficult to integrate automated payment solutions with existing healthcare systems?

Modern automation solutions are designed to be easily integrated with existing electronic health records (EHR) and billing systems. Many providers offer seamless APIs and support for smooth implementation.

7. What security measures are in place for automated insurance payments?

Automated payment solutions comply with industry standards like HIPAA, ensuring data encryption, secure transactions, and controlled access to sensitive patient information.

8. How can patients benefit from automated insurance payment solutions?

Patients experience faster claim approvals, reduced out-of-pocket expenses, transparent billing, and fewer disputes. This improves their overall experience and trust in the healthcare system.