Modern medical organizations rely on revenue integrity for their financial well-being. As hospitals, clinics, and physician groups balance between delivering quality care and staying financially sound, the need for skilled revenue integrity professionals has never been more critical.

Table of Contents

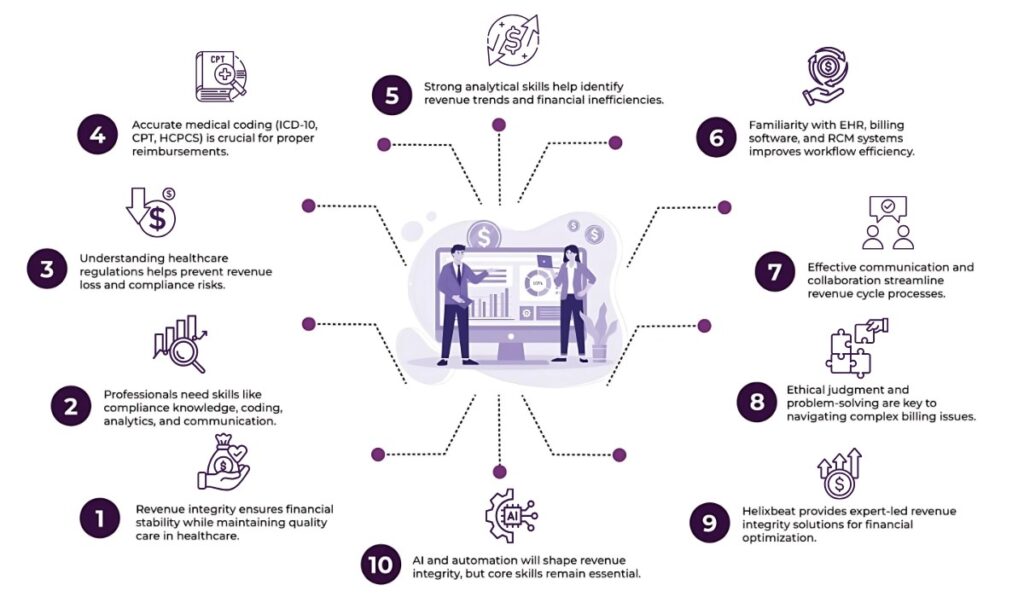

So, what does it take to thrive in this field?

Whether you’re eyeing a role in revenue integrity or already working in it and aiming to level up, mastering a specific set of skills is key. Here’s a closer look at the 10 must-have skills every revenue integrity professional needs to thrive.

1. Deep Knowledge of Healthcare Regulations and Compliance

Revenue integrity professionals live at the intersection of care and compliance. This means having a firm grasp of healthcare regulations like HIPAA, Medicare billing rules, and CMS guidelines. They’re responsible for identifying regulatory risks tied to revenue leakage, underbilling, overbilling, and improper coding.

Therefore, understanding national and regional rules surrounding billing practices, payer contracts, and audits allows these professionals to identify and rectify issues before they become costly problems.

2. Mastery of Medical Coding and Billing Standards

To maintain revenue integrity in healthcare, you need to speak the language of codes—ICD-10, CPT, and HCPCS. Accurate documentation and coding are at the heart of correct billing. Even small errors in this area can lead to significant revenue loss or legal complications.

That’s why revenue integrity teams often act as translators between clinical staff and billing departments. They review charts, spot inconsistencies, and translate medical services into appropriate reimbursement codes.

3. Strong Analytical and Critical Thinking Skills

This is not a role for someone who avoids spreadsheets. Data is a core driver of revenue integrity in healthcare, and professionals in this role are expected to dive deep into revenue cycle metrics—analyzing claims denials, identifying trends, and uncovering the root cause of revenue leakage.

For these reasons, you must be able to interpret complex financial and clinical data, detect patterns, and recommend actionable solutions. Think Sherlock Holmes, but with a stethoscope and a pivot table.

4. Clear and Confident Communication

A revenue integrity professional wears many hats—collaborating with clinical teams, finance departments, compliance officers, and IT staff. There’s a lot of different communication styles and agendas to juggle.

Whether you’re explaining a compliance issue to a physician or presenting audit findings to the C-suite, your ability to communicate with clarity and confidence can influence how quickly issues get resolved.

5. Proficiency with Revenue Cycle Management (RCM) Systems

Electronic Health Records (EHRs), billing software, and RCM platforms are daily tools for revenue integrity teams. Therefore, understanding how these systems work and interact is important for identifying process gaps or tech-driven errors.

Hands-on experience with charge capture systems, payer rules engines, and denial management workflows provides an edge in spotting inefficiencies and building better processes.

6. Attention to Detail Without Losing the Big Picture

One day, you’re reviewing dozens of charts for modifier errors. Next, you’re outlining a strategy to reduce denials by 15% over the quarter. The ability to shift focus from micro-level tasks to macro-level thinking defines successful revenue integrity professionals.

Small mistakes can cost thousands, while big-picture oversights can derail compliance initiatives or revenue forecasting. Balancing both is a skill you develop over time. Zoom out often to connect your daily tasks with organizational goals.

7. Collaboration and Cross-Functional Teamwork

Revenue integrity in healthcare isn’t a siloed function. It connects departments that historically operated independently—clinical, billing, compliance, finance, and IT. Therefore, your ability to work effectively across these groups makes all the difference.

Collaborative professionals can bridge the gap between departments, lead meetings, and create consensus around revenue optimization strategies. You’re not just spotting errors—you’re driving systemic improvement.

8. Problem-Solving Mindset

Every denial, underpayment, or rejected claim is a puzzle waiting to be solved. And when volumes hit in the thousands, the stakes grow high. That’s why revenue integrity professionals must be persistent problem solvers.

You’re not just flagging what’s wrong—you’re proposing solutions that align with regulations, protect patient rights, and support revenue recovery.

9. Project Management and Process Improvement Skills

Many revenue integrity projects span departments, systems, and time zones. Leading these initiatives requires solid project management capabilities, including planning timelines, tracking milestones, managing stakeholders, and documenting outcomes.

Therefore, familiarity with Lean, Six Sigma, or similar methodologies can help you tackle recurring issues like charge lag, under-coding, or process redundancies. Bonus points if you can lead training sessions or implement new workflows to support better results.

10. Ethical Judgment and Integrity

It may seem obvious, but it deserves repeating: integrity is not just in the title—it’s a daily practice. In revenue integrity, professionals are stewards of both the organization’s finances and patients’ trust.

You’ll often face gray areas—billing rules open to interpretation, pressure from departments to “code differently,” or claims that look profitable but fall into legal ambiguity. That’s why having a strong ethical compass and the courage to speak up defines your long-term success.

Why These Skills Matter More Than Ever

As healthcare continues to move toward value-based care, alternative payment models, and real-time analytics, the demand for skilled revenue integrity professionals is skyrocketing. What was once a backend function is now a strategic role in operational performance.

With healthcare revenue margins tightening and audits growing more frequent, having a team that understands how to protect and optimize every dollar is a competitive advantage. And that team starts with professionals who bring this unique skillset to the table.

Why Choose Helixbeat as Your Healthcare RCM Partner

So, you’ve identified that your organization might be ready. But choosing the right partner is critical to success. Here’s why Helixbeat stands out:

1. Specialized Experience in Your Medical Field

Helixbeat covers ICD-10-CM, CPT, and HCPCS standards to minimize claim rejections and maximize reimbursements. With our team of certified coders and robust claim submission workflows, we help healthcare providers reduce delays, stay compliant, and improve cash flow from day one.

2. Proven Success with Similar-Sized Practices

Whether you’re a growing clinic or a large hospital network, Helixbeat has a proven track record of optimizing revenue cycles for healthcare providers of all sizes. Our case studies highlight real-world results, from improved collections to reduced denials.

3. Robust Data Security & HIPAA Compliance

Helixbeat adheres to the highest standards in data protection, including full HIPAA compliance, encrypted data exchange, and regular audits to keep your sensitive information safe.

4. Seamless Integration with EHR & PM Systems

Helixbeat offers seamless integration with leading EHR and Practice Management systems to minimize disruption and facilitate smoother workflows.

5. Dedicated Account Managers & Clear SLAs

With Helixbeat, every client is assigned a dedicated account manager who serves as a single point of contact—backed by service level agreements (SLAs) that clearly define response times, performance benchmarks, and accountability.

6. Transparent Reporting & Real-Time Dashboards

Helixbeat’s intuitive dashboards and transparent reporting provide real-time insights into collections, claims, denials, and key financial KPIs.

The Future of Revenue Integrity in Healthcare

Looking ahead, the role of revenue integrity professionals will evolve with emerging technologies like AI-powered coding, predictive analytics for denials, and automation in charge capture. But the fundamentals—understanding regulations, collaborating across teams, and solving problems—will remain the foundation.

At Helixbeat, our expert-led solutions can help you build a smarter, more efficient revenue cycle — one that drives both financial and clinical success. Connect with us today to get started.

FAQs

1. What is the role of a revenue integrity professional in healthcare?

A revenue integrity professional bridges the gap between clinical services and financial operations. Their job is to support accurate coding, billing, compliance, and revenue recovery while collaborating with multiple departments.

2. What coding systems should revenue integrity professionals be familiar with?

They should be well-versed in ICD-10, CPT, and HCPCS codes to translate clinical services into accurate billing and reimbursement data.

3. How does data analysis contribute to revenue integrity?

Analyzing data allows professionals to identify claim denial patterns, detect revenue loss, and develop actionable strategies for improvement.

4. Why is cross-functional collaboration necessary for revenue integrity?

Because revenue integrity spans multiple departments, professionals need to work with various teams to align strategies and promote smooth revenue flow.

5. How important is attention to detail in revenue integrity roles?

Very. Small errors in documentation or coding can lead to major financial losses, while overlooking broader trends can impact strategic decisions.

A problem-solving mindset helps professionals go beyond flagging issues—they propose solutions that are compliant, ethical, and financially sound.