The healthcare system is constantly evolving, bringing its fair share of challenges and transformations. One of the most notable shifts is the transfer of financial responsibility from insurance providers to patients, which continues to impact hospital revenue collection. While this change has been underway for some time, many hospitals and health systems are struggling to keep up.

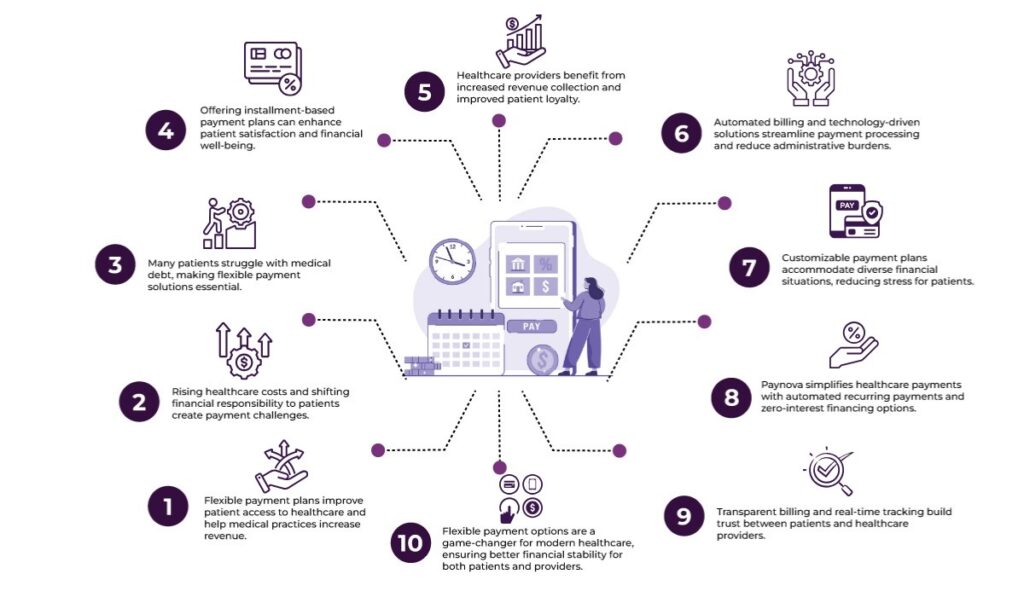

To maintain financial stability, healthcare providers must take a proactive approach to collecting payments from patients, who now represent a significant revenue source. Traditional collection strategies—designed to secure full and timely reimbursement from insurance companies and government programs—must adapt to this new landscape. This is where flexible payment plans become essential.

To boost revenue, healthcare providers need to think outside the box. Offering patients more flexible payment options increases the likelihood of successful collections. Most patients want to fulfill their financial responsibilities without falling into medical debt, but many lack access to feasible and manageable payment solutions.

Table of Contents

Understanding the Financial Barriers to Healthcare Access

To offer effective payment options, healthcare providers must first recognize the financial obstacles patients face. Factors such as income level, financial capacity, and affordability play a crucial role in determining access to healthcare. While the number of uninsured individuals in the U.S. has been declining, over 25 million people still lack health insurance. This highlights a significant financial barrier that prevents many from receiving the care they need.

The high cost of insurance remains a primary reason for lack of coverage, along with ineligibility for subsidized plans. Even individuals with employer-sponsored insurance struggle with rising costs. According to a 2023 survey by the Kaiser Family Foundation (KFF), the average annual premium for single coverage reached $8,435, while family coverage soared to $23,968—marking a 7% increase from the previous year.

If healthcare providers view unpaid bills merely as an inconvenience without considering the patient’s financial perspective, the likelihood of successful payment collection diminishes. Additionally, this approach negatively impacts the overall patient experience. Just as delivering exceptional medical care is a priority, ensuring a seamless and compassionate payment process should be equally important.

The Benefits of Flexible Payment Plans

Some healthcare practices only offer standard payment plans with limited flexibility, which may impact revenue collection but only moderately. Others have successfully implemented discounts of 10%, 15%, or even 20% for patients who pay their bills within a set timeframe.

A common approach is to break medical bills into monthly payments. Allowing patients up to a year—or even longer in some cases—to pay off their medical expenses increases the likelihood of full payment. However, some patients may require extended timelines.

By working with patients to establish realistic payment schedules, healthcare providers can improve adherence to financial commitments. Offering flexible payment plans delivers key benefits such as:

- Providing financial relief by spreading costs over a set time.

- Enhancing patient satisfaction and loyalty by recognizing diverse financial situations.

- Encouraging more patients to complete treatment plans or elective procedures.

- Differentiating the practice and helping attract and retain more patients

The Benefits of Flexible Payment Plans Flexible payment plans provide numerous advantages for both patients and healthcare providers. Below are some of the key benefits:

- Improved Patient Access to Care: When patients know they can break down medical costs into manageable payments, they are more likely to seek the care they need without delay. This leads to better health outcomes and prevents minor health issues from developing into severe conditions.

- Increased Revenue Collection: Many hospitals struggle with unpaid medical bills due to patients’ inability to pay in full. Flexible payment options increase the likelihood of successful collections, ensuring a steady revenue stream for healthcare providers.

- Reduced Financial Stress on Patients: Offering patients the ability to pay their medical bills over time alleviates financial stress. This enhances their overall experience, making them more satisfied with their care.

- Better Provider-Patient Relationships: Patients appreciate when healthcare providers offer solutions that consider their financial challenges. This builds trust and loyalty, encouraging patients to return for future healthcare needs.

- Lower Administrative Burden: Traditional billing and collection processes can be time-consuming and costly for healthcare providers. Implementing flexible payment solutions streamlines billing operations, reducing administrative workloads and improving efficiency.

- Greater Financial Flexibility for Patients: From a patient’s point of view, the opportunity to enroll in flexible payment plans has clear benefits. It allows them to receive the care they need without fear of costly medical bills. Instead of paying upfront, they can spread the cost over time under a structured payment plan.

Implementing Effective Payment Plan Strategies

To successfully integrate flexible payment plans into a healthcare practice, providers must adopt a well-structured approach. Below are essential steps for implementing an effective strategy:

1. Assess Patient Needs

Understanding the financial challenges of your patient population is crucial. Conduct surveys, analyze payment trends, and determine which types of plans will be most beneficial.

2. Offer Multiple Payment Plan Options

Patients have different financial situations, so a one-size-fits-all approach is ineffective. Offering a variety of plans, such as interest-free installments, extended payment terms, and income-based plans, allows for greater flexibility.

3. Ensure Clear Communication

Patients need to be fully aware of their payment options. Train staff to explain available plans clearly and provide written materials that outline payment terms and conditions.

4. Use Technology for Automation

Automated billing and payment systems help streamline the collection process. Online portals and mobile payment options make it easier for patients to manage their accounts and make timely payments.

5. Monitor and Adjust Plans as Needed

Regularly review the effectiveness of payment plans and make necessary adjustments based on patient feedback and collection success rates.

Overcoming Challenges and Addressing Concerns

While flexible payment plans offer numerous benefits, healthcare providers may face some challenges when implementing them. Addressing these concerns proactively can ensure a smooth transition.

1. Risk of Non-Payment

Some healthcare providers worry about the risk of patients defaulting on their payments. To mitigate this, providers can conduct credit assessments, set up automated reminders, and establish clear terms for missed payments.

2. Administrative Complexity

Managing multiple payment plans can become complex. Implementing a robust billing system and using third-party payment platforms can simplify the process.

3. Regulatory Compliance

Healthcare providers must ensure that their payment plans comply with industry regulations and consumer protection laws. Consulting legal and financial experts can help ensure compliance.

How Paynova Helps with Flexible Payment Plans

Paynova is a leading payment solution designed to make healthcare payments more manageable for both patients and providers. With rising medical costs, many patients struggle to pay their bills upfront, leading to delayed treatments or financial stress. Paynova solves this problem by offering flexible payment plans that allow patients to pay in smaller, more manageable installments. This benefits both patients—by reducing their financial burden—and healthcare providers—by ensuring a steady flow of revenue.

1. Customizable Payment Plans for Patients

One of Paynova’s biggest advantages is its ability to offer customized payment plans tailored to a patient’s financial situation. Instead of requiring full payment at once, Paynova allows patients to divide their bills into smaller payments over a period of weeks or months.

For example, if a patient has a $2,000 medical bill and cannot afford to pay it upfront, they can opt for a 6-month installment plan through Paynova. This means they would pay around $333 per month instead of the full amount all at once. This ensures they can receive necessary medical treatment without delaying due to financial concerns.

2. Automated Recurring Payments

To make the process seamless, Paynova offers automated payment scheduling, ensuring patients don’t miss a payment. Once a patient enrolls in a plan, their payments are deducted automatically from their bank account, credit card, or digital wallet.

For instance, if a patient sets up bi-weekly payments, Paynova will deduct the agreed amount every two weeks. This helps patients stay on track with their payments while reducing administrative work for healthcare providers.

3. Zero-Interest or Low-Interest Financing

Many patients hesitate to opt for payment plans due to high interest rates. Paynova partners with financial institutions to offer zero-interest or low-interest financing options.

For example, a patient undergoing a $5,000 surgery might be eligible for a 12-month interest-free plan if they meet certain criteria. This means they can pay approximately $416 per month without extra charges. If they need a longer repayment period, they can opt for a low-interest plan, ensuring affordability without excessive fees.

4. Transparent Billing and Real-Time Payment Tracking

Patients have access to a self-service portal where they can:

1. View their total bill and breakdown of charges

2. Check their payment history and future installments

3. Modify their payment method or schedule if needed

This level of transparency eliminates confusion and builds trust between patients and healthcare providers.

5. Benefits for Healthcare Providers

For healthcare providers, offering flexible payment plans through Paynova leads to:

1. Faster and guaranteed collections due to automated payments

2. Lower administrative costs, as Paynova handles billing and tracking

3. Improved patient satisfaction, leading to better retention and referrals

Final thoughts

Healthcare costs can be overwhelming, but flexible payment plans are changing the game. By breaking down medical bills into manageable installments, patients can get the care they need without financial stress, and providers can improve collection rates without the hassle. Paynova makes this process even smoother with automated payments, interest-free financing, and real-time tracking.

When patients feel supported financially, they’re more likely to complete treatments and stay loyal to their healthcare providers. In today’s world, offering flexible payment options isn’t just a nice-to-have—it’s a must for creating a better patient experience and a healthier bottom line.

Frequently asked questions

What are flexible payment plans in healthcare?

Flexible payment plans allow patients to pay their medical bills in smaller, manageable installments over time, rather than paying the full amount upfront. This helps ease the financial burden on patients while ensuring healthcare providers receive payments.

How do flexible payment plans benefit healthcare providers?

These plans improve revenue collection by making it easier for patients to pay over time, reducing the likelihood of unpaid bills. They also enhance patient loyalty, attract new patients, and streamline administrative processes.

Can all healthcare providers offer flexible payment plans?

Yes, healthcare providers of all sizes can implement flexible payment plans, but the complexity and types of plans offered may vary. Providers may need to use payment platforms like Paynova to simplify the process.

Are there interest charges on flexible payment plans?

Some flexible payment plans may come with zero or low-interest financing options, depending on the provider and the payment platform used. For example, Paynova offers both interest-free and low-interest plans.

How does Paynova make flexible payment plans easier for patients?

Paynova automates the payment process, offers customizable plans, and provides real-time tracking, making it easier for patients to manage their payments. The platform also ensures transparency by allowing patients to view their payment details at any time.

Do flexible payment plans improve patient satisfaction?

Yes, flexible payment plans reduce financial stress, making it easier for patients to access care. This leads to higher patient satisfaction, better patient-provider relationships, and greater patient loyalty.

How can healthcare providers assess which payment plans will work best for their patients?

Providers can assess patient needs by conducting surveys, analyzing payment trends, and reviewing patient feedback to offer a variety of plans, such as income-based plans or extended payment terms.

What happens if a patient misses a payment?

Many platforms, including Paynova, offer automated reminders and have clear terms for missed payments. Providers can also conduct credit assessments and work with patients to adjust payment terms if necessary.