Is managing your company’s payroll becoming a challenge? With multiple tasks like calculating deductions, generating payslips, and ensuring compliance, it’s no surprise that many businesses find payroll management overwhelming. However, it doesn’t have to be this way. In today’s fast-paced business environment, a streamlined payroll management system like Synergy by HelixBeat can make all the difference. By automating payroll processes, Synergy helps businesses of all sizes minimize errors and ensure smooth operations. Let’s dive into how payroll reconciliation works and how Synergy can help optimize your payroll management system for success.

Table of Contents

What is Payroll Reconciliation?

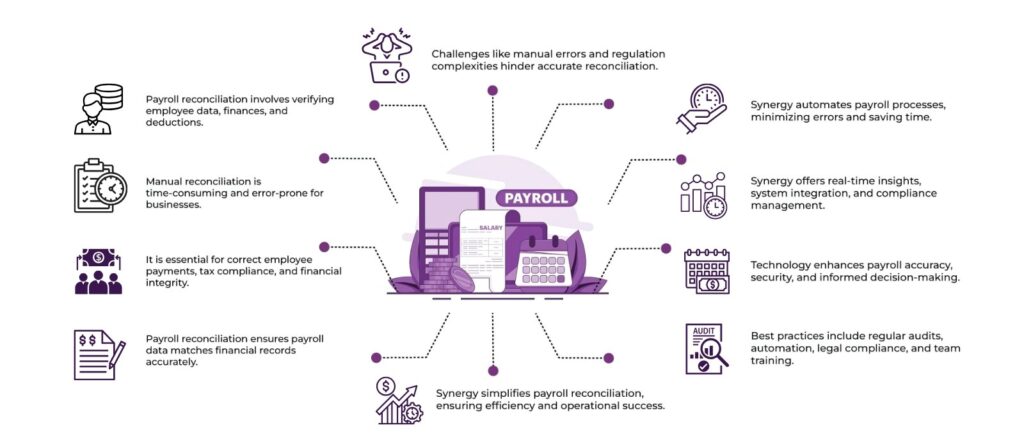

Payroll reconciliation refers to the process of comparing and verifying payroll data with other financial records to ensure that all amounts are accurate and consistent. This involves checking the total payroll expenses, cross-referencing them with bank statements, tax filings, and employee benefits, and making sure everything is in sync.

Payroll reconciliation is a crucial task for any business, especially as it ensures that employees are paid correctly, taxes are filed properly, and your company’s financial records are accurate. An effective employee payroll management system like Synergy streamlines this entire process by automating calculations, handling tax deductions, and generating accurate reports.

Why is Payroll Reconciliation Important?

Reconciliation helps businesses maintain accurate financial records, ensure compliance with tax laws, and prevent fraud or errors in payroll processing. It also helps HR and finance teams track and manage discrepancies, ensuring timely corrections.

For businesses that use manual systems, payroll reconciliation can be a time-consuming and error-prone process. The use of a payroll processing system such as Synergy significantly reduces the time spent on reconciliation and minimizes the risk of errors. This system provides automatic updates and real-time visibility into payroll data, making reconciliation both quicker and more reliable.

How Payroll Reconciliation Works?

Payroll reconciliation involves a step-by-step review of all payroll records. Here’s how it works:

Verify Employee Data

Ensure that all employee details (like hours worked, overtime, salary, and deductions) are accurately entered into the payroll system. This step also involves checking that any changes to employee status (e.g., promotions, bonuses, tax deductions) are reflected properly.

Cross-Check with Financial Records

Compare the payroll data against the company’s financial records to ensure consistency. This includes checking payroll expenses against the general ledger and verifying tax deductions with the tax filings. With an efficient employee payroll management system, this step becomes more accurate and automated.

Review Tax Deductions and Benefits

Confirm that the right tax deductions, health benefits, retirement contributions, and other withholdings are applied correctly. This step is critical in ensuring that the company is compliant with tax regulations and that employees’ pay is accurate. Using a payroll processing system like Synergy simplifies this process by automatically calculating and applying the correct deductions.

Generate and Compare Reports

Once all the data is reviewed, the payroll system generates detailed reports for managers and HR teams to analyze. These reports include a breakdown of employee pay, tax contributions, benefits, and more. Synergy’s reporting tools offer an efficient way to generate these reports automatically, saving HR teams time and reducing errors.

Final Verification and Adjustments

After reviewing the reports and making any necessary adjustments, the final step involves verifying the payroll records once again before the payments are made.

Challenges in Payroll Reconciliation

Payroll reconciliation can be difficult due to the following reasons:

Manual Errors: Manual payroll processing increases the risk of data entry errors, which can lead to incorrect tax filings or payroll discrepancies. This issue is significantly reduced with an employee payroll management system like Synergy, which automates calculations and reduces human error.

Complex Regulations: Keeping up with constantly changing tax laws and employee benefit regulations can be overwhelming for businesses. A reliable payroll processing system like Synergy ensures compliance by automatically updating tax rates and benefit regulations, reducing the burden on HR and finance teams.

Time-Consuming: Without automated systems, payroll reconciliation takes up valuable time that HR and finance teams could otherwise devote to more strategic activities. Synergy’s automated payroll processes save time and streamline the entire payroll cycle, allowing HR teams to focus on more critical tasks.

Fortunately, a comprehensive payroll processing system like Synergy can alleviate these challenges. Synergy automates payroll calculations, tax deductions, and report generation, reducing the chances of errors and saving time.

How Synergy Simplifies Payroll Reconciliation?

Synergy, HelixBeat’s HRMS solution, is designed to streamline payroll management and reconciliation. Here’s how Synergy makes payroll reconciliation easier:

Automated Payroll Processing

Synergy automates payroll calculations, ensuring that deductions and employee pay are calculated correctly every time. This reduces manual errors and ensures compliance with tax laws. By using an employee payroll management system like Synergy, businesses can minimize the chances of costly payroll mistakes.

Real-Time Payroll Insights

With Synergy, HR managers and decision-makers can access real-time payroll data and reports. This transparency makes reconciliation faster and more accurate, as discrepancies are spotted immediately. The payroll processing system also provides immediate insights into payroll status, making it easier to take corrective actions when necessary.

Seamless Integration with Financial Systems

Synergy integrates with other financial systems, such as accounting software or enterprise resource planning (ERP) systems. This integration ensures that payroll data matches up with the company’s financial records, eliminating the need for manual data entry. This seamless integration streamlines the reconciliation process, saving time and effort for HR and finance teams.

Compliance Management

Synergy keeps track of the latest tax laws and compliance regulations, ensuring that all payroll deductions are in line with government requirements. This feature is particularly valuable for businesses operating in multiple locations or countries. The payroll processing system in Synergy helps businesses stay compliant and avoid costly penalties.

Efficient Reporting Tools

Synergy’s comprehensive reporting capabilities allow HR managers to generate custom reports, review payroll data in real-time, and compare payroll expenses to financial records. These reports help facilitate quicker reconciliation and provide transparency into payroll operations. By using the employee payroll management system, HR teams can access accurate data quickly, making reconciliation more efficient.

The Role of Technology in Payroll Reconciliation

Technology has transformed payroll reconciliation, moving it from a manual, error-prone process to an automated and streamlined task. By implementing advanced payroll processing systems like Synergy, businesses can:

Save Time and Effort: Automation speeds up payroll reconciliation and reduces the time spent on manual tasks. With an employee payroll management system, businesses can eliminate tedious manual steps, allowing HR teams to focus on more strategic activities.

Increase Accuracy: Automated systems reduce human error, ensuring that employees are paid accurately and on time. The employee payroll management system in Synergy ensures that calculations are consistent and precise, minimizing mistakes.

Enhance Security: Payroll systems like Synergy use robust security measures to protect sensitive employee data and prevent fraud. This ensures that payroll information remains confidential and secure at all times.

Improve Decision-Making: With real-time data and comprehensive reporting, HR and finance teams can make more informed decisions and address issues faster. Synergy’s payroll processing system enables access to real-time insights, empowering managers to make data-driven decisions quickly.

Best Practices for Payroll Reconciliation

To ensure effective payroll reconciliation, follow these best practices:

Regular Audits: Conduct regular audits of payroll data and financial records to catch discrepancies early. This proactive approach ensures that discrepancies are identified before they become issues.

Use Automation Tools: Invest in an automated payroll processing system like Synergy to streamline reconciliation tasks. Automation reduces the workload on HR teams and ensures efficiency in the process.

Stay Updated on Regulations: Track changes in tax laws and employee benefit regulations to ensure compliance. Synergy’s employee payroll management system automatically integrates regulations updates, ensuring compliance.

Train Your Team: Ensure that HR and finance teams are well-trained in using the payroll management system and understanding the reconciliation process. This knowledge is key to reducing errors and ensuring smooth payroll operations.

Final Words

Payroll reconciliation is a vital process that ensures the accuracy of payroll data, tax filings, and financial records. Without proper reconciliation, businesses risk errors, compliance issues, and employee dissatisfaction. Fortunately, tools like Synergy make this process far more manageable.

With its automated payroll processing, real-time insights, and seamless integration with financial systems, Synergy offers a powerful solution for businesses looking to simplify payroll reconciliation. By adopting Synergy, HR teams can save time, reduce errors, and ensure accurate payroll management, all through an efficient employee payroll management system.

Experience Synergy today — Start your free demo and discover how Synergy can transform your HR and payroll operations.

FAQs

1. What is reconciliation in payroll?

Reconciliation in payroll is the process of reviewing and verifying payroll data to ensure that it matches with other financial records, such as tax filings, bank statements, and accounting records. It helps ensure that employees are paid correctly, taxes are properly deducted, and all payroll expenses are accurate.

2. How to test payroll reconciliation?

To test payroll reconciliation, compare the payroll records with financial documents, such as bank statements, tax filings, and accounting reports. Ensure that the deductions, wages, bonuses, and taxes match the company’s records. Also, verify that the payroll system’s calculations align with actual payments made to employees.

3. What is reconciliation in HR?

Reconciliation in HR refers to the process of comparing and verifying employee-related data, such as attendance, payroll, and benefits, against company records. It ensures that HR information is accurate, up-to-date, and compliant with company policies and regulations.

4. How to audit a payroll?

To audit a payroll, review all payroll records, including employee hours, wages, benefits, and tax deductions. Compare these records against financial documents, such as bank statements and tax filings, to identify discrepancies. Check that all payroll calculations are accurate and ensure compliance with relevant labor laws.

5. What is a payroll checklist?

A payroll checklist is a list of tasks that need to be completed during the payroll process. It includes verifying employee details, calculating wages and deductions, ensuring tax compliance, generating payslips, and making sure payments are made correctly. The checklist helps ensure that all necessary steps are completed and payroll is processed accurately.