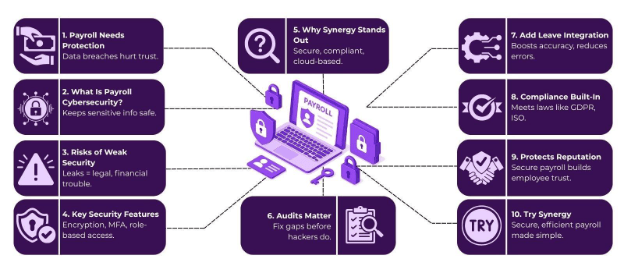

When managing payroll, accuracy and timeliness are usually top priorities. However, another critical aspect often goes unnoticed—cybersecurity in payroll. With the increasing incidence of data breaches and cyber-attacks, businesses must ensure their payroll systems are secure and compliant. Sensitive employee payroll data, including salaries, tax details, and personal information, is a prime target for cybercriminals. In this blog, we’ll explore why cybersecurity in payroll is essential, the risks of managing payroll without robust security measures, and how a comprehensive HRMS solution like Synergy can safeguard your payroll data from potential threats.

What Is Cybersecurity in Payroll?

Cybersecurity in payroll refers to the practices, technologies, and policies that safeguard payroll data from unauthorized access, theft, or damage. It ensures that sensitive financial information, employee records, and compliance-related data remain secure from cybercriminals who may attempt to exploit vulnerabilities in the payroll system. By implementing robust payroll software security, businesses can minimize the risk of data breaches and maintain the integrity of their payroll processes.

Table of Contents

Risks of Poor Payroll Data Security

- Data Breaches: Cybercriminals often target payroll systems to access personal and financial information. These breaches can lead to identity theft, fraud, and the exposure of sensitive data, including employees’ salary details, social security numbers, and tax information. Effective employee payroll data security measures are essential to prevent unauthorized access and ensure confidential information is kept safe.

- Compliance Risks: Data breaches involving payroll information can result in violations of privacy laws and regulations such as GDPR (General Data Protection Regulation) or the Maternity Benefit Act. Such violations may lead to significant fines, legal consequences, and irreparable damage to the company’s reputation. Maintaining strong payroll software security helps ensure compliance with these important regulations and avoids legal penalties.

- Financial Loss: Cyberattacks that compromise payroll data can cause overpayments or underpayments, leading to financial discrepancies. This not only disrupts company finances but also erodes employee trust and satisfaction. Inaccurate payroll data may result in incorrect deductions, taxes, and bonuses, which can negatively impact both employees and businesses. Investing in cybersecurity in payroll protects against these financial setbacks by ensuring payroll accuracy.

With the right payroll management software in place, businesses can implement necessary cybersecurity measures to protect employee payroll data security and minimize the risks associated with payroll errors. Robust payroll software security features, such as encryption, access control, and data backups, can help safeguard sensitive data from breaches and cyber threats. By prioritizing cybersecurity in payroll, businesses can ensure their payroll systems remain secure, compliant, and efficient.

How Payroll Software Security Protects Employee Data?

Using the best payroll software in India, equipped with robust security features, is crucial for safeguarding employee payroll data. These features are designed to protect sensitive payroll information, ensuring it remains secure through encryption, authentication, and access control measures. These measures help prevent unauthorized access, keeping employee data safe from cyber threats and breaches.

Features of Payroll Software Security

- Data Encryption: Payroll software security ensures that sensitive data is encrypted both during transmission and when stored. This ensures that payroll data, including employee salaries, tax information, and personal details, is unreadable to unauthorized individuals. Whether the data is being transferred over the internet or stored within the payroll system, encryption is essential in protecting against potential data breaches and cyberattacks.

- Multi-Factor Authentication (MFA): Multi-factor authentication adds an additional layer of security to payroll systems by requiring multiple forms of identity verification. Users must authenticate their identity using something they know (like a password), something they have (like an OTP), or something they are (biometric verification). MFA minimizes the chances of unauthorized access, ensuring that only authorized personnel can access or modify payroll information, boosting cybersecurity in payroll systems.

- Access Controls: Payroll software security includes strong access controls, which define specific user roles and permissions. This means only authorized individuals can access sensitive payroll data. For example, HR managers might have full access to payroll data, while employees may only access their own pay stubs and leave balances. These restrictions ensure that only relevant personnel can modify or view sensitive data, protecting employee payroll data security.

- Regular Security Audits: To further strengthen the security posture, regular audits are crucial for identifying vulnerabilities in the payroll system. Security audits help businesses recognize weaknesses, allowing for timely patches and updates before potential cybercriminals can exploit any gaps. This process ensures that payroll systems remain compliant with security standards and regulations.

Synergy, Helixbeat’s advanced payroll and attendance management software, incorporates these features, offering a secure platform for managing payroll data. With its focus on payroll software security, Synergy ensures that sensitive employee payroll data is secure, compliant, and protected from potential threats. By using Synergy, businesses can avoid common payroll errors and improve efficiency, while maintaining a high level of security in payroll processes.

Enhancing Security with Integrated Payroll and Leave Management Software

Combining payroll management software with leave management software can improve both operational efficiency and security. When both systems are integrated, businesses can automate various tasks, reducing human error and eliminating potential security risks associated with manual processes.

Benefits of Integrating Payroll and Leave Management Software

- Seamless Data Flow: Integration ensures that attendance and leave data is automatically transferred to the payroll system, reducing the risk of errors that could lead to security vulnerabilities and enhancing cybersecurity in payroll.

- Enhanced Data Accuracy: By automating data entry, businesses can avoid discrepancies in employee hours, leave balances, or salary calculations, which could otherwise lead to financial discrepancies and security issues, improving employee payroll data security.

- Better Compliance Tracking: Automated systems help ensure that all payroll and leave management processes comply with labor laws, preventing violations that could expose the company to data security risks and improve payroll software security.

By using Synergy, which integrates payroll and leave management, businesses can enhance security, improve efficiency, and ensure that all employee data remains secure and compliant.

How Synergy Safeguards Payroll Data from Cyber Threats?

Synergy stands out as a comprehensive employee payroll management software that not only helps businesses manage payroll efficiently but also ensures robust security. Here’s how Synergy helps protect payroll data:

Security Features of Synergy

- Advanced Data Encryption: All payroll data is encrypted with the latest encryption standards, ensuring that it cannot be intercepted or accessed by unauthorized parties.

- Role-Based Access Control: Synergy allows businesses to assign specific roles and permissions to different users, ensuring that only authorized personnel can access sensitive payroll data.

- Cloud-Based Security: With Synergy, your payroll data is stored securely on the cloud, which is regularly backed up and protected by multi-layer security measures to prevent data loss or breaches.

- Compliance with Industry Standards: Synergy adheres to industry best practices and compliance standards, such as GDPR and ISO certifications, ensuring that payroll data is handled securely and in accordance with data protection laws.

By integrating these features, Synergy ensures that your payroll data remains protected from cyber threats, preventing financial and reputational damage.

Importance of Employee Payroll Data Security for Business Reputation

The security of employee payroll data is not just an internal concern; it’s also a crucial factor for maintaining a company’s reputation. A single breach of sensitive payroll information can harm employee trust and tarnish the company’s public image. Here’s why businesses should prioritize payroll data security:

Consequences of Payroll Data Breaches

- Loss of Trust: Employees expect their payroll data to be secure. A breach can lead to a loss of trust and decreased morale, impacting productivity and engagement.

- Legal Ramifications: Data breaches may lead to legal consequences, including fines and lawsuits, especially if the company fails to comply with data protection laws.

- Financial Penalties: Companies may face financial penalties for not protecting employee data adequately, which can significantly affect their bottom line.

By investing in secure payroll management software like Synergy, businesses can avoid these risks and ensure that employees feel confident about the safety of their personal information.

Wrapping Up

Securing payroll data through cybersecurity in payroll is vital for protecting employee trust and business reputation. With Synergy’s automated solutions and advanced cybersecurity features, businesses can ensure compliance, reduce risks, and streamline payroll processes. Experience Synergy today to safeguard your payroll data and enhance operational efficiency. Start your free demo !

Download Synergy Now →

FAQs

1. How does cybersecurity in payroll help businesses?

Cybersecurity in payroll ensures that sensitive payroll data, including employee salaries and personal details, is protected from data breaches, fraud, and legal penalties.

2. What are the risks of poor payroll data security?

Risks include financial penalties, loss of employee trust, legal issues, and damage to company reputation due to data breaches or unauthorized access.

3. How does Synergy ensure payroll data security?

Synergy employs advanced encryption, role-based access controls, cloud-based security, and real-time monitoring to safeguard payroll data from cyber threats.

4. What is the best payroll software for security in India?

Synergy is among the best payroll software in India, offering robust security features like encryption, compliance with regulations, and seamless integration with attendance management systems.

5. How does Synergy integrate cybersecurity with payroll?

Synergy integrates advanced encryption, multi-factor authentication, and continuous monitoring to protect payroll data while automating payroll tasks for businesses.