Healthcare payments are frequently a confusing mess that frustrates patients and professionals alike. The continuous battle with insurance verification, complex billing, and claim denials takes time and money, which affects patient satisfaction and income. As healthcare teams sort through tons of paperwork, each denied claim seems like a speed bump that wears them down. Everyone feels worn out and overburdened by the difficult grind.

A study by the Medical Group Management Association (MGMA) found that approximately 30% of healthcare providers face issues with claim denials, which can lead to delayed payments and lost revenue.

How can you tackle these common hurdles in managing payments? Stay tuned as this blog explores the top seven payment challenges and provides practical solutions to tackle them quickly.

Table of Contents

Common Challenges in Healthcare Payment Systems

1. Compliance with Regulatory Standards

The healthcare industry is one of the most heavily regulated sectors. Healthcare payment systems must comply with various standards such as HIPAA (Health Insurance Portability and Accountability Act) and other regional regulations. Non-compliance can lead to hefty fines, reputational damage, and legal consequences.

Solution:

- Invest in payment platforms that are designed to adhere to these standards.

- Conduct regular audits to ensure compliance with evolving regulations.

- Train staff on the importance of compliance and secure handling of payment data.

2. Ensuring Payment Security

Security breaches are a top concern in the healthcare sector due to the sensitive nature of patient data. Cybercriminals target healthcare systems for both financial and personal information, leading to devastating data breaches.

Solution:

- Implement end-to-end encryption to protect payment data.

- Use multi-factor authentication (MFA) to enhance system security.

- Partner with payment solution providers that prioritize security and employ robust fraud detection mechanisms.

3. Scalability and Systems Integration

As healthcare organizations grow, their healthcare payment systems must scale accordingly. Many providers struggle with integrating healthcare payment systems into existing Electronic Health Record (EHR) systems and other technologies.

Solution:

- Opt for cloud-based healthcare payment systems that can scale with demand.

- Use APIs to enable seamless integration with existing systems.

- Regularly evaluate system performance to identify and address bottlenecks.

4. Patient Experience and Payment Transparency

Patients often struggle to understand their bills. Complex invoices, hidden fees, and a lack of payment options can lead to dissatisfaction and delayed payments.

Solution:

- Simplify billing statements with clear breakdowns of costs.

- Offer multiple payment options, including digital wallets and instalment plans.

- Use patient portals to provide easy access to billing information and payment tracking.

5. Delayed Reimbursements

Healthcare providers frequently face delays in insurer reimbursements. These delays can impact cash flow, leading to operational challenges.

Solution:

- Automate claim submissions and tracking to reduce manual errors.

- Use predictive analytics to identify potential claim issues early.

- Collaborate with insurers to streamline the reimbursement process.

6. High Operational Costs

Managing healthcare payment systems can be expensive due to administrative burdens, outdated technologies, and inefficiencies in manual processing.

Solution:

- Use automation to handle routine tasks and reduce reliance on manual processes.

- Opt for cloud-based platforms to lower infrastructure costs.

- Conduct regular reviews to eliminate redundancies and improve cost efficiency.

7. Interoperability Across Systems

Fragmentation in healthcare systems often results in difficulties when integrating payment platforms with other software, such as EHR, CRM, or telehealth solutions.

Solution:

- Choose platforms with interoperability as a core feature.

- Use middleware to connect disparate systems.

- Regularly test integrations to ensure smooth functionality.

8. Billing Complexity

One of the biggest challenges is the sheer complexity of healthcare billing. Providers have to deal with varying insurance policies, complex codes (like ICD-10 for diagnosis and CPT for procedures), and differing patient obligations (co-pays, deductibles). Mistakes in coding or billing can lead to denied claims, delays in reimbursement, and dissatisfied patients.

Solution:

- Employ specialized billing staff or services to manage coding and claims processing.

- Use advanced billing software to reduce errors and ensure accuracy.

- Regular training for billing staff on updates in codes and insurance policies is conducted.

9. Delayed Payments

Delays in payments from both insurance companies and patients are a common pain point. Insurance companies may take weeks to process claims, leading to provider cash flow issues. If claims are denied due to errors, the delay is further extended. Patients, too, may delay payments, especially if they are confused by medical bills or face high out-of-pocket costs.

Solution:

- Automate reminders for patient payments and follow-ups.

- Implement clear communication regarding billing details upfront.

- Leverage tools to verify insurance eligibility before services are rendered.

10. Insurance Verification and Claim Denials

Many providers face challenges with verifying patient insurance coverage upfront. If the insurance information is outdated or incorrect, providers may render services only to discover that the claim will not be reimbursed. Claim denials are another significant issue arising from reasons such as incomplete information, incorrect codes, or services deemed non-essential by the insurer.

Solution:

- Use real-time insurance verification systems.

- Invest in claim management software to minimize errors.

- Train staff to handle appeals effectively to reduce delays.

11. Administrative Burden

The administrative burden of managing healthcare payments is substantial. Healthcare providers must employ staff to handle insurance claims, patient billing, follow-ups, and complex healthcare payment regulations. This burden detracts from the provider’s ability to focus on delivering care and increases operating costs.

Solution:

- Outsource administrative tasks to trusted third-party providers.

- Automate repetitive processes to reduce workload.

- Conduct periodic assessments to streamline administrative workflows.

12. Patient Out-of-Pocket Costs

Patients in the US healthcare system often bear a significant portion of their healthcare expenses, particularly with high-deductible health plans. Understanding and managing these costs can be confusing for many, leading to delayed payments or defaulting on bills altogether. High out-of-pocket costs can also deter patients from seeking necessary care.

Solution:

- Provide upfront cost estimates to patients.

- Offer flexible payment plans or financial counselling services.

- Use transparent billing practices to enhance trust and understanding.

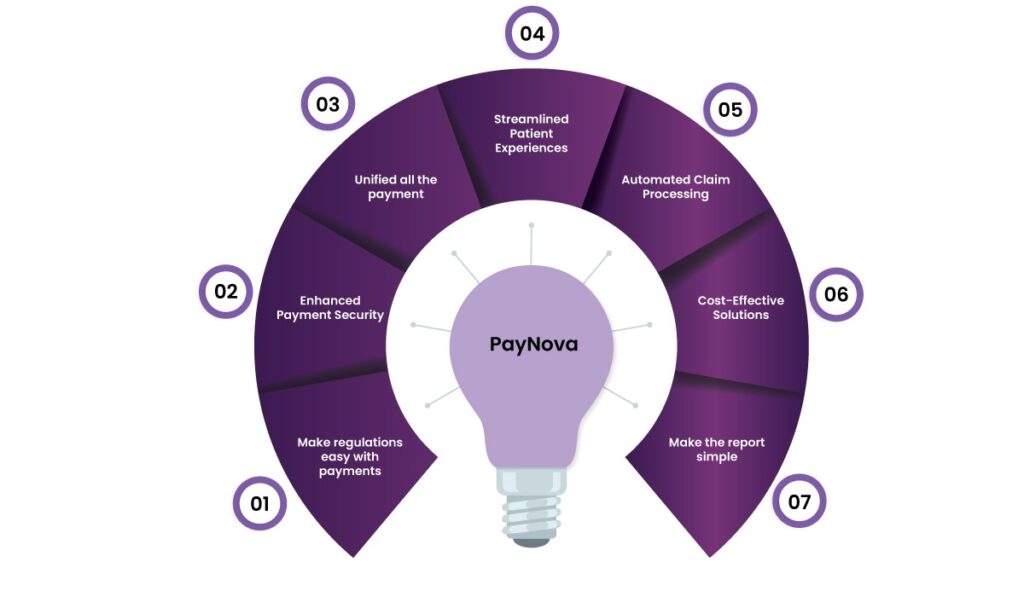

How PayNova Helps Overcome Healthcare Payment Challenges

1. Make regulations easy with payments

Navigating complex regulatory landscapes like HIPAA can be daunting for healthcare organizations. PayNova provides pre-compliant healthcare payment systems that meet regulatory requirements from the start. Its real-time compliance monitoring and updates help healthcare providers stay ahead of evolving legal mandates. This proactive approach reduces the risk of penalties and simplifies auditing processes, ensuring peace of mind for administrators. Additionally, PayNova offers tailored compliance training for healthcare staff to build a culture of adherence and security within organizations.

2. Enhanced Payment Security

The sensitive nature of healthcare data makes robust security paramount. PayNova leverages cutting-edge encryption and tokenization technologies to safeguard transactions against breaches. Real-time fraud detection systems actively monitor payment activity, reducing the risk of financial losses. The platform also supports multi-factor authentication, ensuring only authorized individuals can access payment information. By prioritizing security, PayNova helps healthcare providers build patient trust while minimizing cyberattack vulnerability.

3. Unified all the payment

Integrating healthcare payment systems with existing healthcare systems, such as EHRs, can be a challenge. PayNova simplifies this process through its API-driven architecture, enabling quick and smooth integration with multiple platforms. The solution also supports interoperability across diverse software ecosystems, reducing fragmentation. Healthcare organizations benefit from unified data flow, improved operational efficiency, and enhanced system scalability to accommodate future growth.

4. Streamlined Patient Experiences

Patient satisfaction is at the core of healthcare payments. PayNova is a revolutionary healthcare payment system where patients can effortlessly view, understand, and pay bills. Transparent invoicing eliminates confusion, while multiple payment options, including digital wallets, enhance convenience. By addressing these pain points, PayNova encourages timely payments and fosters a patient-first approach, ultimately improving retention rates.

5. Automated Claim Processing

Delays in insurance reimbursements are a common frustration for healthcare providers. PayNova’s automated claim submission and tracking tools streamline the entire process. Predictive analytics identify potential claim errors before submission, minimizing rejections. Providers can also track claims in real-time, enabling faster resolutions. This efficiency translates into better cash flow management and reduced administrative burden for organizations.

6. Cost-Effective Solutions

Healthcare providers often grapple with high operational costs associated with healthcare payment systems. PayNova helps reduce expenses by automating repetitive tasks and transitioning systems to the cloud. These solutions lower infrastructure costs and free up resources for other priorities. Regular process evaluations identify inefficiencies, enabling further cost optimization and fostering financial sustainability.

7. Make the report simple

PayNova empowers healthcare providers with advanced reporting capabilities that simplify data analysis and decision-making. Its intuitive dashboards generate real-time insights into payment trends, outstanding bills, and claim statuses. Customizable reporting options allow administrators to focus on specific metrics, such as revenue cycles or reimbursement delays. PayNova enables stakeholders to identify bottlenecks, forecast cash flow, and strategize more effectively by providing easy-to-understand visualisations.

At nutshell,

Medical billing challenges are constantly evolving. Healthcare providers must adapt to new payment trends to bridge the gaps. Ensure transparency, robustness, and a patient-centric approach to payments in your hospitals. Instead of depending on outdated methods, adopt innovations for seamless healthcare payment systems.

PayNova’s holistic approach to healthcare payment systems ensures that providers can confidently navigate complexities, delivering a seamless experience for patients and stakeholders alike. With the right strategies and tools, the future of healthcare payments looks achievable and remarkably promising.

Frequently asked question

1. What do healthcare payment systems face the main challenges?

The main challenges, especially in the US, are compliance with regulations, payment security, complexity in billing, operational costs, delayed reimbursements, and integrating payment gateways into various systems.

2. How can PayNova help healthcare providers comply with regulations?

PayNova is designed exclusively for healthcare domains. It meets regulatory standards like HIPAA and can be updated over time. By implementing these, you can stay aligned with evolving legal standards and reduce the risk of penalties.

3. What measures does PayNova take to ensure payment security?

PayNova protects sensitive payment data with advanced encryption, tokenization, and multi-factor authentication. It also incorporates real-time fraud detection to mitigate cybersecurity threats.

4. Can PayNova integrate with existing Electronic Health Record (EHR) systems?

PayNova’s API-driven architecture allows seamless integration with EHR systems and other healthcare platforms, ensuring smooth data flow and operational efficiency.

5. How does PayNova improve the patient payment experience?

PayNova enhances the patient experience with user-friendly portals, transparent billing, and multiple payment options. These features simplify the payment process and encourage timely transactions.

6. What are PayNova’s solutions for managing delayed insurance reimbursements?

PayNova offers automated claim submission and real-time tracking tools that minimize errors and reduce delays. Predictive analytics further streamline the reimbursement process, ensuring steady cash flow.

7. Does PayNova provide tools for financial reporting and analysis?

Yes, PayNova includes comprehensive reporting tools with intuitive dashboards. These enable healthcare providers to generate real-time insights, monitor payment trends, and make informed decisions.

8. How does PayNova help reduce operational costs for healthcare organizations?

By automating manual tasks, transitioning to cloud-based systems, and optimizing workflows, PayNova reduces infrastructure costs and administrative burdens, allowing organizations to focus on delivering quality care.