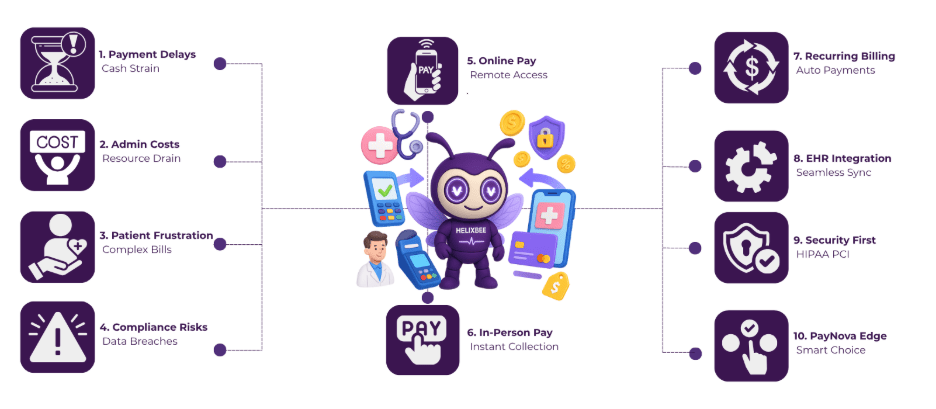

In healthcare, delivering excellent care is only half the battle—managing payments remains one of the biggest challenges. Hospitals, clinics, and telehealth providers frequently encounter challenges such as delayed reimbursements, claim rejections, high administrative costs, and compliance risks.

For patients, the pain points include confusing invoices and limited payment options, which reduce satisfaction and trust. This is where mobile merchant services step in to bridge the gap. By enabling fast, secure, and flexible transactions both in-person and online, they address the financial bottlenecks that traditional billing systems fail to solve.

A reliable merchant services credit card processor ensures compliance with HIPAA and PCI DSS while improving cash flow for providers. Evaluating top merchant processors through a detailed list of merchant services credit card processors helps healthcare organizations choose the right partner. This blog compares in-person and online mobile merchant services, explaining how they can transform healthcare payments.

Table of Contents

Why Mobile Merchant Services Matter in Healthcare

Healthcare providers in the U.S. face significant challenges in managing patient payments. These challenges not only impact cash flow but also affect patient satisfaction and overall operational efficiency. Let’s delve into these issues:

1. Delayed Reimbursements

Insurance claim rejections and delays are a persistent problem. Between 2022 and 2023, care denials increased by an average of 20.2% for commercial claims and 55.7% for Medicare Advantage claims American Hospital Association. These delays can significantly disrupt a provider’s revenue cycle, resulting in financial strain.

2. High Administrative Costs

Administrative expenses in healthcare are alarmingly high. A 2021 study by McKinsey estimated hospital administrative costs at $250 billion, representing 21% of total healthcare spending Commonwealth Fund. These costs are primarily driven by billing, coding, and insurance-related activities, diverting resources from patient care.

3. Poor Patient Satisfaction

Complex billing processes contribute to patient dissatisfaction. A study found that 36% of adults skipped or postponed necessary healthcare due to cost KFF. Confusing invoices and limited payment options exacerbate this issue, leading to increased patient frustration.

4. Compliance Risks

Handling sensitive payment and medical data without proper safeguards exposes providers to compliance risks. In 2023, over 133 million healthcare records were exposed due to data breaches The HIPAA Journal. Ensuring compliance with regulations like HIPAA and PCI DSS is crucial to protect patient information.

By adopting mobile merchant services, healthcare providers can address these challenges effectively:

- Flexible Payment Options: Accepting payments via credit cards, mobile wallets, and ACH transfers offers patients convenient choices, reducing the likelihood of delayed payments.

- Seamless Integration: Integrating payment systems with Electronic Health Records (EHR) and billing systems streamlines operations, reducing administrative burdens.

- Enhanced Security: Mobile merchant services ensure compliance with industry standards, safeguarding sensitive patient data and minimizing compliance risks.

- Improved Cash Flow: Faster payment processing accelerates revenue cycles, alleviating financial pressures on healthcare providers.

In-Person vs. Online Mobile Merchant Services

Healthcare payments can happen either in person or online, and each method has its own advantages and disadvantages. Understanding these differences helps providers choose the right mobile merchant services for their practice.

1. In-Person Transactions

In traditional healthcare settings—clinics, hospitals, diagnostic centers—patients usually pay at the reception or billing desk. Staff use POS devices powered by mobile merchant services to process payments.

Advantages:

- Instant Payment Collection: Payments are processed immediately at the point of care, reducing outstanding balances and improving cash flow.

- Multiple Payment Options: Clinics can accept credit cards, debit cards, contactless payments, and mobile wallets, offering convenience for patients who prefer physical transactions.

- Trust and Transparency: Face-to-face interactions build confidence, as patients can ask questions and get immediate clarification on bills.

Disadvantages:

- Requires Physical Presence: Patients must visit the facility, which can be inconvenient for those with mobility issues, busy schedules, or chronic conditions.

- Hardware Costs: Clinics need to invest in POS machines, tablets, or mobile devices to accept payments—an upfront cost that may be significant for smaller practices.

- Limited Flexibility for Follow-Up Payments: Patients who need recurring or installment payments must return to the facility or rely on manual processes.

- Poor Patient Satisfaction: Long queues at billing counters and complicated billing procedures often frustrate patients. A crowded waiting room can make the payment experience stressful.

- Staff Burnout: Administrative staff spend hours handling cash, reconciling payments, and managing billing errors. This repetitive work contributes to fatigue and burnout, reducing efficiency.

- Time-Consuming Processes: Verifying insurance coverage, processing co-pays, and correcting billing mistakes at the desk takes time, increasing wait times for all patients.

In short, while in-person mobile merchant services ensure immediate payment, they often create operational bottlenecks and reduce overall patient satisfaction.

2. Online Transactions

Online healthcare payments are increasingly common, particularly with the growth of telemedicine, digital pharmacies, and patient portals. These transactions use mobile merchant services integrated into websites or apps.

Advantages:

- Convenience for Patients: Patients can pay from anywhere, reducing travel and waiting times. This flexibility is especially helpful for patients with chronic illnesses or mobility challenges.

- Automates Recurring Payments: Subscription-based care or recurring treatments (e.g., physiotherapy, chronic disease management) can be billed automatically, reducing the risk of missed payments.

- Reduces Manual Paperwork: Billing staff no longer need to manually enter payments or reconcile transactions, saving time and minimizing errors.

- Faster Insurance Processing: Online systems often integrate with EHR and insurance verification tools, speeding up claim submissions and reimbursements.

- Improved Patient Experience: Clear digital invoices and multiple payment options make it easier for patients to understand and pay their bills, boosting satisfaction.

Features Comparison: In-Person vs. Online Mobile Merchant Services

| Feature | In-Person Mobile Merchant Services | Online Mobile Merchant Services |

| Payment Speed | Instant collection at checkout | Near-instant, depends on gateway; automated processing reduces delays and accelerates revenue cycles |

| Hardware Requirement | POS terminal, tablet, or mobile device | No physical hardware needed; works on any web-enabled device |

| Patient Convenience | Good for walk-ins, in-clinic payments | Excellent for remote/telehealth patients; pay from home or anywhere |

| Fraud Risk | Low, but dependent on staff vigilance | Moderate to high; mitigated by secure encryption, fraud detection, and PCI compliance |

| Integration with EHR/Billing | Moderate; manual reconciliation often required | High; integrates seamlessly with EHR, billing software, and telehealth platforms |

| Recurring Payments | Limited; manual follow-up needed | Strong support for recurring billing, subscription care, or installment plans |

| Transparency for Patients | Medium; invoices often paper-based, can be confusing | High; digital invoices with clear itemization improve patient understanding |

| Operational Efficiency | Staff-intensive; prone to delays and human error | High; automated reconciliation reduces administrative workload and errors |

| Patient Satisfaction | Can be low due to long queues, waiting time, and payment complexity | High; convenient, quick, and flexible payment options improve overall patient experience |

| Accessibility for Remote Patients | Poor; requires physical presence | Excellent; patients can pay from anywhere without visiting the clinic |

| Scalability | Limited by physical space and staff | High; easily scales to handle large volumes of payments online |

| Security & Compliance | Good if POS and staff are trained | Very high with HIPAA and PCI DSS–compliant gateways and secure encryption |

| Support for Telehealth Services | Not applicable | Fully supports telemedicine platforms, digital pharmacies, and patient portals |

| Cost Efficiency | Medium; hardware and staff add costs | High; minimal hardware, reduced staffing needs, and automated processing lower overall costs |

| Best Use Case | Clinics, hospitals, diagnostic labs with walk-in patients | Telemedicine, online pharmacies, patient portals, chronic care subscriptions |

Role of Merchant Services Credit Card Processors in Healthcare

A merchant services credit card processor acts as the backbone of healthcare transactions. They securely move payment data from the patient to the provider’s bank, ensuring compliance and efficiency.

Healthcare providers often evaluate a merchant services credit card processor list to compare costs, transaction speed, security features, and integrations with existing systems.

Some of the top merchant processors in the healthcare space include:

- PayNova (specialized in healthcare payments).

- Square.

- Stripe.

- Chase Payment Solutions.

Each provider has unique pricing, compliance strengths, and integration capabilities.

Advantages of Mobile Merchant Services in Healthcare

- Faster Payments – Reduce billing cycles from weeks to hours.

- Higher Patient Satisfaction – Multiple payment options improve convenience.

- Reduced Admin Burden – Automates payment tracking and reconciliation.

- Better Compliance – Protects against data breaches with PCI DSS standards.

- Scalability – Works for both small clinics and large hospital networks.

Disadvantages of Mobile Merchant Services in Healthcare

- Processing Fees – Every merchant services credit card processor charges a fee per transaction.

- Integration Complexity – Some EHRs require custom development.

- Digital Divide – Not all patients are comfortable with mobile apps or online portals.

- Fraud Risks – Especially higher in online transactions if security is weak.

How to Choose the Right Processor

When evaluating a merchant services credit card processor list, healthcare providers should consider:

- Compliance (HIPAA, PCI DSS).

- Payment Options (cards, wallets, ACH).

- Integration (EHR, billing software, telehealth platforms).

- Pricing (transaction fees, monthly charges).

- Support (24/7 availability for critical healthcare environments).

The best approach is to compare top merchant processors against your organization’s exact needs rather than defaulting to the cheapest option.

Why PayNova is the Best Mobile Payment Solution for Healthcare

Managing healthcare payments can be challenging, but PayNova simplifies the process for both providers and patients. Unlike traditional billing systems, PayNova offers a comprehensive mobile merchant services solution that works seamlessly for in-person and online transactions. With PayNova, healthcare providers can accept payments anywhere—whether at a clinic desk, during home visits, or through telehealth portals—ensuring faster reimbursements and improved cash flow.

PayNova’s key features set it apart from other merchant services credit card processors:

- Multiple Payment Options: Patients can pay via credit/debit cards, mobile wallets, ACH transfers, or set up recurring payments for chronic care.

- Seamless Integration: PayNova integrates with Electronic Health Records (EHR), billing systems, and telehealth platforms, reducing administrative workload.

- Enhanced Security: HIPAA and PCI DSS compliance ensure sensitive patient data is fully protected.

- Improved Patient Experience: Digital invoices, clear billing, and flexible payment options boost satisfaction and trust.

- Scalability and Support: Whether it’s a small clinic or a large hospital network, PayNova handles growing transaction volumes with reliable 24/7 support.

By choosing PayNova, healthcare providers not only streamline payments but also enhance patient convenience, reduce administrative burden, and position their practice for future-ready digital healthcare. PayNova is more than a payment processor—it’s a partner in delivering efficient, patient-centered care.

Final Thoughts

Healthcare payments don’t have to be complicated. With the right mobile merchant services, providers can streamline billing, improve cash flow, and enhance patient satisfaction.

PayNova stands out as a trusted solution for both in-person and online healthcare transactions, offering multiple payment options, seamless EHR integration, and HIPAA-compliant security. Its flexible platform supports recurring payments, telehealth services, and large-scale hospital operations, making payment management efficient and straightforward.

Don’t let billing challenges slow your practice—experience the benefits of faster, secure, and patient-friendly transactions.

Get started with PayNova today and transform your healthcare payment experience.

FAQs:

- What are mobile merchant services in healthcare?

Mobile merchant services allow healthcare providers to accept secure, flexible payments from patients both in-person and online.

- Why is PayNova ideal for healthcare payments?

PayNova offers multiple payment options, seamless EHR integration, HIPAA & PCI DSS compliance, and 24/7 support for efficient healthcare transactions.

- What’s the difference between in-person and online healthcare payments?

In-person payments happen at clinics via POS devices, while online payments are processed through telehealth portals or apps, offering convenience and automation.

- How do mobile merchant services improve patient satisfaction?

They reduce waiting times, simplify billing, offer multiple payment options, and allow patients to pay securely from anywhere.

- Are mobile merchant services secure for healthcare data?

Yes. Providers like PayNova comply with HIPAA and PCI DSS standards to ensure all patient payment and medical data remain protected.

- Can mobile merchant services support recurring payments?

Absolutely. Online systems like PayNova automate recurring billing for chronic care, subscriptions, and installment plans, improving cash flow and reducing missed payments.