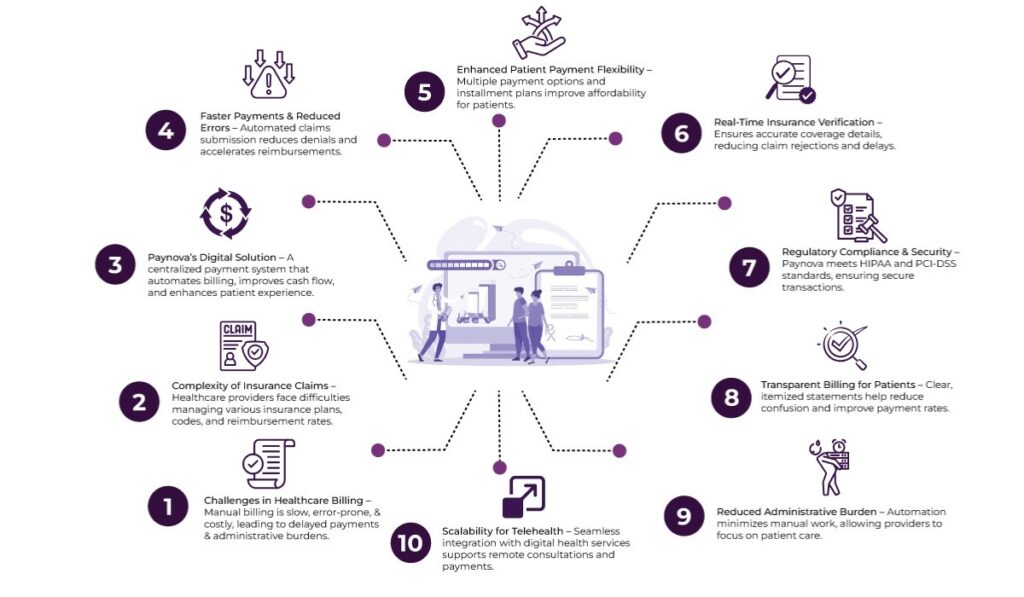

The healthcare sector, particularly in the United States, has long struggled with complex and often outdated billing systems. From paper-based claims to delayed reimbursements, healthcare providers face a myriad of challenges that hinder their ability to focus on patient care. The introduction of digital payment systems like Paynova offers a transformative solution to these longstanding issues.

This blog will explore how Paynova, a dedicated payment system, can help streamline healthcare billing operations, improve cash flow, and enhance the patient experience.

Table of Contents

The Current State of Healthcare Billing

In the U.S., the healthcare payment system is a complex web of interactions involving patients, insurance companies, government programs (like Medicare and Medicaid), and healthcare providers. At its core, this system operates under a fee-for-service model where providers are reimbursed for each service they render. However, this model is riddled with inefficiencies that lead to delayed payments, administrative errors, and financial strain for both healthcare providers and patients.

One of the most significant pain points is billing complexity. Healthcare providers often deal with numerous insurance plans, each with its own set of codes, regulations, and reimbursement rates. Patient co-pays, deductibles, and other out-of-pocket expenses further compound these complexities. The result is a convoluted and error-prone process that can lead to denied claims, payment delays, and a strained relationship between healthcare providers and patients.

Challenges in manual billing

Manual billing in healthcare poses several significant challenges that can hinder the efficiency and accuracy of the payment process. These challenges affect healthcare providers’ financial health and impact patient satisfaction and the overall delivery of care.

- Time-Consuming Processes: Manual billing is an inherently slow process. Each patient’s charges need to be manually entered into billing systems, and claims must be processed individually. This can lead to substantial delays in generating invoices, processing claims, and ultimately receiving payments. The time spent on administrative tasks takes away from valuable resources that could be focused on patient care.

- Increased Risk of Errors: Manual billing is prone to human error. Whether it’s an incorrect insurance code, a typo in the patient’s details, or a missed charge, these mistakes can lead to billing discrepancies and claim rejections. Such errors often result in denied payments from insurance providers, necessitating time-consuming re-submissions or appeals, further delaying reimbursement.

- Lack of Transparency: Patients often face confusion regarding their medical bills with manual billing. Without a clear, itemized breakdown, patients may struggle to understand what they owe, leading to disputes, delayed payments, or even unpaid bills. Furthermore, manual systems lack the ability to provide real-time updates, so both healthcare providers and patients are often left in the dark about the status of claims.

- High Administrative Costs: Managing manual billing systems requires hiring dedicated staff to handle paperwork, follow-up calls, and data entry, resulting in significant operational costs. These administrative duties could be better allocated to tasks that directly contribute to improving patient care.

- Limited Payment Flexibility: Manual systems generally offer limited payment options for patients, making it harder to accommodate various payment preferences. This limitation can lead to delayed payments and poor cash flow for healthcare providers.

Overall, manual billing is inefficient, error-prone, and labor-intensive, making it a significant hurdle in the healthcare payment system.

The Role of Paynova in Streamlining Healthcare Billing

Enter Paynova, a digital payment gateway designed specifically for the healthcare sector. Paynova offers a comprehensive solution that addresses the core challenges of manual billing systems by digitizing and automating payment processes. Here’s how Paynova helps healthcare providers streamline their billing operations:

1. Centralized Payment Processing

One of the primary advantages of Paynova is its ability to centralize payment processing. By consolidating insurance claims, patient self-payments, and third-party payments into a single system, Paynova simplifies the reconciliation process and reduces administrative overhead. Providers can track all payments—whether from insurance companies, government programs, or patients—within one platform. This unified system makes it easier to manage cash flow and ensures that no payment is overlooked or lost in the process.

2. Faster Payment Collection

Manual billing processes can lead to delayed payments, especially when insurance companies take weeks to process claims. With Paynova, payments are processed automatically, accelerating the entire payment cycle. Automated systems ensure that claims are submitted correctly the first time, reducing the risk of denials and ensuring faster reimbursements. Moreover, Paynova supports recurring payments and payment plans, allowing patients to pay off their medical bills over time, reducing the likelihood of missed payments and improving cash flow for healthcare providers.

3. Enhanced Patient Payment Flexibility

A key pain point for healthcare providers is managing patient payments, particularly when high out-of-pocket costs are involved. Paynova solves this by offering multiple payment options, including credit and debit cards, bank transfers, and digital wallets. Patients can also set up payment plans, making it easier to manage large medical expenses without financial strain. This flexibility improves the likelihood of timely payments and reduces the financial burden on patients, enhancing their overall experience.

4. Improved Compliance with Healthcare Regulations

In the healthcare industry, compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) and PCI-DSS (Payment Card Industry Data Security Standard) is critical. Failure to comply can lead to severe penalties, including fines and loss of patient trust. Paynova ensures that all financial transactions are handled securely, with robust encryption and compliance features built into the system. This guarantees that sensitive patient data is protected, and healthcare providers can avoid costly security breaches.

5. Real-Time Insurance Verification and Claims Management

One of the most significant challenges in healthcare billing is insurance verification. Traditional methods require providers to manually verify patient insurance coverage, which is often outdated or inaccurate. Paynova solves this by integrating real-time insurance verification, allowing providers to check coverage details instantly. This ensures that services are pre-approved and that providers are reimbursed for covered services without delay. Additionally, Paynova simplifies the claims process by automatically submitting claims to insurance companies, reducing the chance of errors and speeding up reimbursement times.

6. Clear, Transparent Billing for Patients

One of the leading causes of delayed payments and disputes in healthcare is the lack of clarity in medical billing. Many patients struggle to understand their medical bills, which can lead to confusion and frustration. Paynova improves this by offering clear, itemized billing that explains each charge in detail. Through a patient-facing portal, patients can view their payment history, track outstanding balances, and set up automatic payments. This transparency not only reduces disputes but also increases patient satisfaction by offering them a clear understanding of their financial obligations.

7. Automated Reporting and Financial Analytics

For healthcare providers, managing revenue streams and financial reporting can be overwhelming. With Paynova, providers gain access to real-time financial data and detailed reports on patient payments, insurance reimbursements, and outstanding balances. This enables healthcare organizations to make informed decisions about their finances, optimize cash flow, and identify areas where billing inefficiencies may exist.

8. Fraud Prevention and Enhanced Security

Fraud is a significant risk in the healthcare payment process. Unauthorized transactions, billing errors, and data breaches can compromise patient trust and result in financial losses. Paynova offers advanced fraud detection and security features to protect both healthcare providers and patients. By utilizing secure encryption methods and compliance with industry standards, Paynova helps mitigate the risk of fraud, ensuring that all transactions are safe and secure.

9. Support for Telehealth and Digital Health Services

With the rise of telehealth and digital health services, healthcare providers need payment systems that can support remote care. Paynova seamlessly integrates with telehealth platforms, allowing providers to accept payments for virtual consultations, digital prescriptions, and remote monitoring services. This ensures that payments for remote care are processed efficiently, making it easier for patients to pay for services from the comfort of their homes.

Solving Major Healthcare Payment Problems with Paynova

Here are some of the most pressing challenges faced by healthcare providers and how Paynova can help solve them:

- Complex Billing Processes: Paynova integrates with Electronic Health Record (EHR) and Practice Management Systems (PMS), automating billing and ensuring accurate claims submissions.

- Delayed Payments and Cash Flow Issues: Paynova accelerates payment collection through automated billing and recurring payment options, improving cash flow and reducing the risk of missed payments.

- Payment Flexibility: With multiple payment methods and flexible payment plans, Paynova allows patients to manage their medical expenses more effectively.

- Regulatory Compliance: Paynova ensures HIPAA and PCI-DSS compliance, safeguarding patient data and ensuring healthcare providers meet regulatory standards.

- Insurance Verification and Claims Handling: Paynova provides real-time insurance verification and handles preauthorizations, reducing delays and improving reimbursement times.

- Confusing Billing for Patients: Paynova offers clear, itemized bills, reducing confusion and improving the likelihood of timely payments.

- High Administrative Burden: Paynova reduces the administrative workload by automating billing and payment processing, allowing healthcare providers to focus more on patient care.

Final thoughts

If your in-house billing process is a constant source of confusion and costly errors, it may be time to hand the responsibility over to the professionals. With the right billing partner like PayNova, you can alleviate these challenges and reclaim your time and energy for what matters most—providing exceptional patient care and running a successful practice.

PayNova’s streamlined, automated billing solutions will reduce errors and improve cash flow and patient satisfaction. Schedule a demo today to discover how PayNova can optimize your billing processes and take your practice to the next level.

Frequently asked question

- What is PayNova’s billing service?

PayNova offers comprehensive billing solutions for healthcare practices, including revenue cycle management (RCM), insurance and patient billing, claims processing, and payment collections.

- How can PayNova reduce billing errors?

PayNova uses advanced automation and AI to minimize human error, ensuring accurate coding, billing, and claim submission, which leads to fewer denials and delays in payments.

- What benefits does PayNova offer small practices?

PayNova helps small practices reduce administrative overhead, improve cash flow, increase efficiency, and focus more on patient care rather than managing complex billing tasks.

- How does PayNova integrate with existing systems?

PayNova seamlessly integrates with most electronic health record (EHR) systems and practice management software, making the transition easy without disrupting your current workflow.

- Can PayNova handle both insurance and patient billing?

Yes, PayNova manages both insurance and patient billing, providing a comprehensive solution that simplifies your entire billing process from start to finish.

- How quickly can I see improvements in my revenue cycle?

Many clients report noticeable improvements within the first 30-60 days, thanks to PayNova’s optimized processes, quicker claim submissions, and reduced denials

- Is PayNova compliant with healthcare regulations?

Absolutely. PayNova complies with all healthcare regulations, including HIPAA and other industry standards, ensuring that your patient data remains secure and confidential.

- 8.How do I get started with PayNova’s billing solutions?

Getting started is easy! Simply schedule a demo with PayNova’s team to learn how their services can optimize your practice’s revenue cycle and billing processes.