A positive patient experience goes beyond just quality healthcare; it extends to seamless financial interactions. While excellent medical care is the cornerstone of patient satisfaction, efficient billing and accessible payment solutions ensure that patients complete their healthcare journey with confidence and peace of mind. However, research indicates that 41% of patients believe their medical bills may contain errors, highlighting the urgent need for clarity and precision in billing practices.

Modern billing and payment solutions, such as those provided by Paynova, are revolutionizing the way healthcare providers handle financial transactions. By streamlining payment processing services, reducing administrative burdens, and offering flexible online payment services, these solutions create a smooth and transparent patient journey from start to finish.

Table of Contents

Understanding the Patient Journey in Healthcare

The patient journey encompasses every financial and medical touchpoint, from appointment booking to final bill payment. Although healthcare needs may vary, the financial aspects of a patient’s experience follow a common pattern. Transparent billing, accessible payment methods, and financial clarity are crucial in ensuring patient trust and satisfaction.

Key Financial Steps in the Patient Journey:

- The patient schedules a medical service.

- The patient seeks to understand the expected costs, including insurance coverage, copayments, and out-of-pocket expenses.

- The patient books their appointment.

- The patient has the option to make payments before or immediately after their visit.

- The patient receives a digital invoice via email, SMS, or an online portal.

- The patient reviews and understands the charges on their bill.

- The patient navigates through available online payment services to settle their balance securely.

Financial clarity must be prioritized at every stage of the patient journey. According to recent studies, nearly 40% of patients struggle to understand their medical bills, leading to confusion, delayed payments, and dissatisfaction. Additionally, 85% of patients prefer digital payment options, making it essential for healthcare providers to adopt modern payment solutions like those offered by Paynova.

Challenges in Traditional Billing Practices

Traditional medical billing systems often create barriers to a smooth patient experience. Patients frequently encounter complex billing structures, unexpected charges, and limited payment options, resulting in frustration and potential delays in payment processing services.

Common Billing Disruptions:

- Complex and Unclear Invoices – Patients often receive medical bills filled with jargon and hidden fees, making it difficult to understand their financial responsibility.

- Limited Payment Methods – Many patients are accustomed to digital transactions but find that their healthcare providers offer only outdated, rigid payment methods.

- Delayed Billing and Payment Processing: Paper-based billing leads to late payments, affecting both patient experience and revenue cycle management.

- Manual Errors – Human errors in manual invoice processing contribute to billing inaccuracies and administrative inefficiencies.

The Integral Role of Billing in Patient Experience

Billing is often the final touchpoint in a patient’s healthcare journey, leaving a lasting impression. A cumbersome or opaque billing process can overshadow the quality of medical care received, leading to frustration and diminished trust. Conversely, a seamless and transparent billing experience enhances patient satisfaction and fosters loyalty.

Transparency: Building Trust Through Clarity

Patients frequently encounter confusion due to complex medical bills laden with jargon and unexpected charges. This lack of clarity can result in anxiety and a sense of helplessness. Implementing transparent billing practices, where costs are clearly itemized and explained, empowers patients to understand their financial responsibilities, thereby reducing stress and building trust. For instance, providing upfront cost estimates and clear communication about insurance coverage can demystify the billing process.

Flexibility: Catering to Diverse Financial Needs

Rigid payment options can pose significant challenges for patients, especially those facing financial constraints. Offering flexible payment solutions, such as installment plans, online payment portals, and acceptance of various payment methods—including credit/debit cards and digital wallets—accommodates the diverse needs of patients. This flexibility not only eases the payment process but also demonstrates a provider’s commitment to patient-centric care.

Automation: Enhancing Efficiency and Accuracy

Manual billing processes are prone to errors and delays, which can frustrate patients and disrupt cash flow for providers. Automation addresses these challenges by streamlining tasks such as insurance verification, claims processing, and payment tracking. Automated systems reduce administrative burdens, minimize errors, and expedite reimbursements, leading to a more efficient and satisfactory patient experience.

How Advanced Billing and Payment Solutions Transform the Patient Experience with PayNova

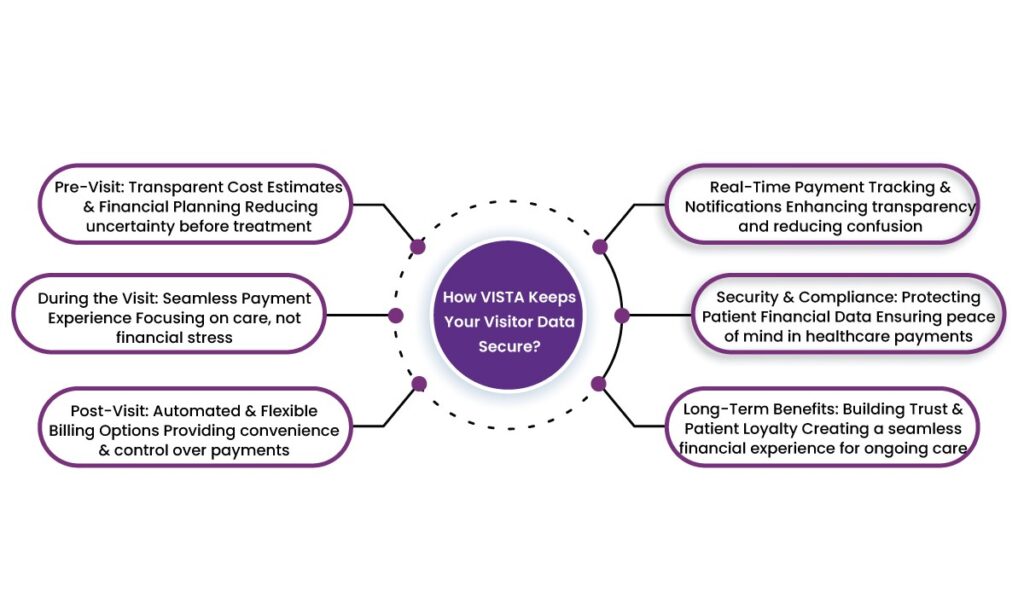

1. Pre-Visit: Transparent Cost Estimates & Financial Planning

Reducing uncertainty before treatment

One of the biggest worries patients face is not knowing how much a medical visit, procedure, or treatment will cost. According to a 2022 survey by Healthcare Financial Management Association (HFMA), 75% of patients reported that unexpected medical bills caused them financial stress, and 40% even delayed care due to cost uncertainty.

With PayNova, patients can eliminate these concerns by receiving real-time cost estimates before their visit. Here’s how:

- Clear breakdowns of insurance coverage: Patients see exactly what their insurance covers, co-pays, and their expected out-of-pocket expenses.

- Custom payment plan options: Patients can explore installment-based payment plans before treatment, reducing financial burden.

- Upfront cost transparency: Providing an estimate before care builds trust between the patient and provider and helps prevent surprise medical bills.

Example: Sarah, a working mother, needs an MRI but is hesitant due to cost concerns. With PayNova, she logs into her provider’s portal and sees an upfront estimate of $1,200, with insurance covering $900 and an out-of-pocket cost of $300. She opts for a three-month installment plan, making it easier to manage her budget.

2. During the Visit: Seamless Payment Experience

Focusing on care, not financial stress

A study by InstaMed revealed that 74% of patients find the medical billing process confusing, and long wait times due to manual billing frustrate both patients and providers. Administrative burdens should not interfere with patient care.

With PayNova, payment processes become effortless:

- Integrated with Electronic Health Records (EHRs): No need for manual data entry—patients’ financial details are stored and accessible instantly.

- Multiple payment options: Patients can choose credit/debit cards, digital wallets, or ACH transfers at check-in.

- Contactless and automated payments: Reduces errors and long wait times, ensuring a smoother check-in process.

Example: John, a patient with a busy schedule, checks in at a clinic. Instead of filling out multiple forms, his insurance details are already stored via PayNova. He simply taps his phone to complete payment via Google Pay—no delays, no hassle.

3. Post-Visit: Automated & Flexible Billing Options

Providing convenience and control over payments

Many patients receive medical bills weeks after treatment, often leading to confusion and disputes. According to the Kaiser Family Foundation, 67% of Americans had an unexpected medical bill in the past year, with many struggling to understand the charges.

PayNova ensures a better post-visit experience with:

- Itemized digital invoices: Accessible immediately via email or an online portal.

- Flexible payment plans: Instead of one large bill, patients can opt for smaller, manageable installments.

- Automated payment reminders: Reduces missed payments and late fees, helping patients stay on top of their finances.

Example: Mark underwent minor surgery and was expecting a bill of $5,000. Instead of receiving a surprise invoice a month later, PayNova sends a detailed breakdown via email immediately after discharge. Mark chooses a six-month payment plan, reducing financial strain.

4. Real-Time Payment Tracking & Notifications

Enhancing transparency and reducing confusion

Patients often struggle to keep track of medical payments, leading to missed due dates or confusion over pending insurance claims. According to Experian Health, 50% of patients are unaware of their payment responsibilities until after receiving care.

With PayNova:

- Patients track bills in real-time: A secure dashboard shows all transactions, pending claims, and outstanding balances.

- Automated SMS/email reminders: Patients are notified of due payments, completed transactions, or any outstanding balances.

- Instant dispute resolution: Any billing errors are flagged and resolved quickly through customer support integration.

Example: Lisa recently visited a specialist. Using PayNova, she tracks her insurance claim status and receives a reminder about an upcoming $150 co-pay. She avoids late fees and maintains clarity on her payments.

5. Security & Compliance: Protecting Patient Financial Data

Ensuring peace of mind in healthcare payments

In 2023, the healthcare sector saw a 93% increase in cyberattacks targeting financial and medical data (Source: Healthcare Cybersecurity Report). Patients need assurance that their sensitive information is protected.

With PayNova:

- HIPAA and PCI DSS compliance: Ensures encrypted transactions and safeguards patient data.

- Multi-layer authentication: Prevents fraud and unauthorized access.

- Secure payment portals: Patients can confidently make payments without worrying about data breaches.

Example: David pays his hospital bill via PayNova’s online payment services using two-factor authentication. Unlike traditional methods that store card details insecurely, PayNova encrypts transactions, reducing fraud risk.

6. Long-Term Benefits: Building Trust & Patient Loyalty

Creating a seamless financial experience for ongoing care

A seamless billing experience leads to increased patient satisfaction and loyalty. According to a study by Accenture, 80% of patients are more likely to return to providers who offer clear and hassle-free billing processes.

With PayNova:

- Loyalty incentives: Providers can offer discounts for early payments or reward long-term patients.

- Improved patient retention: A stress-free payment process encourages patients to continue seeking care.

- Enhanced reputation: Positive online reviews from satisfied patients boost provider credibility.

Example: After experiencing transparent billing and easy payment options with PayNova, Jane leaves a five-star review for her healthcare provider, attracting more patients to the clinic.

By integrating PayNova’s financial solutions, healthcare providers eliminate billing stress, improve patient satisfaction, and build long-term trust. A seamless payment experience is not just a convenience—it’s a necessity for modern healthcare.

The Impact of Advanced Billing and Payment Solutions

For Patients:

- Reduced Financial Stress: Knowing costs upfront and having flexible payment options ease financial burdens.

- Improved Transparency: Clear, easy-to-understand bills prevent confusion and disputes.

- Greater Convenience: Digital and mobile payment options allow quick and hassle-free transactions.

- Higher Satisfaction: A seamless financial experience enhances overall healthcare quality perception.

For Healthcare Providers:

- Faster Payments: Automated billing reduces delays, improving cash flow.

- Lower Administrative Costs: Digital solutions reduce paperwork and manual errors.

- Enhanced Patient Loyalty: A smooth billing experience increases patient retention and referrals.

- Compliance and Security: Advanced online payment services ensure compliance with regulations and protect patient data.

The Financial Benefits of Paynova’s Modern Payment Solutions

Beyond enhancing patient satisfaction, Paynova’s billing and payment solutions offer significant financial and operational benefits to healthcare providers.

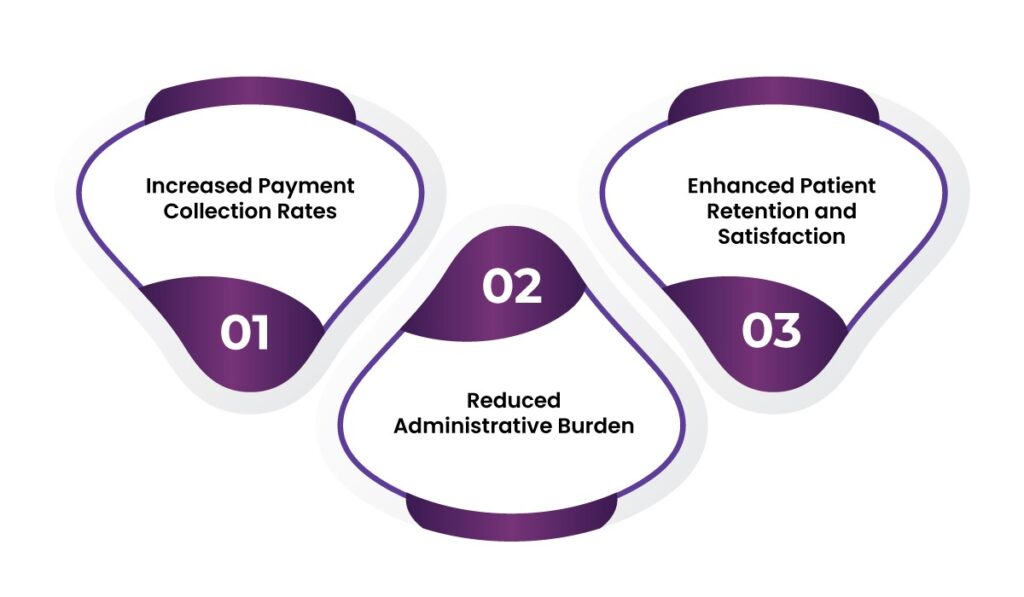

1. Increased Payment Collection Rates

With flexible payment methods and automated reminders, healthcare practices experience faster and more consistent payment collections, reducing outstanding balances and improving cash flow.

2. Reduced Administrative Burden

Automating the payment processing services minimizes manual errors and frees up administrative staff to focus on patient care instead of billing disputes.

3. Enhanced Patient Retention and Satisfaction

Patients are more likely to return to providers that offer transparent, stress-free billing experiences. A survey found that 64% of patients prioritize cost transparency when choosing a healthcare provider.

The Future of Patient-Centric Billing with Paynova

The evolution of digital payment solutions is transforming healthcare financial management. As patient expectations shift towards seamless, flexible, and automated billing, Paynova continues to lead the industry with innovative payment processing services that prioritize both patient satisfaction and provider efficiency.

By integrating Paynova’s cutting-edge solutions, healthcare providers can:

- Eliminate billing confusion through upfront cost transparency.

- Enhance patient satisfaction with flexible and secure payment methods.

- Reduce administrative workload through automated billing and payment reminders.

- Improve revenue cycles with fast, reliable payment processing services.

Upgrade Your Billing Experience with Paynova

Mapping the patient experience with modern billing and payment solutions is essential for a smoother, more patient-friendly financial journey. By adopting Paynova’s advanced payment solutions, healthcare providers can ensure a frictionless billing process while maximizing efficiency and revenue.

If you’re ready to enhance your practice’s billing and payment processes, schedule a demo with Paynova today and discover how our secure, flexible, and innovative payment solutions can transform your patient experience and financial success.

Frequently Asked Questions (FAQs):

- How do advanced billing solutions improve the patient experience?

Advanced billing solutions ensure transparency, reduce errors, and offer flexible payment options, making healthcare payments stress-free.

- What are the common challenges patients face with traditional billing?

Patients often struggle with unclear invoices, hidden fees, limited payment options, and delayed billing, leading to confusion and frustration.

- How does PayNova provide financial clarity in healthcare payments?

PayNova offers upfront cost estimates, real-time tracking, and flexible payment plans, ensuring patients understand their financial responsibilities.

- Can patients pay medical bills in installments with PayNova?

Yes, PayNova provides installment-based payment plans, allowing patients to manage healthcare costs more conveniently.

- How does automation enhance the billing process?

Automation eliminates manual errors, speeds up claim processing, and sends timely reminders, reducing missed payments and late fees.

- Are digital payments secure with PayNova?

Absolutely! PayNova follows HIPAA and PCI DSS compliance, encrypts transactions, and uses multi-layer authentication for data protection.

- How do billing solutions impact patient retention?

A smooth and transparent billing experience fosters trust, leading to higher patient satisfaction, loyalty, and positive online reviews.

- What payment methods does PayNova support?

PayNova accepts credit/debit cards, digital wallets, ACH transfers, and other online payment services for a seamless patient experience.