Handling payroll manually can get really tricky, especially as your business grows and rules keep changing. One small mistake in salary or tax calculations can cause problems like fines or unsatisfied employees. That’s why automated payroll calculation technologies have become a mandatory. Where, they help you to cut down errors and save time in payroll process.

This is where Synergy HRMS steps in to help. This smart payroll management software solution takes care of all the tough calculations, stays updated with the latest rules, and connects easily with your attendance and leave data.

With Synergy HRMS, you can stay away from payroll headaches and focus on business development. In this blog, we’ll explain automated calculation technology and the role of Synergy in payroll precision.

Table of Contents

What Is Payroll Management Software and How Does It Help Modern Businesses?

Payroll management software is a tool that helps businesses manage employee salaries, taxes, benefits, and compliance with labor laws automatically and accurately. Instead of manually calculating wages and deductions, this software simplifies the entire payroll process, saving time and reducing errors.

In modern work culture, having efficient payroll management software is essential. It not only calculates employee pay but also handles tax filings and attendance integration and generates detailed reports. This automation allows HR and finance teams to focus on strategic tasks rather than getting caught up in repetitive calculations.

For many companies, especially in India, choosing the right payroll management software solution is critical to staying compliant with complex regulations like Provident Fund (PF), Employee State Insurance (ESI), and tax laws. Some businesses even start with free payroll software to test basic features but soon realize the need for more comprehensive tools.

Solutions like Synergy HRMS offer complete HR payroll software in India and beyond, designed to meet both local and global payroll needs. By using such software, modern businesses can reduce payroll errors, improve employee satisfaction, and maintain smooth operations.

How Automated Payroll Calculation Technologies Eliminate Errors

1. Accurate Calculations Through Automation

Manual payroll calculations often lead to mistakes. Automated payroll management software uses built-in formulas and rules to calculate salaries, taxes, and deductions precisely. This reduces errors that come from manual entry and complex computations, giving you confidence in your payroll numbers every time.

2. Real-Time Updates for Compliance

Tax laws and labor regulations frequently change, especially in countries like India. Automated payroll systems like Synergy HRMS regularly update to include the latest rules, ensuring your payroll complies with local requirements. This helps you to stay away from high penalties and legal issues.

3. Integration with Attendance and Leave Systems

Errors often happen when payroll doesn’t match employee attendance or leave records. Modern HR payroll software in India integrates seamlessly with attendance management, capturing real-time data for accurate payroll processing. This integration makes sure employees are paid fairly for hours worked and leaves taken, eliminating common mistakes.

4. Provides Complete Solutions

While free payroll software can handle simple payroll needs, it often lacks the automation and compliance features necessary for growing businesses. Investing in a full-fledged payroll management software solution like Synergy HRMS gives you automated workflows, detailed reports, and scalable features that grow with your business.

What Are the Consequences HR Faces Without Automated Payroll Calculations?

1. Increased Risk of Errors and Financial Loss

Without automation, manual payroll calculations are prone to mistakes like incorrect salary payments, tax miscalculations, or missed deductions. These errors can lead to financial losses for the company, costly penalties, and strained employee relationships.

2. Time-Consuming and Inefficient Processes

Manual payroll management takes up a significant amount of HR’s time, involving repetitive tasks like data entry, calculations, and compliance checks. This slows down operations and diverts HR’s focus from strategic activities like employee engagement and development.

3. Compliance Challenges and Legal Risks

Keeping up with constantly changing tax laws and labor regulations is tough without automated updates. Failing to comply with statutory requirements can result in fines, legal complications, and damage to the company’s reputation.

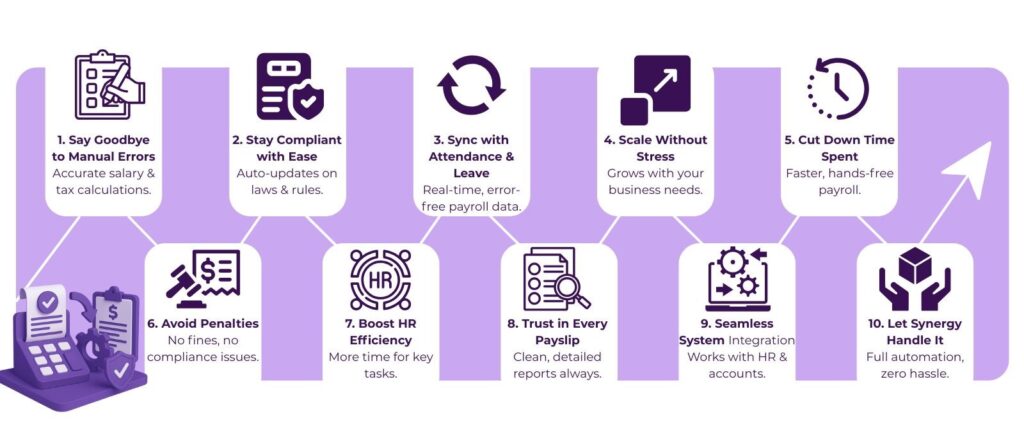

How HR Benefits from Automated Payroll Calculation Technologies

1. Accurate Calculation: Automates complex calculations to minimize errors in salaries, taxes, and deductions, ensuring employees are paid correctly every time.

2. Save Time and Energy: Speeds up payroll processing by reducing manual tasks, freeing HR teams to focus on more strategic work.

3. Meet Regulatory Compliance: Automatically update your business with the latest tax laws and labor regulations to keep it compliant and avoid penalties.

4. Integrate with Related Systems: Connects seamlessly with attendance, leave, and accounting systems for smooth, error-free payroll management.

How Synergy’s Automated Payroll Calculations Work

Synergy HRMS simplifies payroll by automating every step of the calculation process to ensure accuracy and compliance. Here’s how it works:

1. Data Collection and Integration

Synergy pulls employee information such as salary details, attendance records, leaves, and benefits from connected HR and attendance systems. This integration ensures all data used for payroll is accurate and up-to-date.

2. Automated Salary and Deduction Calculations

Based on the collected data, Synergy automatically calculates gross salary, tax deductions, Provident Fund (PF), Employee State Insurance (ESI), professional tax, and other statutory contributions. The software uses predefined rules and formulas that reflect the latest government regulations.

3. Real-Time Compliance Updates

Synergy regularly updates its payroll rules to comply with changing tax laws and labor regulations in India and other regions. This means your payroll calculations always follow current legal requirements without manual intervention.

4. Payslip Generation and Reporting

Once calculations are done, Synergy generates detailed payslips for employees and comprehensive payroll reports for management. These documents are accurate, easy to understand, and ready for auditing or tax filing.

By automating these processes, Synergy HRMS reduces errors, saves time, and helps businesses maintain smooth, compliant payroll operations.

Final thoughts:

Automated payroll calculation technologies play a crucial role in achieving payroll precision. Automation makes payroll accurate and efficient by removing manual errors and using real-time data from attendance and leave systems. This payroll precision builds trust among employees and protects businesses from costly penalties.

Synergy HRMS stands out as a powerful payroll management software solution that brings all these benefits together. With its smart automation, up-to-date compliance features, and seamless integration capabilities, it helps businesses of all sizes maintain error-free payroll operations.

With Synergy, you get reliable, fast, and accurate payroll every time, so you can focus more on business growth. Experience hassle-free, accurate payroll with Synergy HRMS; get started today.

FAQ:

1. Which payroll software is best in India?

Synergy HRMS is widely regarded as one of the best payroll software solutions in India. It handles complex Indian payroll rules, automates calculations, and stays updated with changing regulations, making payroll management easy and error-free.

2. Is there any free payroll software?

Yes, there are free payroll software options available that handle basic payroll tasks. However, free versions often lack advanced features, compliance updates, and integration capabilities that growing businesses need. Many companies start with free software but upgrade to paid solutions like Synergy HRMS for better performance.

3. What is HR and payroll software?

HR and payroll software combines human resource management functions with payroll processing. It helps businesses manage employee records, attendance, leave, salary calculations, tax deductions, and compliance all in one platform.

4. How to use Tally for payroll?

Tally ERP software includes payroll features that allow you to maintain employee details, attendance, and salary structures and generate payslips. However, it may require manual configuration and lacks some automation and compliance updates found in dedicated payroll software like Synergy HRMS.

5. What do you mean by payroll management software?

Payroll management software is a tool that automates the calculation and processing of employee salaries, taxes, and benefits. It ensures accurate payments and compliance with laws and generates reports to simplify payroll tasks.

6. Which Payroll System Was Made in India?

Synergy HRMS is a payroll system made for India. It handles Indian laws like PF, ESI, and TDS automatically, keeping payroll accurate and compliant for businesses.