Technology plays a remarkable role in modernizing payments in the evolving healthcare era. Unlike traditional payment, innovation like PayNova seamlessly resurfaces healthcare operations. Undoubtedly, these innovations meet patient expectations and boost hospitals’ revenue cycles.

Every significant transformation begins with a small step. The healthcare payment system in the United States is complex, involving multiple players such as patients, insurance companies, government programs (Medicare, Medicaid), and healthcare providers.

Traditional payment methods, such as cash and paper-based systems, have disappeared, failing to meet the demands of the modern healthcare environment. Integrating tech solutions like PayNova is crucial in modernizing payment processes, streamlining workflows, and ultimately enhancing the patient experience.

Through this blog, we will learn the role of technology in transforming payments in healthcare, focusing on how solutions like PayNova can improve the industry.

Table of Contents

The Evolution of Payments in Healthcare

The introduction of electronic computers in the 1940s revolutionized the healthcare industry, marking a shift from analogue to digital systems—a transformation that laid the foundation for modern medical advancements. While significant progress has been made only in recent years, technology continues to shape a brighter and more efficient future for healthcare. The health of any system today is closely tied to the quality and extent of the technology it employs. In the past, healthcare providers often spent countless hours addressing inefficiencies detracting from patient care. Thankfully, advancements in technology are paving the way for a more streamlined and patient-focused approach.

The widespread adoption of technological innovations in healthcare has significantly enhanced the efficiency and accuracy of medical billing processes. The transition from paper-based records to electronic health records (EHRs) has been a game-changer, offering quicker and easier access to patient data for both patients and healthcare professionals. These cutting-edge internal processes, enabled by new technologies, have simplified administrative workflows and contributed to longer, healthier lives for patients. By automating medical billing, healthcare providers can reduce the risk of errors that often arise from manual processes. Automated systems provide accurate, accessible information about patient health and available treatments, fostering better health outcomes.

The impact of technology in healthcare extends far beyond numbers or financial metrics. It has fundamentally transformed medical practices, streamlining processes and enabling more personalized care. While technology offers financial benefits, its value lies in reducing the administrative burden on healthcare providers. By automating routine tasks, technology empowers providers to dedicate more time and attention to their patients, ultimately enhancing the quality of care.

Why Modernize Healthcare Payments?

Healthcare systems in the U.S. are under constant pressure to optimize operational efficiency and patient care. Traditional payment methods, reliant on paper invoices and manual data entry, often lead to delays, errors, and dissatisfaction among patients and providers alike. According to a 2023 McKinsey report, nearly 40% of healthcare providers cited outdated payment systems as a barrier to financial growth.

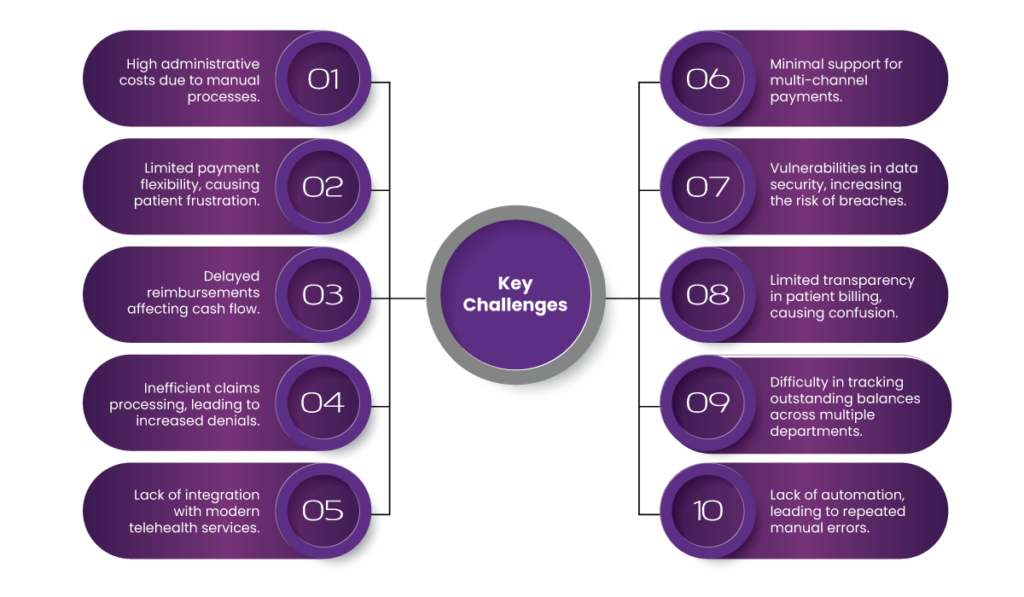

Key Challenges with Legacy Payment Systems:

- High administrative costs due to manual processes.

- Limited payment flexibility, causing patient frustration.

- Delayed reimbursements affecting cash flow.

- Inefficient claims processing, leading to increased denials.

- Lack of integration with modern telehealth services.

- Minimal support for multi-channel payments.

- Vulnerabilities in data security increase the risk of breaches.

- Limited transparency in patient billing is confusing.

- Difficulty in tracking outstanding balances across multiple departments.

- Lack of automation leads to repeated manual errors.

With healthcare costs rising annually and patients demanding seamless experiences similar to those in other industries, integrating cutting-edge technology into payment systems is imperative.

How PayNova is Redefining Healthcare Payments

PayNova, a technology-driven payment solution, has emerged as a game-changer in the healthcare sector. It integrates seamlessly with electronic health records (EHRs), enhances transparency, and simplifies complex financial processes. Here’s how PayNova is revolutionizing healthcare payments:

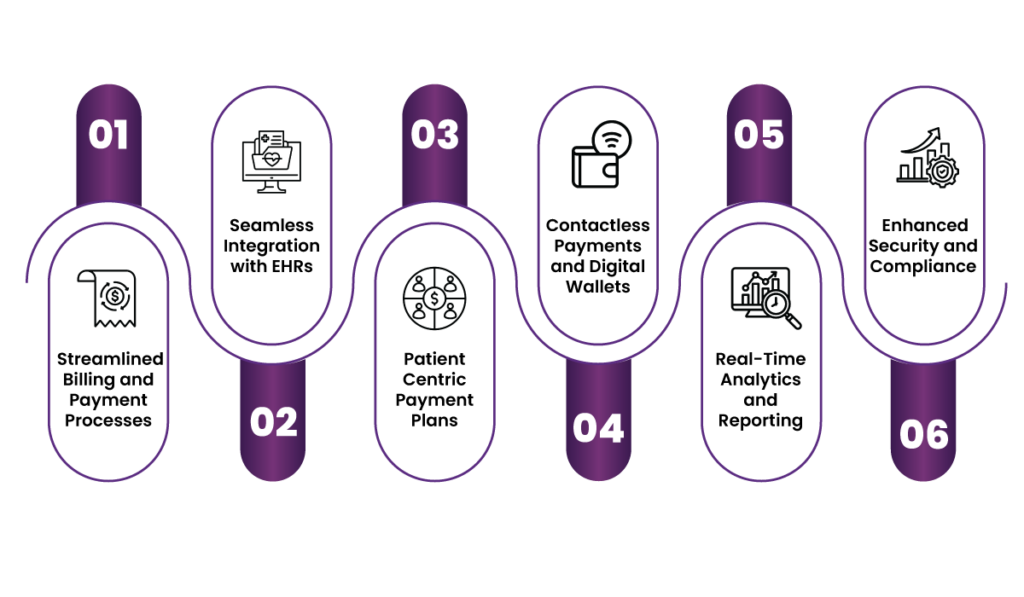

1. Streamlined Billing and Payment Processes

Manual billing processes are prone to human errors, causing discrepancies and delayed payments. PayNova automates billing, ensuring that invoices are accurate, easy to understand, and delivered promptly. Patients receive clear breakdowns of charges, reducing confusion and disputes. Meanwhile, it handles complex billing easily.

Example Use Case:

A busy urban hospital implements PayNova to manage its outpatient services. Patients can view their invoices online, select a payment plan, and settle their dues via mobile apps—all within minutes. This reduces the need for follow-ups, improving both cash flow and patient satisfaction.

2. Seamless Integration with EHRs

Integrating payment systems with electronic health records (EHRs) is crucial for creating a cohesive patient experience. PayNova ensures that financial data is seamlessly linked to medical records, enabling healthcare providers to effortlessly access patient payment histories and outstanding balances.

Example Use Case:

A multispecialty clinic uses PayNova to synchronize payment data with EHRs. During check-out, front-desk staff can view pending dues and remind patients to clear balances. Patients appreciate the transparency, while the clinic benefits from improved collection rates.

3. Patient-Centric Payment Plans

Healthcare costs can be overwhelming for many patients. PayNova addresses this challenge by offering flexible payment plans tailored to individual needs. Patients can choose from interest-free instalment options or pre-scheduled payments, reducing financial stress.

Example Use Case:

A cancer treatment centre adopts PayNova’s payment plan feature to support patients undergoing long-term therapies. Families can spread out payments over manageable periods, ensuring timely treatment without financial strain.

4. Contactless Payments and Digital Wallets

In a post-pandemic world, contactless payments are no longer optional—they’re essential. PayNova supports multiple digital payment methods, including credit cards, digital wallets, and even QR code-based payments, minimizing physical contact and enhancing convenience.

Example Use Case:

An emergency care unit integrates PayNova’s QR code payment system. Patients or their family members can scan a code at the reception desk to make instant payments, eliminating the need for physical cash or card swiping.

5. Real-Time Analytics and Reporting

Tracking payment statuses, revenue cycles, and financial performance is crucial for healthcare providers. PayNova’s advanced analytics and reporting tools offer real-time insights into payment trends, helping administrators make data-driven decisions.

Example Use Case:

A rural hospital uses PayNova’s dashboard to monitor overdue accounts and send automated reminders to patients. This proactive approach ensures steady revenue flow while reducing administrative workload.

6. Enhanced Security and Compliance

Handling sensitive patient data requires the highest levels of security and compliance with regulations like HIPAA. PayNova incorporates robust encryption, tokenization, and fraud detection features to ensure data safety and regulatory adherence.

Example Use Case:

A diagnostic lab leverages PayNova’s secure payment gateway to protect patient data during online transactions, building trust and safeguarding its reputation.

Broader Healthcare-Specific Use Cases

While PayNova’s features are versatile, its impact shines in the following healthcare scenarios:

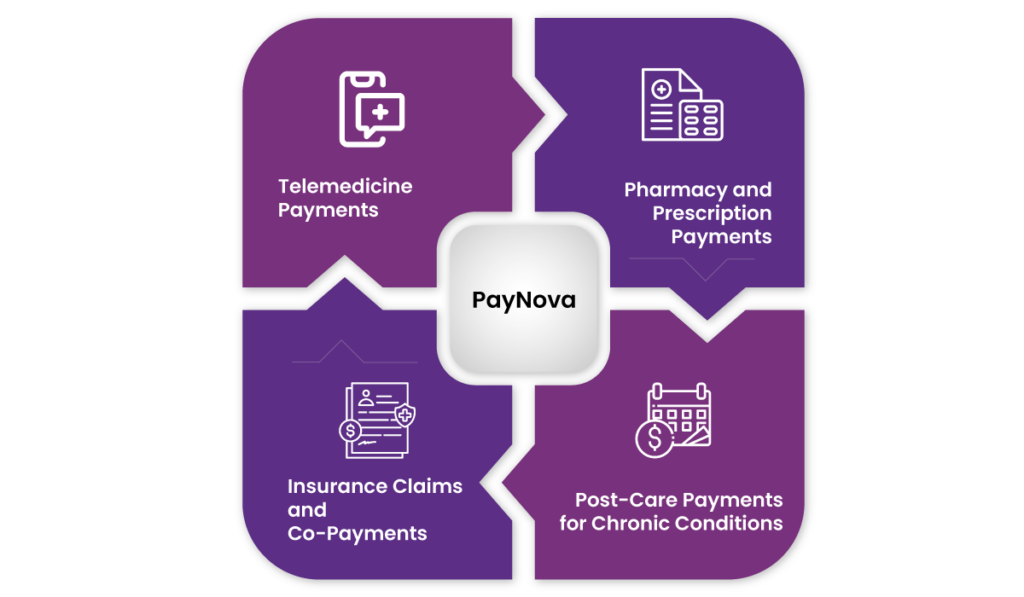

Telemedicine Payments

With the rise of telehealth, patients need convenient ways to pay for virtual consultations. PayNova enables one-click payments integrated directly into telemedicine platforms, ensuring a seamless experience.

Example: A telehealth app integrates PayNova to allow patients to pay for video consultations upfront, streamlining scheduling and billing processes.

Pharmacy and Prescription Payments

PayNova simplifies pharmacy payment workflows by integrating with prescription management systems. Patients can pay for medications online or at the counter, reducing wait times and errors.

Example: A chain pharmacy uses PayNova to enable patients to pay for recurring prescriptions via subscription-based models, boosting customer retention.

Insurance Claims and Co-Payments

Navigating insurance claims and co-payments is one of the most challenging aspects of healthcare payments. PayNova’s intelligent claim management tools simplify this process by automating calculations and facilitating direct payment adjustments with insurers.

Example: An orthopaedic center uses PayNova to calculate co-payment amounts instantly, giving patients clarity before undergoing procedures.

Post-Care Payments for Chronic Conditions

Patients with chronic conditions often require ongoing care and regular payments. PayNova supports subscription billing and reminders to ensure timely payments without overwhelming patients.

Example: A diabetes clinic employs PayNova’s automated billing for its monthly care packages, giving patients peace of mind while ensuring uninterrupted services.

Benefits for Patients and Providers

The adoption of advanced payment systems like PayNova in healthcare benefits all stakeholders:

For Patients:

- Convenience: Flexible payment options, contactless payments, and online portals make it easy to pay bills.

- Transparency: Clear breakdowns of costs eliminate confusion and disputes.

- Flexibility: Patient-centric payment plans reduce financial burdens.

For Providers:

- Efficiency: Automated workflows reduce administrative overheads.

- Revenue Growth: Faster payment processing improves cash flow.

- Data Insights: Real-time analytics support strategic decision-making.

Conclusion

Modernizing the payment system is not a question of questioning it but a must in healthcare delivery to bring about superior patient experiences and greater operational efficiency. Innovations like PayNova, with its EHR integration, contactless payments, flexible payment plans, and real-time analytics, lead this charge in dealing with unique issues in the healthcare industry.

With all the technological developments, healthcare organizations need to embrace advanced payment technologies to remain competitive and provide their patients with the convenience and transparency they deserve. With solutions such as PayNova, healthcare providers can create a seamless, patient-centric ecosystem for payment management.

Let’s embrace the future of healthcare payments—one transaction at a time.

Frequently asked question

- Why should healthcare providers modernize their payment systems?

- Modernizing payment systems helps reduce administrative costs, improve efficiency, enhance patient satisfaction, and minimize errors in billing and reimbursements. It also addresses challenges posed by legacy systems, such as delayed payments and lack of flexibility.

- What is PayNova, and how does it help healthcare providers?

- PayNova is an advanced payment solution designed for healthcare providers. It offers features like automated billing, real-time tracking, patient-friendly portals, and integration with telehealth services to streamline workflows and improve patient experience.

- How does PayNova enhance the patient’s financial experience?

- PayNova provides patients with clear cost breakdowns, flexible payment plans, user-friendly online portals, and faster billing processes, fostering trust and making healthcare expenses more manageable.

- What makes PayNova different from other payment gateways?

- PayNova is specifically designed for healthcare providers. It integrates seamlessly with EHR systems and manages complex billing structures like insurance reimbursements, co-pays, and customizable payment plans. It ensures compliance with HIPAA regulations and automates processes to reduce administrative burdens and accelerate cash flow.

- How does PayNova ensure the security and privacy of patient payment data?

- PayNova safeguards sensitive information with cutting-edge encryption and fraud detection systems. It complies with HIPAA standards, offering robust protection against data breaches while maintaining patient and provider trust.

- Can PayNova integrate with my current billing and management systems?

- PayNova is built for easy integration with existing EHR, Practice Management Systems (PMS), and billing software. Our technical support team ensures a smooth implementation, allowing providers to benefit from improved workflows without operational disruptions.

- What payment options does PayNova support?

- PayNova supports a wide range of payment methods, including credit and debit cards, bank transfers, ACH payments, and digital wallets. Patients can also set up recurring payments or customized plans to manage their medical expenses more effectively.

- How does PayNova streamline insurance reimbursement processes?

- PayNova automates insurance verification, pre-authorizations, and claims submission to minimize errors and reduce reimbursement delays. This automation ensures faster claim approvals and lowers administrative workloads.

- Does PayNova offer features tailored for telehealth services?

- Absolutely. PayNova integrates seamlessly with telehealth platforms, enabling instant post-appointment payments, secure data storage, and real-time invoice generation, all of which enhance the virtual care experience for patients and providers.

- What reporting and analytics features does HelixPay provide?

- HelixPay offers advanced reporting tools that give healthcare providers actionable insights into payment trends, outstanding balances, and revenue forecasts. These analytics improve financial planning and operational efficiency.