Running a healthcare practice isn’t just about treating patients—it’s also about keeping the business side running smoothly. From booking appointments to receiving final payments, every financial interaction plays a role in sustaining a hospital, clinic, or private practice. However, with complex billing systems and insurance claims to manage, keeping track of revenue can quickly become overwhelming.

That’s where Revenue Cycle Management (RCM) steps in. Acting as the financial engine of healthcare, RCM streamlines everything from patient registration to reimbursement, helping providers maintain steady cash flow, reduce billing errors, and improve overall financial performance.

Let’s take a closer look at what makes RCM such a critical part of healthcare administration.

Table of Contents

Understanding Revenue Cycle Management

At its core, revenue cycle management is the financial process that healthcare providers use to track patient care episodes, from registration to the final payment. It involves administrative and clinical functions such as insurance verification, charge capture, claims processing, payment collection, and revenue analysis. A well-structured RCM process helps healthcare providers minimize revenue leakage and enhance profitability.

A successful revenue cycle follows a structured sequence of steps that work together to streamline financial workflows and improve cash flow. Let’s explore these steps in detail.

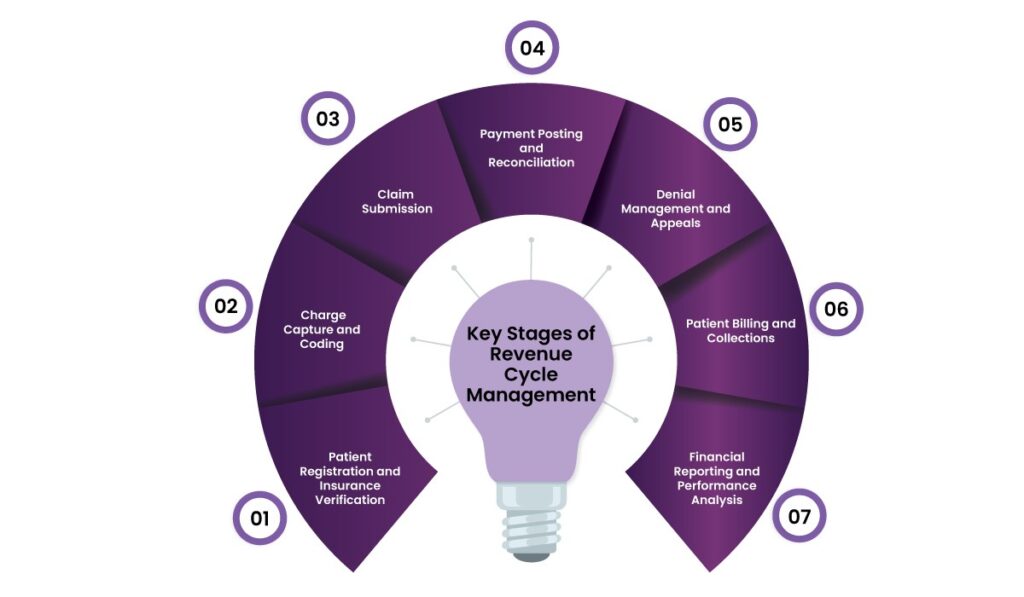

Key Stages of Revenue Cycle Management

1. Patient Registration and Insurance Verification

The revenue cycle starts the moment a patient books an appointment. Collecting accurate demographic information and verifying insurance eligibility at this stage helps prevent claim denials later in the process.

2. Charge Capture and Coding

Once a patient receives care, the next step is translating medical services into billable charges. This is where medical coding becomes necessary.

Medical coders use standardized coding systems, such as ICD-10, CPT, etc., to classify diagnoses and procedures. Accurate coding is vital because errors can lead to claim rejections, audits, or compliance issues.

3. Claim Submission

Once coding is complete, claims are sent to insurance companies for reimbursement. This step requires compliance with payer policies and billing guidelines. Even minor mistakes in a claim—such as missing patient details or incorrect procedure codes—can result in denials or delays.

4. Payment Posting and Reconciliation

Once an insurance company processes a claim, the provider receives an Explanation of Benefits (EOB) detailing the payments and adjustments. Payment posting involves matching these reimbursements with patient accounts to identify any discrepancies.

5. Denial Management and Appeals

Denied claims are a major challenge for healthcare providers. Therefore, a strong denial management strategy helps identify common reasons for rejections, which enables providers to address them proactively. Besides, analyzing denial patterns and resubmitting corrected claims instantly improves revenue recovery.

6. Patient Billing and Collections

Once insurance payments are processed, patients receive bills for any outstanding balance. Multiple payment options, such as online portals and installment plans, can improve collection rates. Likewise, clear communication regarding out-of-pocket expenses also helps reduce disputes and enhance patient satisfaction.

7. Financial Reporting and Performance Analysis

The final step in the revenue cycle management involves tracking financial performance through reporting and analytics. Providers analyze key performance indicators (KPIs) such as claim denial rates, days in accounts receivable, collection efficiency, etc. Data-driven insights help healthcare organizations refine their financial strategies and optimize cash flow.

Why Choose Helixbeat for Revenue Cycle Management Services?

At Helixbeat, we provide a comprehensive Revenue Cycle Management (RCM) solution designed to optimize financial performance, reduce claim denials, and enhance cash flow for healthcare providers.

Here’s why healthcare organizations trust us:

1. Patient Registration & Eligibility Verification

We streamline patient intake with accurate data collection and real-time insurance verification, so eligibility details are correct upfront. This proactive approach minimizes claim delays and denials.

2. Medical Coding & Billing

Our expert medical coders use precise and compliant coding (ICD-10-CM, CPT, HCPCS) to reduce errors. We manage claims submission, follow-ups, and billing accuracy, so that providers receive timely reimbursements while remaining compliant with evolving industry regulations.

3. Claims Management

We take the complexity out of claims processing by managing submission, tracking, and follow-ups from start to finish. Our team actively engages with payers to resolve unpaid or underpaid claims, and we implement denial management strategies to secure maximum reimbursements for providers.

4. Payment Posting

Helixbeat ensures that all payments are correctly recorded, discrepancies are identified, and reports are generated to provide a transparent overview of collections. This improves financial forecasting and revenue tracking.

5. Accounts Receivable (AR) Management

Our AR specialists monitor and proactively follow up on overdue claims to achieve faster payment recovery and reduce aging balances. Our streamlined AR workflows keep revenue cycles moving smoothly.

6. Denials Management

Our dedicated team conducts:

- Root cause analysis to prevent recurring denials.

- Proactive appeals management for denied or underpaid claims.

- Real-time tracking and reporting to optimize revenue recovery.

- Compliance-driven strategies to mitigate future denials.

7. Financial Reporting & Analytics

We empower healthcare providers with real-time dashboards and customizable reports on revenue, claim statuses, and denial trends. These actionable insights enhance decision-making, optimize revenue cycle efficiency, and improve profitability.

8. Compliance & Regulatory Management

Helixbeat ensures that providers comply with industry regulations such as HIPAA, payer contracts, and other legal standards. We implement robust internal controls and audits to minimize risks and keep organizations ahead of regulatory changes.

Final Thoughts

Revenue Cycle Management is a vital component of healthcare administration. By optimizing financial workflows from patient registration to payment collection, providers can minimize revenue losses, improve cash flow, and enhance patient satisfaction.

Helixbeat leverages its expertise, technology-driven solutions, and proactive revenue cycle strategies to help healthcare organizations reduce claim denials, accelerate reimbursements, and maintain compliance. Contact us today for a seamless, efficient, and profitable RCM process.

FAQs

1. What is Revenue Cycle Management in healthcare?

Revenue Cycle Management (RCM) is the financial process healthcare providers use to track patient care episodes, from appointment scheduling to final payment collection. It helps streamline billing, insurance claims, and payment processes.

2. Why is RCM important for healthcare providers?

RCM helps healthcare providers maintain a steady cash flow, reduce billing errors, improve reimbursement rates, and enhance overall financial performance by minimizing revenue leakage.

3. What are the key stages of Revenue Cycle Management?

The main stages of RCM include:

- Patient registration and insurance verification

- Charge capture and medical coding

- Claim submission and processing

- Payment posting and reconciliation

- Denial management and appeals

- Patient billing and collections

- Financial reporting and performance analysis

4. How does Helixbeat improve the RCM process for healthcare providers?

Helixbeat offers end-to-end RCM solutions, including real-time insurance verification, medical coding, claim submission, denial management, financial reporting, and compliance support. Our technology-driven approach enhances cash flow and revenue recovery.

5. What are key performance indicators (KPIs) used in RCM?

Healthcare providers track various KPIs, such as:

- Claim denial rates

- Days in accounts receivable

- Net collection rate

- Percentage of clean claims submitted

- Payment turnaround time

6. How can patient billing and collections be optimized?

Offering multiple payment options, providing transparent billing statements, and communicating out-of-pocket costs upfront can improve collection rates and enhance patient satisfaction.

7. What role does payment posting play in RCM?

Payment posting involves recording reimbursements received from insurance companies and patients. It helps track financial performance, identify underpayments, and detect discrepancies for timely resolution.

8. How does an effective denial management strategy help?

A strong denial management strategy helps identify recurring rejection reasons, correct errors before resubmitting claims, and improve reimbursement rates by addressing payer concerns promptly.