Table of Contents

Introduction

Medical billing is a nightmare for both patients and healthcare providers. Confusing invoices, endless paperwork, and delayed payments make the whole process frustrating and inefficient. Patients struggle to decipher their bills, while providers face mounting administrative costs and payment delays.

That’s where automated payment processing comes in. It’s not just another tech upgrade—it’s a real solution to a long-standing problem. By simplifying payments, reducing errors, and ensuring faster transactions, automation is changing the way healthcare providers handle their finances. Patients get clearer, more manageable bills, and hospitals or clinics see improved cash flow without chasing down payments.

In this blog, we’ll break down why automated payment processing matters, how it improves healthcare billing, and how Paynova is leading the way in making payments seamless for everyone involved.

Understanding Automated Payment Processing

Automated payment processing refers to the use of technology to manage billing and payment transactions without manual intervention. This system integrates digital payment gateways, electronic health records (EHR), and automated invoicing to facilitate seamless transactions. By leveraging artificial intelligence (AI) and machine learning, healthcare providers can reduce administrative burdens and improve financial efficiency.

Key features of automated payment processing include:

- Electronic Billing & Invoicing – Digital invoices replace traditional paper-based billing, ensuring accuracy and speed.

- Automated Claims Processing – Claims are submitted and processed electronically, reducing delays and denials.

- Recurring Payment Systems – Patients can set up automated payment processing for medical bills, minimizing missed payments.

- Fraud Detection & Security – AI-powered systems detect unusual transactions, reducing fraud risks.

- Multiple Payment Options – Patients can pay through credit/debit cards, digital wallets, and bank transfers.

Benefits of Automated Payment Processing in Healthcare

1. Reduced Billing Errors

Manual billing often results in errors, leading to claim rejections and delayed payments. Automation eliminates common mistakes, such as incorrect patient information, duplicate entries, and coding errors, ensuring accuracy in billing.

2. Improved Revenue Cycle Management

By automating payment processes, healthcare providers can accelerate revenue collection. Faster claim processing and timely reimbursements improve cash flow, reducing financial stress on healthcare facilities.

3. Enhanced Patient Experience

Patients often struggle with understanding medical bills and managing payments. Automated systems provide clear, itemized invoices and offer flexible payment plans, making it easier for patients to pay their bills on time.

4. Time & Cost Savings

Automation significantly reduces administrative workload, allowing healthcare staff to focus on patient care instead of paperwork. Fewer resources are required for billing, claims management, and payment tracking, cutting operational costs.

5. Compliance & Security

Healthcare transactions must comply with HIPAA and PCI-DSS regulations to protect patient data. Automated payment processing systems integrate security protocols, ensuring compliance and safeguarding sensitive financial information.

6. Minimized Claim Denials

Automated claims verification checks for errors before submission, reducing the chances of rejections. This leads to faster reimbursements and fewer disputes between healthcare providers and insurers.

How to Automate the Medical Billing Process?

To fully automate medical billing, healthcare providers can integrate a ready-made billing system or create custom features for their EHR. The system should cover essential billing stages:

1. Speed Up Registration

Patients can enter their details faster with automated data verification, reducing errors in billing information. Pre-filled data for existing patients ensures seamless transactions.

2. Set Up Automated Eligibility Checks

Automatically verify patient insurance eligibility during registration or appointment scheduling to avoid claim denials and revenue losses. Electronic verification provides real-time insurance details, ensuring service coverage.

3. Automate Coding and Charge Capture

After verifying patient details, the system captures charges, collects copayments, and generates medical reports. Automated coding aligns with payer reimbursement rules, minimizing rejections.

4. Implement Billing Compliance Checks

Automated compliance checks ensure that claims adhere to OIG and HIPAA coding guidelines, reducing the risk of claim denials due to incorrect formats or missing information.

5. Leverage Electronic Claims Submission

Submitting claims electronically speeds up the reimbursement process and ensures regulatory compliance. HIPAA mandates electronic data exchange for healthcare claims.

6. Automate Medical Billing Follow-Up

Healthcare providers can track claim statuses in real-time, allowing prompt responses to denials, rejections, or approvals. This improves revenue cycle management and ensures timely payments.

7. Integrate Electronic Health Records (EHR) with Billing Software

A seamless integration between EHR and billing systems ensures that patient records, treatments, and invoices are synchronized, reducing errors and duplication.

8. Adopt Digital Payment Gateways

Implementing secure and user-friendly payment gateways allows patients to make payments online through multiple channels, improving convenience and collection rates.

9. Enable Automated Insurance Verification

Automating insurance eligibility verification ensures that claims are submitted correctly, reducing claim denials and delays.

10. Use AI and Machine Learning for Claims Processing

AI-powered systems analyze claims for errors before submission, increasing approval rates and speeding up reimbursements.

11. Offer Flexible Payment Plans

Providing patients with installment-based payments, auto-debits, and subscription models improves affordability and ensures steady revenue for providers.

12. Leverage Mobile and SMS Payment Reminders

Automated reminders notify patients about upcoming payments, reducing missed payments and enhancing financial responsibility.

8 Features of Paynova That Make Automated Payment Processing Stand Out in Healthcare

The U.S. healthcare system faces numerous challenges in patient payment processing, including billing complexity, delayed payments, compliance issues, and financial inefficiencies. Paynova, a dedicated automated payment processing system, offers solutions tailored for healthcare providers. Here’s how its features enhance patient payment processing:

1. Centralized patient Payment Processing for Seamless Transactions

Healthcare providers deal with payments from multiple sources, including insurance companies, government programs (Medicare, Medicaid), and patient out-of-pocket payments. Managing these diverse payment streams manually leads to errors and inefficiencies.

How Paynova Helps:

- Consolidates all payment types into a single platform, reducing the need for multiple systems.

- Automates payment collection from patients and insurance providers, ensuring seamless processing.

- Simplifies reconciliation by integrating with Electronic Health Records (EHR) and Practice Management Systems (PMS).

By centralizing payments, providers can streamline their billing operations, reduce administrative burdens, and minimize errors that lead to claim denials.

2. Multiple Payment Methods for Patient Convenience

Patients often struggle with payment options, leading to delayed or missed payments. Many traditional healthcare payment systems lack flexibility, forcing patients to rely on outdated methods like checks or in-person payments.

How Paynova Helps:

- Supports a variety of payment methods, including credit/debit cards, ACH transfers, digital wallets, and mobile payments.

- Offers online portals where patients can securely make payments at their convenience.

- Provides self-service payment kiosks in hospitals and clinics, reducing staff workload.

By offering multiple payment methods, Paynova ensures that patients can easily pay their bills, reducing payment delays and improving the provider’s cash flow.

3. Faster Payment Collection for Improved Cash Flow

One of the biggest challenges healthcare providers face is the delay in receiving payments from insurance companies and patients. Manual billing processes and insurance claim verifications often slow down cash flow.

How Paynova Helps:

- Automates claims submission to insurance companies, reducing processing time.

- Enables instant payment posting once the claim is approved.

- Allows for automated patient reminders for pending payments, reducing overdue accounts.

By expediting payments, Paynova helps healthcare providers maintain financial stability and focus on patient care instead of chasing unpaid invoices.

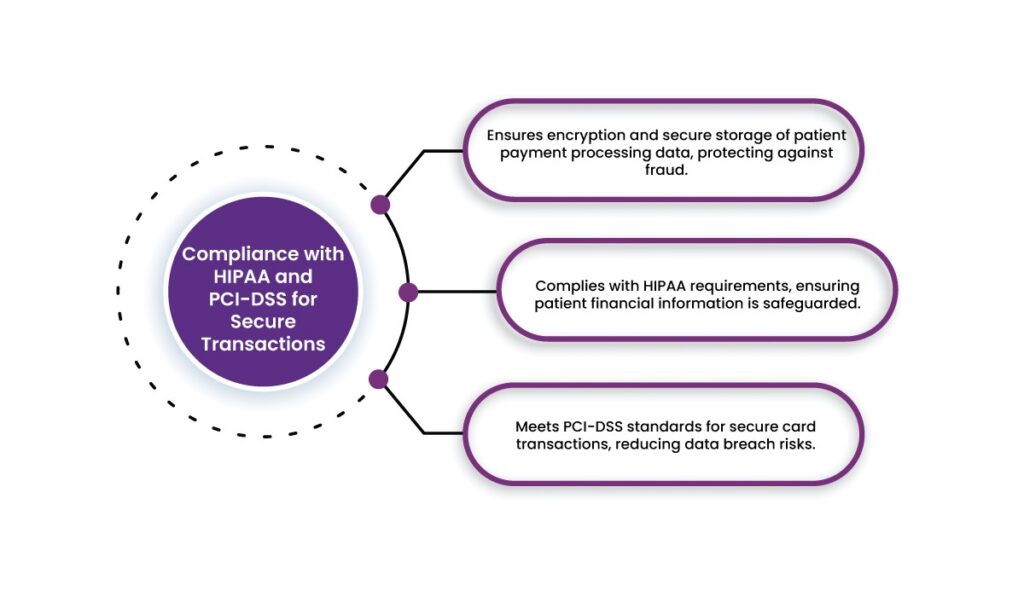

4. Compliance with HIPAA and PCI-DSS for Secure Transactions

Security and compliance are critical in healthcare payments due to regulations like HIPAA (Health Insurance Portability and Accountability Act) and PCI-DSS (Payment Card Industry Data Security Standard). Non-compliance can lead to hefty fines and data breaches.

How Paynova Helps:

- Ensures encryption and secure storage of patient payment processing data, protecting against fraud.

- Complies with HIPAA requirements, ensuring patient financial information is safeguarded.

- Meets PCI-DSS standards for secure card transactions, reducing data breach risks.

By maintaining strict security standards, Paynova allows healthcare providers to process payments confidently while ensuring compliance with federal regulations.

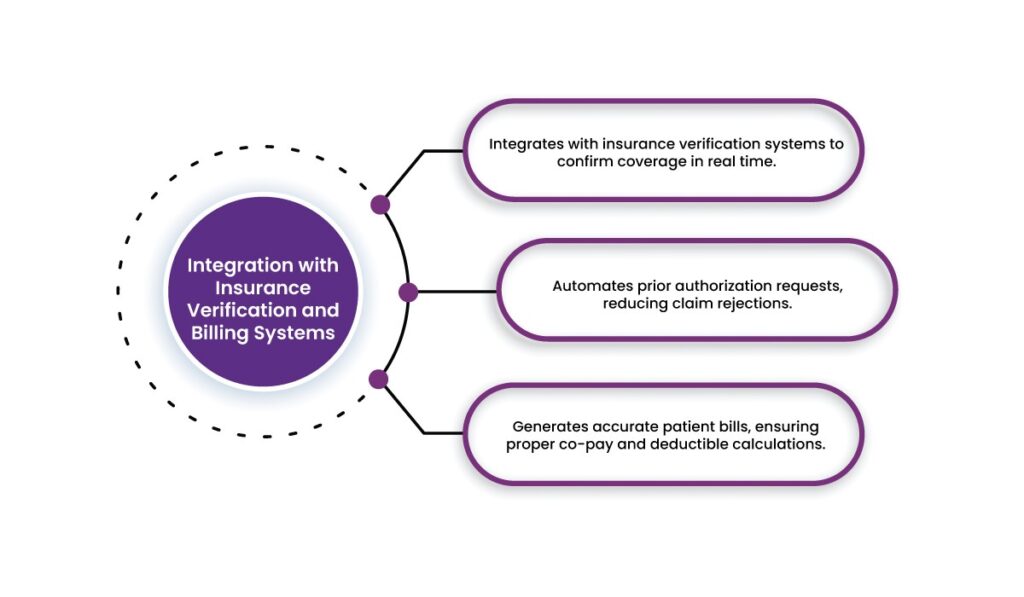

5. Integration with Insurance Verification and Billing Systems

Insurance claim denials are a major pain point for healthcare providers. Incorrect insurance details or lack of prior authorization often lead to rejected claims and delayed payments.

How Paynova Helps:

- Integrates with insurance verification systems to confirm coverage in real time.

- Automates prior authorization requests, reducing claim rejections.

- Generates accurate patient bills, ensuring proper co-pay and deductible calculations.

With real-time verification and billing automation, Paynova minimizes errors that lead to claim denials and administrative burdens.

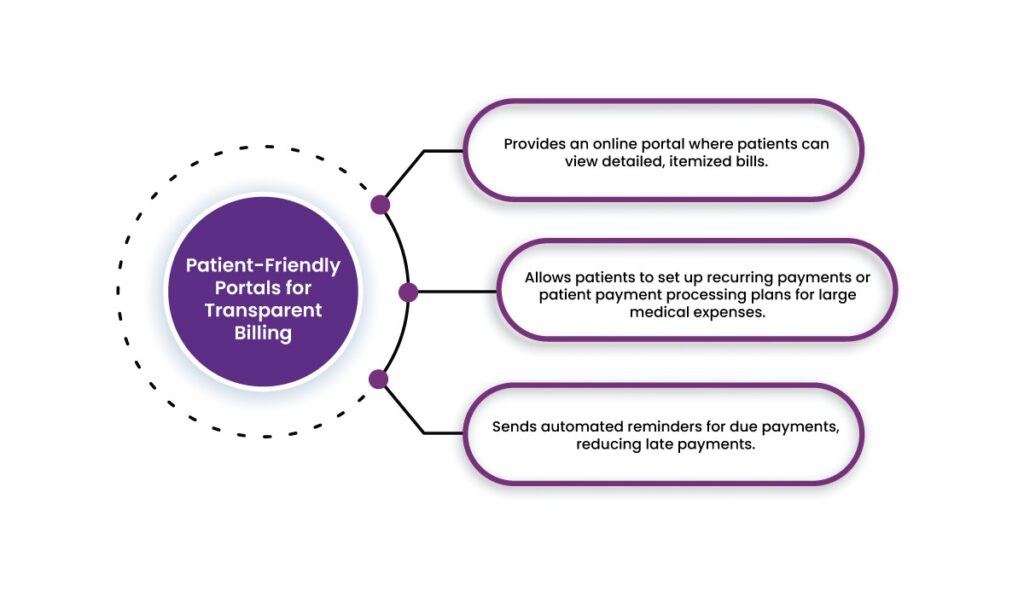

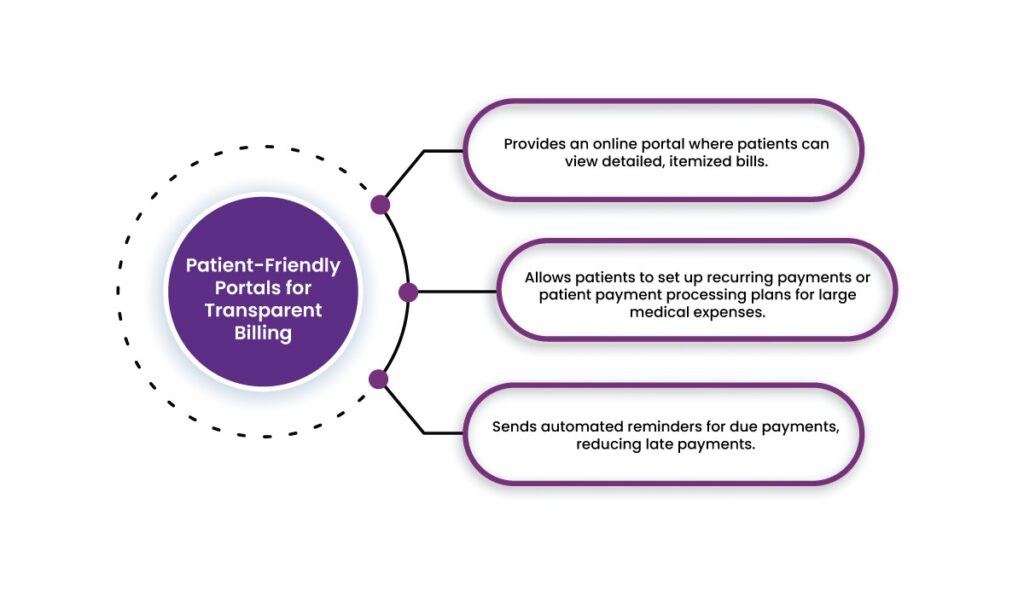

6. Patient-Friendly Portals for Transparent Billing

Many patients struggle to understand complex medical bills, leading to confusion and delayed payments. Traditional billing methods often lack transparency and accessibility.

How Paynova Helps:

- Provides an online portal where patients can view detailed, itemized bills.

- Allows patients to set up recurring payments or patient payment processing plans for large medical expenses.

- Sends automated reminders for due payments, reducing late payments.

By improving billing transparency, Paynova enhances the patient experience, making it easier for them to manage and pay their medical expenses on time.

7. Real-Time Financial Reporting for Better Decision-Making

Healthcare providers need access to accurate financial data to optimize revenue cycles and predict cash flow. Manual reporting processes are often time-consuming and prone to errors.

How Paynova Helps:

- Offers real-time financial analytics and reporting dashboards.

- Tracks revenue streams, outstanding payments, and payment trends.

- Provides insights for financial planning and decision-making.

By leveraging real-time analytics, healthcare providers can proactively manage their revenue cycles and improve overall financial health.

8. Fraud Prevention and Error Reduction with Automation

Billing errors and fraudulent activities are common in healthcare payments, leading to financial losses and compliance risks. Manual data entry increases the likelihood of mistakes.

How Paynova Helps:

- Automates billing and payment reconciliation, reducing human error.

- Detects fraudulent transactions using AI-powered security protocols.

- Ensures proper documentation and audit trails for compliance.

By minimizing errors and preventing fraud, Paynova safeguards healthcare providers from financial losses and regulatory penalties.

Summary

Running a healthcare practice is hard enough—you shouldn’t have to worry about chasing payments too. That’s where Paynova comes in. We make billing simple, fast, and hassle-free, so you get paid on time without the stress. With automated payment processing, quick insurance checks, and easy payment options, both you and your patients win.

Why wait? Let Paynova handle the payments so you can focus on what really matters—caring for your patients. Try Paynova today!

Frequently asked question

What is automated payment processing in healthcare?

Automated payment processing refers to the use of technology to streamline billing, claims, and payment transactions, reducing manual errors and improving efficiency for healthcare providers and patients.

How does automated payment processing benefit healthcare providers?

It reduces billing errors, accelerates claim processing, enhances revenue cycle management, minimizes administrative burdens, and ensures compliance with security regulations.

Can patients use multiple payment methods with automated systems?

Yes, patients can pay via credit/debit cards, digital wallets, ACH transfers, and other online payment options, making the billing process more convenient and accessible.

How does automation improve patient experience in medical billing?

Automated systems provide clear, itemized invoices, offer flexible payment plans, send reminders, and enable seamless online payments, reducing confusion and missed payments.

What role does AI play in automated healthcare payment processing?

AI helps detect billing errors, prevent fraud, streamline claims verification, and ensure accurate coding, reducing denials and accelerating reimbursements.

How does automated payment processing ensure compliance with regulations?

Solutions like Paynova comply with HIPAA and PCI-DSS standards by securing patient data, encrypting transactions, and preventing unauthorized access.

What are the common challenges in traditional healthcare billing?

Manual billing often leads to errors, claim denials, delayed payments, high administrative costs, and a poor patient experience due to confusing invoices.

How can healthcare providers integrate automated payment processing into their systems?

Providers can integrate payment gateways, electronic health records (EHRs), automated insurance verification, and billing compliance checks to create a seamless financial workflow.