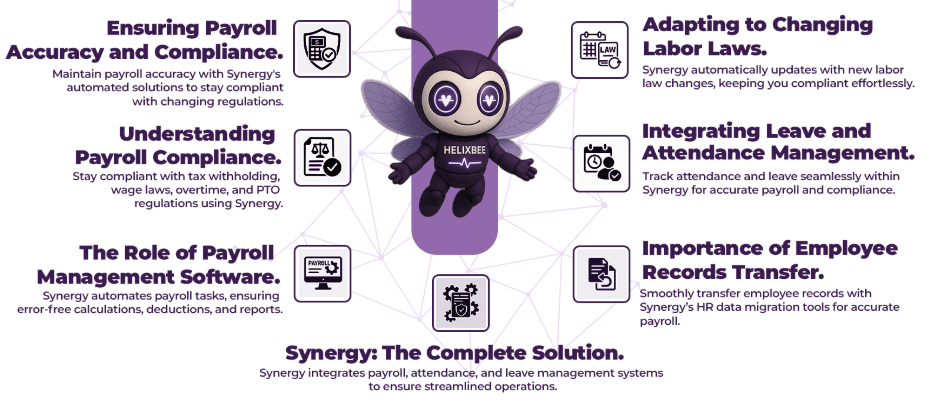

In a constantly evolving legal landscape, how can businesses ensure payroll accuracy and stay compliant with ever-changing regulations? The task can feel daunting, but with the right tools, it doesn’t have to be. Effective payroll management is critical to a company’s success, and it’s essential to ensure that employee compensation is processed accurately and in line with labor laws.

Leveraging payroll management software like Synergy can simplify this complex task. It automates many aspects of payroll processing, ensuring that companies not only meet their statutory obligations but also reduce the risk of costly payroll errors. In this blog, we’ll explore the challenges of maintaining payroll accuracy and compliance and how the right technology can help businesses stay ahead of the curve.

Table of Contents

Understanding Payroll Compliance and Legal Requirements

Staying compliant with payroll laws is not optional; it’s a necessity. As the legal landscape evolves, businesses need to understand how local, state, and federal regulations impact their payroll processes. This includes ensuring compliance with employee payroll management software, employee leave management systems, and employee attendance management systems to accurately track employee time and pay.

Key Legal Payroll Requirements

- Tax Withholding: Ensure the correct tax deductions are made for employees based on their state and federal tax regulations.

- Minimum Wage Laws: Stay compliant with varying state and local minimum wage laws.

- Overtime: Accurately calculate overtime pay based on legal requirements.

- Paid Time Off (PTO): Track and manage vacation, sick days, and other leave types in line with statutory requirements.

Synergy, as the best HR and payroll software in India, helps businesses automate compliance checks, reducing the burden on HR teams and minimizing the risk of costly errors. With Synergy, you can ensure compliance is seamlessly integrated into every payrollcycle.

Role of Payroll Management Software in Ensuring Accuracy

Manual payroll processes are time-consuming and prone to errors. Mistakes in calculating wages, deductions, or benefits can lead to unhappy employees and potentially costly legal issues. This is where payroll management software comes in. It ensures accuracy by automating tasks like calculating salaries, deductions, bonuses, and overtime.

Using an automated system like Synergy’s employee payroll management software not only increases the accuracy of payroll processing but also saves time and resources.

How Payroll Software Enhances Accuracy

- Automated Calculations: Eliminate manual errors in calculations, ensuring each employee is paid correctly.

- Integrated Systems: Sync attendance, leave, and payroll data automatically, avoiding discrepancies between the records.

- Real-Time Reporting: Generate real-time reports for payroll, taxes, and compliance to ensure transparency and accuracy.

By using Synergy, the best HR and payroll software in India, businesses can automate complex calculations and ensure that every paycheck is accurate and compliant with legal requirements.

Adapting to Changing Labor Laws and Compliance Regulations

One of the most challenging aspects of payroll management is staying current with changing labor law updates. These changes may include adjustments to tax rates, minimum wage laws, benefits requirements, and other labor regulations that affect payroll processes.

HR data migration and employee records transfer are key in ensuring that updates are implemented correctly. Without the right tools, businesses risk falling behind on compliance, which can lead to penalties or legal issues.

Steps to Adapt to Legal Changes

- Monitor Legislative Changes: Stay informed about updates in payroll laws at the federal, state, and local levels.

- Regular Software Updates: Use payroll management software like Synergy, which automatically updates with the latest legal requirements, ensuring businesses remain compliant.

- Training HR Teams: Ensure HR professionals are trained on new laws and system updates to avoid errors.

With Synergy’s payroll and leave management software, businesses can stay up-to-date with legal changes automatically, reducing the administrative burden on HR teams. Synergy, the best HR and payroll software in India, ensures that compliance is always up to date and integrated into every payroll cycle.

Integrating Leave and Attendance Management for Payroll Compliance

Managing employee leave and attendance accurately is critical to ensuring payroll accuracy. Inaccurate tracking of leave balances or attendance can lead to payroll discrepancies, non-compliance, or employee dissatisfaction.

Synergy integrates attendance management systems and employee leave management systems into its HRMS, enabling HR teams to track employee hours, leave requests, and absences seamlessly.

Benefits of Integrated Systems

- Accurate Time Tracking: Use real-time data to ensure that employees are paid for the exact hours they work, including overtime.

- Leave Policy Compliance: Automatically track sick days, vacation days, and statutory leaves to ensure compliance with company policies and legal requirements.

- Reduced Errors: By integrating attendance and leave data with payroll, the chances of mistakes are significantly reduced.

Using Synergy’s payroll and leave management software, businesses can integrate and automate attendance and leave tracking, ensuring that payroll is always accurate and compliant. As the best HR and payroll software in India, Synergy provides a comprehensive solution for employee payroll management software, streamlining processes and reducing administrative burdens.

Importance of Employee Records Transfer in Maintaining Payroll Accuracy

When transitioning to new systems, businesses often face challenges in transferring employee records from legacy systems to new HRMS platforms. This is a critical process because any errors in employee records transfer can lead to incorrect payroll processing.

HR data migration must be handled carefully to ensure that all historical employee data, such as salaries, deductions, and benefits, are accurately transferred into the new system.

How to Ensure Smooth Employee Records Transfer

- Data Mapping: Clearly map out how existing records will be transferred to the new system, ensuring that no data is lost or misrepresented.

- Testing and Validation: Run tests after migration to ensure that all records, including payroll and leave data, have been accurately transferred.

- Ongoing Monitoring: Monitor data consistency and accuracy during the transition period to catch any discrepancies early.

With Synergy, businesses can streamline employee records transfer and HR data migration, ensuring that the transition to a new payroll management software is smooth, accurate, and compliant. As the best HR and payroll software in India, Synergy integrates seamlessly with payroll and leave management software and payroll and attendance management software, offering businesses a reliable and efficient solution.

Wrapping Up

Ensuring payroll accuracy and compliance in today’s ever-changing legal landscape requires a combination of attention to detail, timely updates, and the right tools. By leveraging payroll management software like Synergy, businesses can automate complex payroll processes, reduce errors, and stay compliant with the latest labor laws.

With features like employee payroll management software, employee attendance management system, and employee leave management system, Synergy provides an all-in-one solution to manage payroll, attendance, and compliance seamlessly. By automating these tasks, businesses not only save time but also reduce the risk of errors and penalties, ensuring that they remain on the right side of the law.

Start your free demo today and see how Synergy can streamline payroll accuracy and compliance for your business.

FAQs

1. How can payroll management software help businesses stay compliant?

Payroll management software like Synergy automatically updates with new tax regulations, ensuring compliance and reducing the risk of payroll errors.

2. What are the legal requirements for payroll compliance?

Legal requirements include accurate tax withholding, overtime pay, minimum wage adherence, and tracking employee leave balances as per labor laws.

3. How does Synergy ensure payroll accuracy?

Synergy automates calculations, integrates attendance and leave management, and ensures that all data is accurate and up-to-date, reducing errors.

4. What is the benefit of integrating leave and attendance management with payroll?

Integration ensures that leave balances and attendance are tracked in real-time, preventing payroll discrepancies and ensuring compliance.

5. What is HR data migration, and why is it important?

HR data migration is the process of transferring employee records from one system to another, ensuring that payroll and leave data remain accurate and intact.