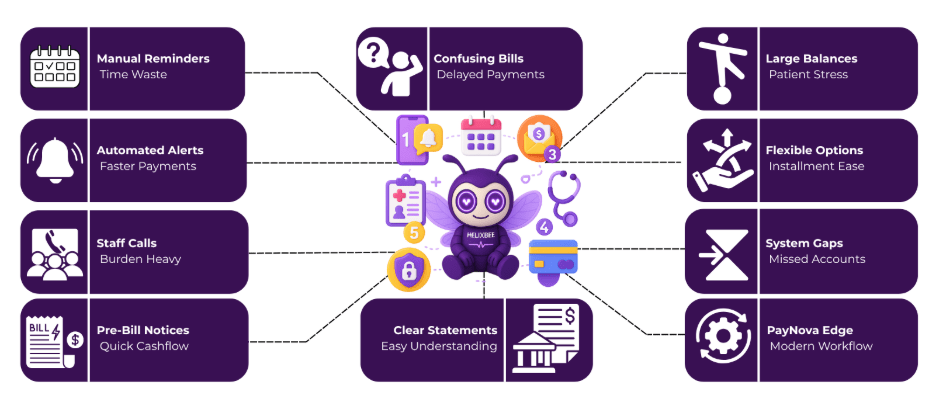

Patient responsibility is at an all-time high, and collecting balances has become one of the biggest challenges for practices of every size. High-deductible health plans, new insurance rules, and confusing statements mean patients are often unsure of what they owe, while providers are left waiting for payments that may never arrive. When staff depend on manual payment reminder calls, valuable time is wasted, morale suffers, and revenue flow slows down.

The good news? Collecting payments doesn’t have to be this difficult. With the right healthcare patient payment solutions, practices can automate reminders, simplify billing, and provide patients with convenient payment options. In this blog, we share five common payment reminder challenges medical practices face — along with practical tips for solving them using modern technology.

Table of Contents

Tip 1: Automate Patient Payment Reminders Across Multiple Channels

The Challenge

Your staff spends countless hours manually calling patients, mailing paper bills, or sending ad hoc emails. These inconsistent reminders often miss their mark, creating delays in collections and straining your cash flow. Manual processes also increase the risk of human error, making it hard to guarantee every patient receives timely communication.

The Solution

Adopting automated healthcare patient payment solutions can transform how you engage with patients. Automated texts and emails maintain consistent communication while keeping the payment process moving forward. Practices that switch to automation often see payments arrive faster, with collections improving by as much as 75%.

With a modern healthcare payment processing solution, reminders can be scheduled at 7, 14, and 21 days after the first bill. Once a payment is made, reminders stop automatically, eliminating duplicate efforts and improving patient satisfaction. This not only lightens the workload for your staff but also ensures patients stay on track.

Tip 2: Reduce Staff Payment Reminder Calls

The Challenge

Manual collection calls drain staff resources. In fact, 88% of providers report relying heavily on phone calls to collect payments. Each call requires time, patience, and repetition, especially during busy billing cycles. Every minute spent chasing payments is time taken away from patient care. Over time, this leads to burnout, lower morale, and inefficient workflows.

The Solution

Automated payment solutions for healthcare providers replace most routine collection calls with consistent, timely reminders. This allows your staff to focus on exceptions, such as patients who require personalized attention, rather than handling repetitive billing calls.

Advanced platforms even enable pre-bill reminders — where patients are invited to pay estimated charges before their appointment. By sending a secure link through text or email, patients can quickly review and pay online, eliminating additional manual work while accelerating cash flow.

Tip 3: Use Clear, Patient-Friendly Statements

The Challenge

Nothing delays payments faster than a confusing bill. Medical billing codes, jargon, and unclear charges often frustrate patients, making them hesitant to pay. A U.S. Bank healthcare payments report found that confusing medical bills remain one of the top reasons for delayed payments.

The Solution

Modern healthcare patient payment solutions provide clear, itemized statements that show exactly what is owed and how to pay. Whether sent by mail, email, or text, every statement is consistent and easy to understand.

For example, mailed bills can include QR codes or direct links that take patients straight to a secure portal. Digital eBills use the same link, so patients always know where to go — avoiding unnecessary steps. Practices using this approach not only see faster collections but also reduce the number of billing-related calls from confused patients.

With the right healthcare payment processing solution, patients can access both current and past bills online, giving them full transparency and confidence in their payment process.

Tip 4: Offer Flexible Payment Options to Reduce Delays

The Challenge

Large medical bills can overwhelm patients. According to industry research, 44% of patients cannot pay a bill greater than $1,000 in full, while 52% would prefer to enroll in a payment plan. Without flexible options, late or missed payments are more likely.

The Solution

With payment solutions for healthcare providers, practices can offer multiple ways to pay — from online portals and in-office payments to mobile wallets like Google Pay and Apple Pay. Patients can also set up recurring payments, use eChecks, or securely save their card details for future transactions.

For larger balances, installment plans and financing options make bills more manageable. Patients can choose structured installments or automatic recurring payments, while providers receive the full amount upfront. This not only reduces default rates but also improves the patient experience by offering stress-free options.

Practices adopting these flexible models report fewer delayed payments and stronger cash flow — a win-win for both patients and providers.

Tip 5: Integrate Payment Reminders With Your Billing System

The Challenge

When billing and payment systems are disconnected, practices face duplicate billing, missed accounts, and additional manual work. Studies show many providers still fail to collect 30–50% of outstanding balances. Without integration, gaps in your revenue cycle are inevitable.

The Solution

The most effective healthcare patient payment solutions integrate directly with billing and practice management platforms. This ensures data flows seamlessly and staff save time.

For overdue accounts, integrated collection services let providers approve and send accounts for recovery directly from the system. Licensed specialists ensure compliance, maintain patient respect, and even offer payment plans when needed. Payments are deposited straight into your account, eliminating delays caused by third-party agencies.

By managing everything in one workflow, practices prevent mismatched reminders, reduce administrative burdens, and strengthen their revenue cycle.

Modernize Your Payment Reminder Process With PayNova

Modernizing your payment reminder process is about more than technology — it’s about building a system that works for patients, staff, and providers alike. With healthcare patient payment solutions like PayNova, you can automate reminders, simplify billing, and provide flexible payment options while ensuring compliance and security.

By adopting the right healthcare payment processing solution, practices can remove barriers, collect payments faster, and give patients a clearer, more convenient financial experience.

Ready to modernize your billing?

Schedule a demo with PayNova today to see how our payment solutions for healthcare providers can help your practice thrive.

FAQs

Q1. What are healthcare patient payment solutions?

Healthcare patient payment solutions are digital platforms that help medical practices streamline billing, send automated payment reminders, offer flexible payment options, and ensure compliance with healthcare regulations.

Q2. How do healthcare patient payment solutions improve collections?

By automating reminders, reducing staff calls, and offering multiple payment methods, healthcare patient payment solutions improve payment consistency and help practices collect balances up to 75% faster.

Q3. Why should providers replace manual billing calls?

Manual calls are time-consuming and inefficient. Automated payment solutions for healthcare providers reduce staff workload, minimize errors, and deliver consistent communication across email, text, and patient portals.

Q4. Can patients use mobile wallets with healthcare payment processing solutions?

Yes. Modern healthcare payment processing solutions support mobile wallets like Google Pay and Apple Pay, along with credit/debit cards, eChecks, and recurring payments.

Q5. How does PayNova ensure compliance and security?

PayNova is designed as a secure healthcare payment processing solution, ensuring HIPAA and PCI-DSS compliance. All patient financial data is encrypted, protecting both patients and providers from fraud or breaches.