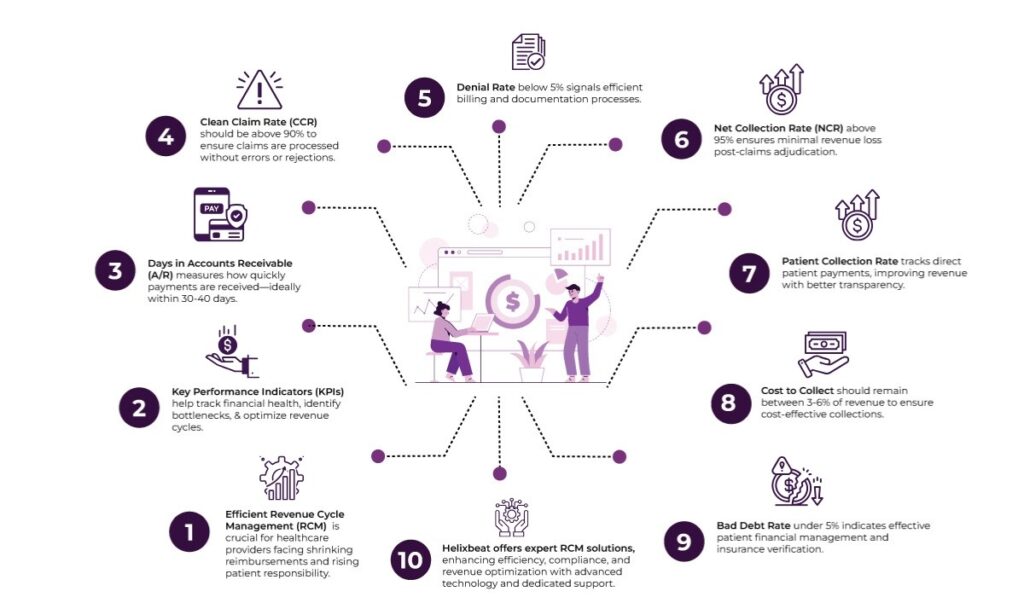

Keeping your healthcare revenue cycle efficient is a cornerstone of operational excellence. Therefore, healthcare providers must closely monitor how their revenue cycle is performing with shrinking reimbursements, rising patient responsibility, and ever-evolving compliance standards.

That’s where KPIs—Key Performance Indicators—come into play.

They provide measurable insights that help leaders make informed decisions, identify bottlenecks, and fine-tune strategies for long-term financial health.

But which KPIs reflect success in Revenue Cycle Management (RCM)? Let’s dive into eight of the most valuable metrics every healthcare organization should be tracking.

Table of Contents

1. Days in Accounts Receivable (A/R)

Why it matters

This KPI measures how long, on average, your practice receives payment after a service has been provided. The longer the money sits in A/R, the more it affects cash flow.

Industry benchmark

Typically, 30 to 40 days is considered healthy. A number above 50 days may signal claims processing, billing, or collections issues.

What to watch for

A high A/R may suggest slow payer reimbursements, denied claims, or inefficiencies in follow-ups. Break the A/R down by age buckets (0-30, 31-60, 61-90, 90+ days) to understand where the delays are most frequent.

2. Clean Claim Rate (CCR)

Why it matters

The Clean Claim Rate reflects the percentage of claims that pass through the system and get paid on the first submission—without errors, omissions, or rejections.

Industry benchmark

An ideal CCR is above 90%, with some high-performing organizations reaching 95% or more.

What to watch for

Low CCR rates often mean your claims are riddled with coding issues, data inaccuracies, or eligibility errors. However, investing in staff training or robust RCM tools can significantly improve this metric.

3. Denial Rate

Why it matters

The Denial Rate tells you what percentage of total claims payers deny. It directly reflects how well your billing and documentation processes are functioning.

Industry benchmark

Anything below 5% is generally acceptable. Rates above that could indicate systemic issues in documentation, coding, or authorization workflows.

What to watch for

Track denial reasons regularly—are they technical (missing info) or clinical (lack of medical necessity)? Understanding the root cause helps tailor interventions more effectively.

4. Net Collection Rate (NCR)

Why it matters

The Net Collection Rate evaluates how much of the allowable revenue you’re actually collecting. It’s one of the best indicators of your financial performance post-claims adjudication.

Industry benchmark

An NCR of 95% or higher is ideal.

What to watch for

A declining NCR may reflect poor follow-up on denied or underpaid claims, patient collection issues, or outdated billing systems. It highlights revenue left on the table—even after adjusting for contractual write-offs.

5. Patient Collection Rate

Why it matters

With high-deductible health plans becoming the norm, patient responsibility has surged. Therefore, tracking how much you’re collecting directly from patients is critical for sustaining revenue.

Industry benchmark

There’s no universal benchmark, but many organizations aim for a patient collection rate of 75% or higher.

What to watch for

High patient balances and poor collection performance often lead to poor payment transparency or weak front-desk communication. However, offering digital payment options and pre-visit estimates can help improve this KPI.

6. First Pass Resolution Rate (FPRR)

Why it matters

This KPI tracks the percentage of claims that are resolved (paid) after the first submission. It complements the Clean Claim Rate but focuses more on resolution than just approval.

Industry benchmark

Look for an FPRR of at least 85%. Higher rates signify fewer touchpoints needed to collect money.

What to watch for

A low FPRR means more time spent on rework, follow-up, and appeals—all of which increase administrative costs. However, streamlined billing processes and automated claim checks can lift this metric significantly.

7. Cost to Collect

Why it matters

Cost to Collect refers to the amount spent on revenue cycle activities for every dollar collected. It covers staffing, software, claims processing, and collections.

Industry benchmark

The typical cost of collecting ranges from 3% to 6% of revenue. Lower is better—but not at the expense of service quality.

What to watch for

If you’re spending too much to collect your money, it may point to inefficient workflows or over-reliance on manual tasks. On the contrary, a very low cost might hint at under-investment in RCM resources, which can lead to long-term losses.

8. Bad Debt Rate

Why it matters

This KPI reflects the portion of receivables that are written off as uncollectible. It’s often the result of uncollected patient payments or claims that go beyond timely filing limits.

Industry benchmark

Keeping bad debt under 5% of net patient revenue is a good goal for most providers.

What to watch for

Frequent write-offs may signal deeper issues in the early stages of the revenue cycle—like insurance verification or patient financial counseling. That’s why addressing the front-end can reduce downstream losses.

Why Choose Helixbeat as a Medical Revenue Cycle Management Partner

Selecting the right medical revenue cycle management (RCM) partner can significantly impact your organization’s financial health and operational efficiency. Here’s why Helixbeat stands out:

1. Specialized Experience in Your Medical Field

Helixbeat covers ICD-10-CM, CPT, and HCPCS standards to minimize claim rejections and maximize reimbursements. With our team of certified coders and robust claim submission workflows, we help healthcare providers reduce delays, stay compliant, and improve cash flow from day one.

2. Proven Success with Similar-Sized Practices

Whether you’re a growing clinic or a large hospital network, Helixbeat has a proven track record of optimizing revenue cycles for healthcare providers of all sizes. Our case studies highlight real-world results, from improved collections to reduced denials.

3. Robust Data Security & HIPAA Compliance

Helixbeat adheres to the highest standards in data protection, including full HIPAA compliance, encrypted data exchange, and regular audits to keep your sensitive information safe.

4. Seamless Integration with EHR & PM Systems

Helixbeat offers seamless integration with leading EHR and Practice Management systems to minimize disruption and facilitate smoother workflows.

5. Dedicated Account Managers & Clear SLAs

With Helixbeat, every client is assigned a dedicated account manager who serves as a single point of contact—backed by service level agreements (SLAs) that clearly define response times, performance benchmarks, and accountability.

6. Transparent Reporting & Real-Time Dashboards

Helixbeat’s intuitive dashboards and transparent reporting provide real-time insights into collections, claims, denials, and key financial KPIs.

Final Thoughts

By consistently monitoring these eight key performance indicators, healthcare organizations gain a clear view of their revenue cycle health. These KPIs uncover inefficiencies, highlight opportunities for optimization, and guide leaders in building a more resilient and profitable practice.

But keeping up with these metrics—and improving them—requires more than internal effort. It takes expert guidance, advanced technology, and a partner who understands the unique challenges of your organization. This is where Helixbeat can transform your revenue cycle with data-driven insights, automation, and end-to-end support. From faster claims processing to smarter collections, we help healthcare providers maximize revenue and minimize administrative burden.

Contact us today and discover how Helixbeat can redefine success for your practice.

FAQs

1. What is the most important KPI to track in Revenue Cycle Management (RCM)?

While all KPIs are important, Days in Accounts Receivable (A/R) is often seen as a key indicator of how efficiently your revenue is being collected. It directly affects your cash flow and highlights any delays in payment.

2. What is considered a healthy Denial Rate in RCM?

A Denial Rate below 5% is generally acceptable. Anything higher may indicate issues in documentation, coding, or authorization processes.

3. What’s the difference between Clean Claim Rate and First Pass Resolution Rate (FPRR)?

Clean Claim Rate measures how many claims are accepted on the first submission, while FPRR tracks how many are fully paid on the first pass. FPRR focuses more on resolution than acceptance.

4. How can Helixbeat help improve these KPIs?

Helixbeat offers specialized RCM services, including expert coding, integrated systems, real-time dashboards, and dedicated support to help healthcare providers track, manage, and improve all key revenue cycle metrics.