Patients often face challenges in paying medical bills due to limited payment options or a lack of flexible payment plans, leading to unpaid bills or delayed payments.

Have you ever wondered why patients sometimes avoid small clinics even when they offer quality care? The answer often lies in payment convenience. Today, patients expect flexible, digital, and seamless payment solutions, like the options offered by big hospitals. Without modern payment processing services, small clinics risk losing patience and revenue.

According to a report by McKinsey, patients prefer clinics that provide flexible digital payment options, highlighting the importance of adopting modern solutions. Further in this blog, we will explore how small clinics can leverage payment processing services like PAYNOVA, the best payment processor for small businesses, to compete with large hospitals, improve patient experience, and optimize revenue. You’ll also discover key methods, benefits, and real-world use cases to help your clinic stay ahead in a competitive healthcare market.

Table of Contents

What is the Largest Source of Payment for Healthcare Services?

Understanding the sources of payment for healthcare services is crucial for small clinics, as it allows them to optimize revenue and streamline billing processes. The healthcare payment system is complex, especially in multi-payer systems like the United States, where payments can come from a variety of sources. Let’s break down the largest payment sources and the challenges clinics may face in managing them.

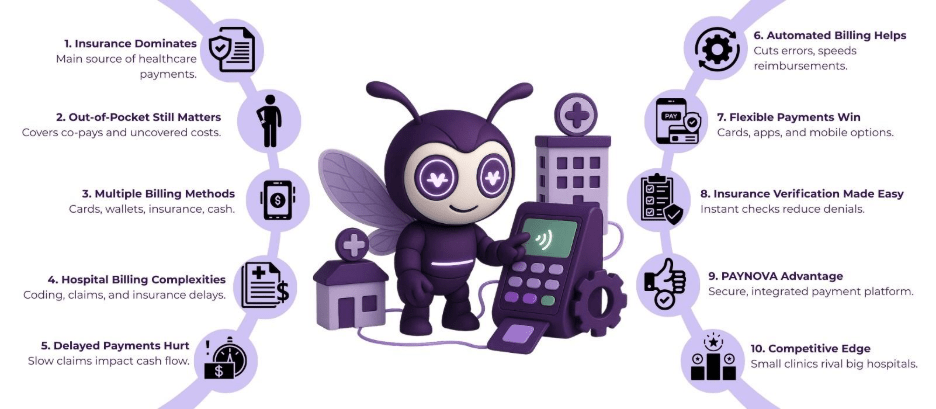

1. Insurance Payments

The largest source of payment in both the U.S. and India comes from insurance claims. Insurance payments can be made by private insurance companies or government programs like Medicare and Medicaid in the U.S. These programs are designed to cover a large portion of medical expenses for patients.

- Private Insurance

- Patients enrolled in private insurance plans often have co-pays, deductibles, and out-of-pocket expenses that need to be managed by the healthcare provider.

- Medicare and Medicaid

- These government programs cover specific patient segments, including the elderly and low-income individuals. The reimbursement process from these programs can be slow, but it remains a significant source of income for many healthcare providers.

- In the healthcare payment system, the insurance reimbursement process is typically initiated when the healthcare provider submits a claim to the insurance company detailing the services provided. The insurer then reviews the claim, decides on reimbursement amounts, and pays the provider accordingly.

2. Out-of-Pocket Payments

Many patients prefer to pay for smaller services or co-pays directly out-of-pocket. This source of payment is critical, especially when insurance does not cover certain expenses or when patients have high-deductible health plans (HDHPs).

- Co-pays and Deductibles

- Patients are responsible for co-pays or deductibles as part of their insurance coverage, leading to direct out-of-pocket payments to the healthcare provider.

- High-Deductible Health Plans (HDHPs)

- These plans often shift more financial responsibility onto patients. Small clinics need to manage these payments carefully to avoid payment delays.

What Are the Payment Methods for Medical Billing?

Small clinics must accommodate a variety of payment methods to enhance patient experience and reduce unpaid bills.

Note: Please create an infographic on the table below.

| Payment Method | Description | Pros | Cons |

| Credit/Debit Cards | Card payments at clinic or online | Quick, widely accepted | Transaction fees apply |

| Mobile Wallets | Payments via apps like Google Pay, Paytm, Phone Pe | Contactless, convenient | Requires app adoption |

| Insurance Claims | Billing via insurance providers | Reduces patient out-of-pocket burden | Processing time, documentation needed |

| Cash/Check | Traditional in-person payments | No technology required | Risk of errors, slower reporting |

What is the Biggest Challenge for Hospitals?

Big hospitals face various challenges that can impact their ability to provide seamless, efficient care while maintaining profitability. Among these challenges are:

Complex Billing and Insurance Workflows

- One of the biggest hurdles in the healthcare sector is billing complexity.

- Hospitals often deal with varying insurance policies, intricate coding systems (like ICD-10 for diagnoses and CPT for procedures), and different patient obligations (such as co-pays and deductibles).

- Healthcare providers are required to have specialized billing staff to navigate these complexities, leading to increased administrative costs.

Delayed Payments

- Delayed payments are a significant pain point for hospitals.

- Insurance companies often take weeks to process claims, resulting in cash flow issues for healthcare providers.

- If claims are denied due to errors or incomplete documentation, delays are further extended.

- On the patient side, delayed payments are common, especially when patients are confused by their medical bills or face high out-of-pocket costs.

- These delays can strain a hospital’s financial stability, impacting its ability to reinvest in facilities and services.

Insurance Verification and Claim Denials

- Many hospitals struggle with the insurance verification process.

- If a patient’s insurance information is outdated or incorrect, the hospital may provide care, only to find out later that the claim will not be reimbursed.

- Claim denials are another significant issue, often stemming from reasons such as incorrect codes, missing information, or services deemed unnecessary by insurers.

- This leads to lengthy appeals processes, requiring more administrative effort and further extending payment delays.

Administrative Burden

- Hospitals need to employ dedicated staff to handle complex insurance claims, patient billing, follow-ups, and the complex healthcare regulations surrounding payments.

- This burden detracts from the hospital’s ability to focus on patient care, increases operational costs, and diminishes overall operational efficiency.

Patient Out-of-Pocket Costs

- Many patients, particularly those with high-deductible health plans, bear a significant portion of healthcare expenses.

- For many, understanding medical bills and managing out-of-pocket costs can be confusing, leading to delayed payments or defaulting on bills.

- In some cases, high costs discourage patients from seeking necessary care, further complicating the financial picture for hospitals.

How Small Clinics Use Payment Processing services to Compete with Big Hospitals

By embracing these advanced solutions, small clinics can reduce administrative costs and improve cash flow, allowing them to focus on delivering high-quality care. Here’s a deeper look at how payment processing services can help small clinics compete with larger healthcare institutions:

1. Automated Billing

- Automated billing systems integrated with payment processing services simplify and accelerate the billing cycle.

- These systems automatically generate and send invoices, reducing the chance for human error.

- They also improve the speed and accuracy of claims submission, which minimizes the risk of denied claims.

- By automating these tasks, small clinics can ensure that payments are processed faster, allowing them to receive reimbursements more quickly and focus more on patient care.

- Example: With automated billing systems, small clinics can streamline insurance claim submission and track claim statuses, ensure timely follow-ups, and improve overall cash flow.

CTA: See How PAYNOVA Automates Billing for Faster Reimbursements

2. Flexible Payment Options

- Patients today expect flexibility in how they can pay for their healthcare services, and small clinics can meet these expectations by offering a variety of payment options.

- Integrating mobile payment services like Google Pay, Apple Pay, or credit card payments gives patients the ability to pay using their preferred method.

- By accommodating a wide range of payment methods, small clinics can reduce the friction that often leads to delayed payments and improve patient satisfaction.

- This flexibility helps ensure more patients pay their bills on time, which directly improves cash flow.

- Example: A patient can easily pay their co-pay through a mobile app, eliminating the need to visit the clinic’s front desk, leading to a smoother experience for both the patient and the clinic.

CTA: Explore How PAYNOVA Enables Flexible Payment Options for Clinics

3. Streamlined Insurance Verification

- One of the key challenges for small clinics is managing the complexities of insurance verification.

- Manual verification processes are time-consuming and can lead to costly mistakes.

- With patient engagement software integrated with payment processing systems, small clinics can instantly verify insurance details, eliminate manual checks, and reduce errors in insurance claims.

- This integration helps clinics ensure that they are submitting accurate and complete claims from the start, reducing claim denials and delays in payment.

- Example: With PAYNOVA, small clinics can verify patient insurance coverage at the time of appointment scheduling, ensuring they have the correct information to submit claims accurately the first time.

CTA: See How PAYNOVA Automates Insurance Verification for Clinics

4. Improved Cash Flow

- Faster payment processing is a major benefit of using payment processing services.

- Traditional billing systems may involve slow manual processing, leading to delayed payments and cash flow issues.

- By automating payment collections and integrating payment processing software, small clinics can significantly speed up the payment process, ensuring that funds are received in time.

- Automated follow-ups and payment reminders sent through patient engagement software ensure that patients are reminded of any outstanding balances, reducing the risk of overdue payments.

5. Better Patient Communication

- Effective communication is vital for maintaining strong relationships with patients, and payment processing services can enhance this communication.

- Patient engagement solutions integrated with payment systems allow clinics to send automated reminders about upcoming payments, insurance verifications, and unpaid balances.

- These reminders keep patients informed and help avoid confusion over billing, making it easier for patients to make timely payments.

- Additionally, offering clear, transparent billing information fosters trust and improves patient loyalty.

Benefits of Using Payment Processing Services for Small Clinics

Here are some of the key benefits small clinics experience by adopting advanced payment processing solutions:

1. Faster Transactions

- Traditional payment methods like cash or checks can be time-consuming, leading to longer waiting periods for both patients and staff.

- With digital payment solutions, patients can pay quickly using mobile wallets, credit/debit cards, or online payment platforms, reducing wait times and improving the overall clinic experience.

- Faster payments also result in more efficient patient turnover, allowing clinics to handle more patients without sacrificing quality of care.

2. Improved Cash Flow

- Automated billing and real-time payment tracking are game-changers for small clinics.

- By using payment processing services integrated with their patient record management systems, clinics can automatically generate bills, process payments, and track reimbursements, all in real-time.

- This automated approach eliminates delays in collecting payments, ensuring that clinics maintain a consistent and predictable cash flow.

- It also reduces errors in manual billing, which could lead to financial discrepancies or missed payments.

3. Better Patient Experience

- In an increasingly digital world, patients expect convenience in every aspect of their healthcare experience.

- Payment processing services enable small clinics to offer flexible payment options, allowing patients to pay via mobile payment apps, credit cards, or online payment portals.

- These mobile payment services enable patients to pay from the comfort of their own homes or during their clinic visit.

- It enhances patient satisfaction by offering greater flexibility, reducing payment friction, and making the overall clinic experience more seamless.

4. Reduced Administrative Burden

- Manual billing and payment processing create significant administrative burdens for small clinics.

- Handling patient payments, creating invoices, verifying insurance details, and managing receipts can quickly become overwhelming and error-prone, especially without the aid of automated systems.

- Payment processing services streamline these tasks, automating invoice generation, payment tracking, and even follow-ups.

- This automation reduces human error and lightens the administrative load, allowing healthcare staff to focus more on patient care rather than paperwork.

5. Data Insights

- Payment processing services provide small clinics with valuable data insights into patient payment behaviors and revenue trends.

- With real-time reporting and analytics, clinics can track the types of payments being used, monitor outstanding invoices, and analyze revenue cycles.

- This data allows clinics to identify patterns, such as the most common payment methods or the frequency of delayed payments, enabling them to optimize revenue strategies and adjust their financial management practices accordingly.

- Clinics can also use this data to improve patient engagement, offering timely payment reminders or better payment options based on patient preferences.

Best Payment Processor for Small Business: Why Clinics Choose PAYNOVA

PAYNOVA is specifically designed for healthcare providers, seamlessly integrating with Electronic Health Record (EHR) systems and handling complex billing structures, including insurance reimbursements, co-pays, and payment plans.

Our system ensures compliance with HIPAA and PCI-DSS regulations, providing secure, automated payment processes that reduce administrative work and speed up cash flow.

Enhance your clinic’s financial health with PAYNOVA, secure payments that improve cash flow and reduce administrative burden.

Final Insights

The payment system in healthcare, particularly in small clinics, often comes with its own set of challenges, complex billing processes, delayed payments, and high administrative costs. These issues not only cause frustration for healthcare providers but can also impact patient satisfaction. To overcome these challenges, many clinics are turning to specialized payment processing systems that streamline the billing process, reduce errors, and ensure payment flexibility.

PAYNOVA by HelixBeat stands out as a comprehensive solution tailored for small clinics. By automating insurance claim handling, offering multiple payment options, and seamlessly integrating with patient record management systems, PAYNOVA provides the tools necessary to reduce administrative burdens, improve cash flow, and enhance patient engagement. This all-in-one payment processing platform empowers small clinics to compete with larger healthcare organizations, improve operational efficiency, and offer a better experience for their patients.

To Transform Your Clinic’s Payment Processing, start with PAYNOVA Today!

FAQs

What is the largest source of payment for healthcare services?

Most healthcare payments come from insurance providers, followed by direct patient payments for out-of-pocket expenses.

What is the biggest challenge for hospitals?

Managing billing, insurance claims, and patient payments efficiently while reducing errors is the biggest challenge.

What are the payment methods for medical billing?

Payments can be made via credit/debit cards, UPI, mobile wallets, insurance claims, and bank transfers.

What is the most important factor in sustaining the competitive advantage of a hospital?

Patient convenience and seamless payment experience are key to attracting and retaining patients.

Why should small clinics adopt payment processing services?

These services streamline transactions, reduce billing errors, and enhance patient satisfaction.

How do mobile payment services help clinics?

Mobile payments provide quick, contactless transactions, making it easier for patients to pay anytime, anywhere.

Can PAYNOVA integrate with existing clinic software?

Yes, PAYNOVA integrates seamlessly with most practice management systems and healthcare payment platforms.

Are digital payment solutions secure for patients?

Absolutely. PAYNOVA uses end-to-end encryption and complies with healthcare payment regulations.

How do clinics track payments efficiently?

Clinics can generate real-time reports and dashboards to monitor transactions and reconcile payments.

What is the role of patient engagement in payment processing?

Engaging patients through reminders, receipts, and flexible payment options improves collections and satisfaction.

Does using a payment processor reduce administrative burden?

Yes, it automates billing, reconciliations, and reporting, saving time and minimizing human error.

Is PAYNOVA suitable for small clinics?

Definitely. PAYNOVA is designed as the best payment processor for small business, helping clinics compete with larger hospitals.