Small clinics and hospitals often face financial pressures due to complex payment systems and delayed reimbursements. Payment processing services can either be a cost burden or a financial asset. According to a report, American hospitals continue to face escalating operational costs and economic pressures as they care for patients and communities. Clinics, especially in non-profit healthcare sectors, need affordable payment solutions to stay afloat while offering top-notch care.

PAYNOVA by HelixBeat stands out as a cost-effective solution that helps small clinics optimize their payment processing while maintaining a seamless patient experience. By integrating mobile payment services and automating claims, PAYNOVA eliminates unnecessary costs, reduces administrative workload, and accelerates payment cycles, providing a strong competitive edge.

Table of Contents

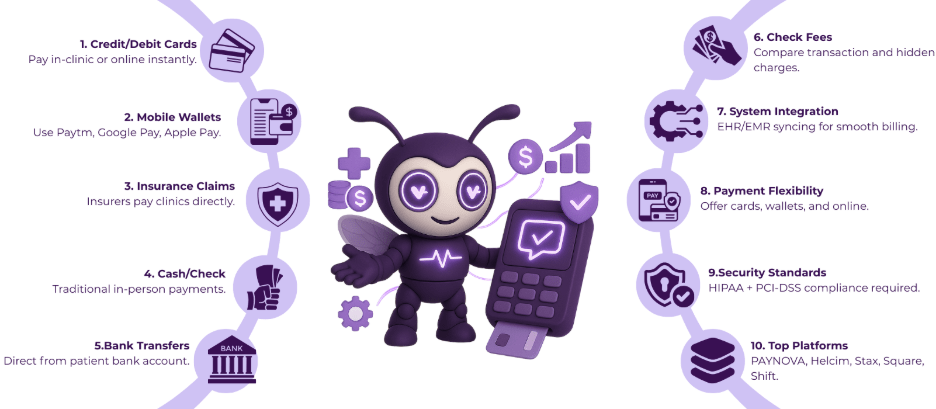

What Are the Payment Methods for Medical Billing?

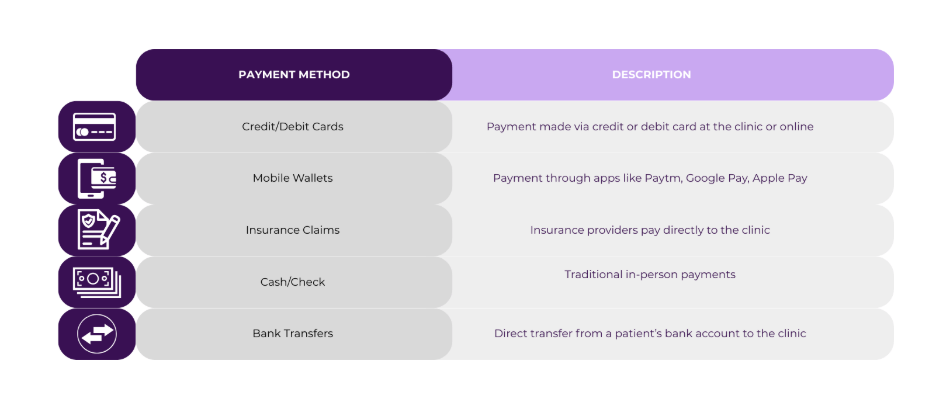

As healthcare payments become more complex, it’s important to understand the available payment methods to choose the most suitable option for your clinic. Below is an overview of the most used payment methods for medical billing:

Note: Create an infographic of the table below with appropriate icons

| Payment Method | Description |

| Credit/Debit Cards | Payment made via credit or debit card at the clinic or online |

| Mobile Wallets | Payment through apps like Paytm, Google Pay, Apple Pay |

| Insurance Claims | Insurance providers pay directly to the clinic |

| Cash/Check | Traditional in-person payments |

| Bank Transfers | Direct transfer from a patient’s bank account to the clinic |

How to Choose the Cheapest Credit Card Processing Platform for Your Hospital

Choosing the right payment processing platform is crucial for your hospital’s financial health, as it directly affects cash flow, patient experience, and administrative efficiency. Here’s a more detailed breakdown of the factors to consider when selecting the cheapest credit card processing platform for your healthcare facility:

1. Transaction Fees

- When evaluating credit card processors, it’s essential to compare the per-transaction fees that each platform charges. These fees can vary significantly across providers, and even a slight difference can have a significant impact on your clinic’s bottom line.

- Flat Rate vs. Interchange Plus: Some platforms offer flat-rate pricing, where you pay a fixed percentage for each transaction, which simplifies budgeting but may be less competitive for larger volumes. Others offer interchange-plus pricing, which is based on the cost of the transaction plus a fixed markup, often better suited for higher volumes of payments.

- Hidden Fees: Look for setup fees, monthly maintenance fees, or cancellation fees that might not be immediately visible in the quoted price. Ensure the provider’s pricing structure is transparent and straightforward to avoid surprises down the road.

2. Integration with Existing Systems

- Seamless integration with your patient record management system (EHR/EMR) is critical for improving operational efficiency. A payment processing platform should work alongside your existing patient data management system to create a unified workflow.

- EHR/EMR Integration: Ensure the platform you choose easily integrates with your current electronic health record (EHR) system for automatic billing updates and real-time patient data syncing. This reduces errors, improves the accuracy of billing, and speeds up payments.

- Billing and Communication: Integration enables seamless patient communication, allowing patients to view outstanding bills, make payments, and receive receipts through a unified platform, thereby improving their overall experience.

- PAYNOVA integrates effortlessly with existing systems to streamline both billing and patient communications, ensuring you spend less time on administrative work and more time on patient care.

3. Payment Flexibility

- With patients increasingly seeking convenience, offering multiple payment options has become essential. Your platform should allow you to accommodate various patient preferences, enhancing their overall experience.

- Mobile Payment Solutions: Look for platforms that offer mobile payment services such as Apple Pay, Google Pay, or Paytm, allowing patients to make contactless payments easily from their smartphones.

- Online Payment Options: Many patients prefer to pay their bills online. Ensure your payment processor supports online payment gateways, enabling patients to pay their bills from the comfort of their homes at any time.

- Flexibility for Patients: Offering flexibility means more timely payments, reducing the risk of outstanding bills. PAYNOVA provides mobile payments, credit/debit card acceptance, and bank transfers, all through an easy-to-use interface.

CTA: Explore Mobile and Online Payment Options with PAYNOVA

4. Security Features

- Patient data security is paramount, especially in healthcare. Choose a payment processor that complies with HIPAA and PCI-DSS standards to protect patient information.

- HIPAA Compliance: Make sure the processor is fully HIPAA-compliant to ensure that all patient health information, including payment details, is kept secure and confidential.

- PCI-DSS Compliance: PCI-DSS (Payment Card Industry Data Security Standard) compliance is required for any service that handles card payments. Ensure that the platform adheres to these rigorous security standards to protect patient payment data from breaches and fraud.

- Data Encryption: Look for platforms that offer end-to-end encryption for every transaction to ensure that sensitive financial information remains safe and secure at all times.

- PAYNOVA is designed with top-tier security features, including HIPAA and PCI-DSS compliance, ensuring both patient information and payment data are securely handled.

5. Customer Support

- When issues arise, having reliable customer service is essential. Payment processors should offer quick, responsive support to resolve any issues promptly and avoid service disruptions.

- 24/7 Support: A reputable payment processor should offer round-the-clock support, especially for healthcare providers who operate during non-traditional hours.

- Responsive Support Channels: Look for a provider that offers various support channels, including phone, email, and live chat. The faster you can address any issues, the less impact they will have on your operations.

- Training and Onboarding: Ensure the processor provides adequate training materials and onboarding support to help your staff become familiar with the system quickly and use it effectively.

Top 5 Non-Profit Healthcare Platforms for Cheapest Credit Card Processing in 2025

Non-profit healthcare organizations, including small clinics, often face financial constraints and need affordable payment processing solutions to manage patient transactions without straining their budget. In 2025, there are several platforms that offer cheapest credit card processing solutions for non-profit healthcare providers. Here are the top 5 platforms that are cost-effective and reliable for processing payments:

1. PAYNOVA by HelixBeat

PAYNOVA is an ideal payment processing solution for small and non-profit clinics looking to streamline their billing processes without breaking the bank. With low transaction fees, PAYNOVA ensures that even smaller healthcare providers can offer flexible payment options to patients, improving their financial operations.

Key Features:

- Low Transaction Fees: Provides competitive, flat-rate pricing, making it budget-friendly for clinics with varying transaction volumes.

- Mobile Payment Services: Enables patients to pay through mobile wallets and smartphones, reducing wait times and improving the overall patient experience.

- Seamless Integration: Easily integrates with your patient record management system, simplifying payment tracking and financial reporting.

- Secure Payment Solutions: Compliant with HIPAA and PCI-DSS, ensuring that all patient payments are processed securely.

CTA: [Compare PAYNOVA with Other Providers →]

2. Helcim

Helcim offers interchange-plus pricing, making it a fantastic choice for healthcare organizations that process a high volume of payments. With transparent pricing and affordable rates, Helcim is known for providing predictable costs, which is essential for budget-conscious non-profits.

Key Features:

- Interchange-Plus Pricing: Reduces the markup fee on each transaction, saving clinics money on larger payments.

- Transparent Pricing: Helcim offers clear and upfront pricing with no hidden fees, making it ideal for non-profit clinics.

- Scalable Solutions: Suited for clinics that experience fluctuations in payment volume, with flexible pricing options to grow with your needs.

- Helcim is a solid option for non-profit healthcare providers looking to manage large transaction volumes without hidden fees or surprises.

3. Stax

Stax is a flexible payment processor that eliminates monthly fees and provides lower per-transaction rates, making it a highly cost-effective option for small clinics, especially non-profit healthcare organizations.

Key Features:

- No Monthly Fees: Ideal for clinics that want to minimize fixed costs and only pay for actual usage.

- Lower Transaction Fees: Stax offers competitive per-transaction rates, ensuring that small clinics can save on payment processing.

- Customizable Solutions: Stax offers a tailored approach to payment processing, allowing clinics to choose features based on their specific needs.

- With Stax, non-profits can enjoy low-cost payment processing that allows for flexibility and scalability as their transaction volumes grow.

4. Square

Square is a popular name in the payment processing industry and is known for its portable credit card processing and user-friendly interface. It’s an excellent choice for clinics with limited staff or those looking for simple mobile payment options.

Key Features:

- Portable Credit Card Processing: Ideal for clinics that require flexibility and want to accept payments anywhere, whether in the clinic or at an off-site location.

- User-Friendly Interface: Square provides easy-to-use tools, allowing healthcare providers to process payments quickly and efficiently without needing technical expertise.

- Affordable Payment Solutions: Low transaction fees make it an affordable option for small healthcare providers with modest payment volumes.

- For small non-profit healthcare providers, Square offers an easy, cost-effective solution with minimal setup required.

5. Shift Payment Solutions

Shift Payment Solutions is a newer player in the market but stands out for its low transaction fees and customizable features that cater to healthcare clinics in need of affordable payment processing.

Key Features:

- Low Transaction Fees: Shift offers competitive rates that help non-profit clinics maintain a strong financial position.

- Customizable Features: Clinics can tailor Shift’s payment processing system to their specific needs, such as accommodating unique billing cycles or payment methods.

- Fast Setup and Support: Shift provides quick implementation and 24/7 customer support, ensuring that clinics can get up and run quickly.

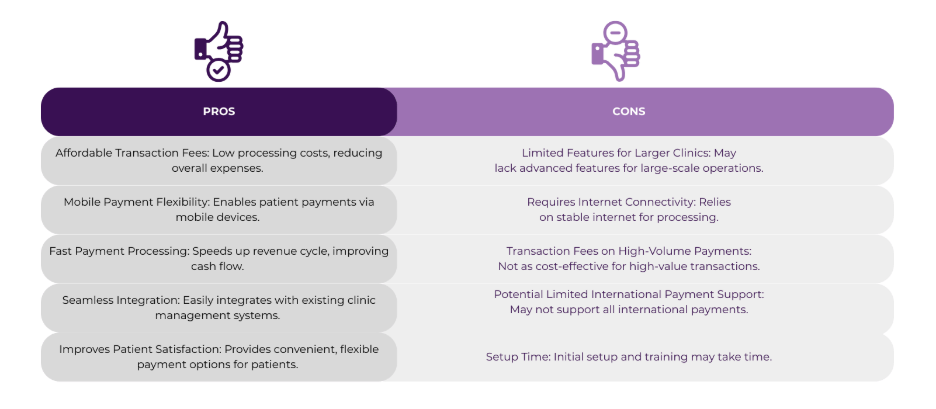

Pros and Cons of Using the Cheapest Credit Card Processing Solution for Your Clinic

This table presents key benefits and drawbacks of using a payment processing solution like PAYNOVA, with a focus on how it can improve clinic profitability.

Note: Create an infographic of the table

| Pros | Cons |

| Affordable Transaction Fees: Low processing costs, reducing overall expenses. | Limited Features for Larger Clinics: May lack advanced features for large-scale operations. |

| Mobile Payment Flexibility: Enables patient payments via mobile devices. | Requires Internet Connectivity: Relies on stable internet for processing. |

| Fast Payment Processing: Speeds up revenue cycle, improving cash flow. | Transaction Fees on High-Volume Payments: Not as cost-effective for high-value transactions. |

| Seamless Integration: Easily integrates with existing clinic management systems. | Potential Limited International Payment Support: May not support all international payments. |

| Improves Patient Satisfaction: Provides convenient, flexible payment options for patients. | Setup Time: Initial setup and training may take time. |

To Sum It Up

Managing payments in healthcare can be a daunting task for small clinics. From complex billing systems to delayed insurance claims, the challenges are numerous. PAYNOVA offers a comprehensive solution that tackles these issues head-on, helping clinics streamline their payment processes and improve cash flow.

PAYNOVA not only simplifies payments but also ensures HIPAA compliance, providing the security and peace of mind that healthcare providers need. Whether you’re looking to improve patient engagement, reduce billing errors, or speed up insurance claims, PAYNOVA offers the tools necessary to enhance your clinic’s operations and financial health.

Compliance Made Easy, Payments Made Simple!

Start Using PAYNOVA to Solve Your Payment Processing Challenges Today

Case Study

A small clinic in New York adopted PAYNOVA as their payment processing solution. Prior to this, the clinic faced delays in payment collections and high administrative costs due to manual billing systems and inconsistent payment methods.

After implementing PAYNOVA, the clinic reduced their payment processing costs by 15% and improved their cash flow by 20%. The clinic also saw a 30% increase in patient satisfaction, as patients found it easier to pay via mobile payment services and digital wallets.

FAQs

What is the cheapest credit card processing method for healthcare?

The cheapest credit card processing methods typically include flat-rate processors like PAYNOVA, which offer predictable costs.

How can I reduce payment processing fees in my clinic?

By choosing platforms like PAYNOVA, which offer low transaction fees and mobile payment services, clinics can reduce costs.

What is the role of mobile payment services in healthcare?

Mobile payment services enhance patient engagement in healthcare, allowing patients to pay using their smartphones, improving convenience and speeding up payments.

Can PAYNOVA integrate with my current patient record management system?

Yes, PAYNOVA integrates seamlessly with patient record management systems, streamlining billing and payment processing.

How do payment processing services improve patient satisfaction?

Offering flexible, mobile payment services and multiple payment options enhances the patient experience, resulting in higher satisfaction and more timely payments.

What are the top benefits of using payment processing services for clinics?

PAYNOVA provides faster transactions, improved cash flow, and enhanced patient satisfaction, which are essential for clinic success.

Is PAYNOVA secure for handling patient payments?

Yes, PAYNOVA complies with all security standards, ensuring secure patient payment processing with end-to-end encryption.

How does PAYNOVA help with insurance claims processing?

PAYNOVA automates the insurance claim handling process, ensuring claims are correctly submitted and tracked.

Can PAYNOVA help reduce administrative costs in my clinic?

By automating billing, claims, and payments, PAYNOVA reduces administrative workload and associated costs.

What’s the most important factor in choosing a payment processor for a clinic?

The most important factor is transaction cost and ease of integration with existing patient management systems, both of which PAYNOVA excels at.

Does PAYNOVA offer multi-channel payment options?

Yes, PAYNOVA allows clinics to accept credit cards, mobile wallet payments, and more.

How can PAYNOVA improve the overall financial health of my clinic?

By reducing billing errors, speeding up payments, and enhancing patient satisfaction, PAYNOVA helps improve your clinic’s revenue cycle.