The process of global payment processing is crucial for the effective operation of healthcare providers, particularly as they serve patients across diverse regions and payment systems. In this article, we will examine the obstacles that healthcare providers face in global payment processing, the impact of these challenges on their financial well-being, and the available solutions to improve payment operations.

Additionally, we will showcase how platforms like PAYNOVA by HelixBeat are revolutionizing global payment management for healthcare clinics, ensuring efficiency, security, and prompt reimbursements.

Table of Contents

What is Global Payment Processing?

Global payment processing refers to managing transactions across different countries, allowing healthcare providers to collect payments from patients, insurance firms, and other organizations globally. This process includes converting and processing payments in multiple currencies, connecting with both local and global payment methods, and ensuring adherence to regional financial regulations.

Key components of global payment processing include:

- Multi-currency support: Accepting payments in a variety of currencies.

- Cross-border payments: Facilitating transactions between different countries.

- Compliance: Ensuring that payments meet regional financial and data security regulations.

Get Started with PAYNOVA for Seamless Global Payments

Key Challenges in Global Payment Systems Today

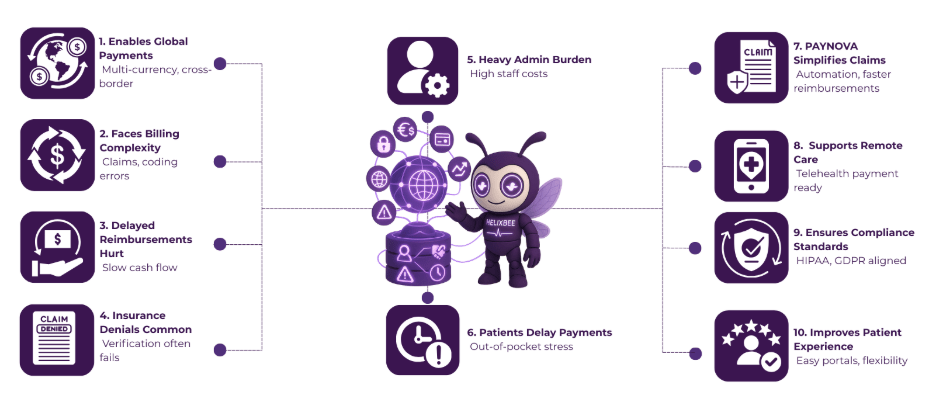

Global payment processing in healthcare presents several significant challenges. Healthcare providers, particularly those offering international services or dealing with patients from diverse regions, face complex payment systems and financial hurdles that can impede smooth operations. Here’s a breakdown of the key challenges:

- Billing Complexity

One of the most prominent challenges in healthcare payments is the sheer complexity of billing. Providers must navigate a complex web of insurance policies, intricate codes (such as ICD-10 for diagnoses and CPT for procedures), and varied patient obligations (including co-pays and deductibles). Errors in coding or billing may result in:

- Denied claims

- Delays in reimbursement

- Dissatisfied patients

- Managing these intricacies often requires specialized billing staff, which adds to operational costs. This complexity can result in significant delays in the revenue cycle, which in turn impacts cash flow.

- Delayed Payments

Delayed payments are a common pain point in the healthcare industry. Insurance companies often take weeks to process claims, leading to cash flow issues for providers. Moreover, if claims are denied due to errors, the delay is prolonged, resulting in additional administrative effort. Patients, too, may delay payments, especially if they find medical bills confusing or face high out-of-pocket costs. This delays the clinic’s ability to collect the revenue needed to continue operations and provide quality care.

- Insurance Verification and Claim Denials

Insurance verification is crucial, but it can also be challenging. Many healthcare providers face difficulties in verifying patient insurance coverage upfront. If the insurance information is outdated or incorrect, providers may render services, only to discover that the claim won’t be reimbursed. Claim denials are another significant issue, arising from:

- Incomplete information

- Incorrect codes

- Services deemed non-essential by the insurer

- This leads to an extended appeals process, further delaying payment and requiring additional administrative resources.

- Administrative Burden

The administrative burden associated with healthcare payments is substantial. Healthcare providers must employ staff to manage insurance claims, patient billing, follow-ups, and comply with complex regulations. This administrative overhead hinders the provider’s ability to focus on patient care and increases operating expenses. As a result, healthcare providers may spend more time on non-clinical tasks, reducing overall efficiency.

- Patient Out-of-Pocket Costs

In many healthcare systems, particularly in the U.S., patients are responsible for a significant portion of their healthcare expenses, especially those with high-deductible health plans. For numerous individuals, it can be daunting to comprehend and handle these expenses. This confusion can lead to:

- Delayed payments

- Defaulted bills

- Reduced willingness to seek necessary care

- High out-of-pocket costs deter patients from seeking care promptly, which can lead to worse health outcomes and increased financial strain on healthcare providers.

How PAYNOVA by HelixBeat Solves Global Payment Processing Issues

- Automated Insurance Verification

Streamline the patient onboarding process by automating insurance verification. This feature helps ensure that the patient’s insurance information is validated in real-time, reducing administrative errors and streamlining the payment process. With automated verification, healthcare providers can verify eligibility, coverage details, and co-pays, ensuring that all necessary information is captured before any services are rendered. This leads to fewer claim denials and faster reimbursements.

- Multipayer Support

The easiest payment gateways support multiple payment systems, allowing you to handle payments from a variety of sources, including credit cards, insurance companies, and direct patient payments. This flexibility ensures that both patients and providers have options for making and receiving payments, leading to enhanced convenience and a broader reach. With multipayer support, you can accommodate the needs of diverse patient demographics, improving their overall experience.

- Automated Claims & Faster Reimbursements

By automating claims processing, the payment gateway minimizes human errors and ensures that claims are submitted accurately and promptly. This feature reduces the waiting time for reimbursements, improving cash flow for healthcare providers. Automated claims reduce the time spent on administrative tasks, allowing your team to focus on more critical aspects of patient care. As a result, healthcare providers receive reimbursements more quickly, which helps stabilize their finances and reduce administrative burdens.

- Support for Telehealth & Remote Care Payments

With the growing trend of telehealth, the easiest payment gateway offers seamless integration with telemedicine platforms, allowing for easy payments for remote consultations and digital healthcare services. This feature supports payment for virtual visits, e-prescriptions, and online medical services, enabling healthcare providers to serve patients regardless of location. It ensures that remote care payments are processed securely and efficiently, offering a consistent experience for both providers and patients.

- Patient-Centric Portals

Patient-centric portals allow patients to view their payment histories, check their balances, make payments, and manage their billing preferences directly through an intuitive interface. These portals empower patients by giving them complete control over their payment experience. It enhances transparency, reduces confusion about billing, and improves overall patient satisfaction. With easy access to statements and payment options, patients are more likely to complete their payments on time.

The Benefits of Efficient Payment Processing in Healthcare

Adopting a global payment solution is essential for ensuring seamless, efficient, and secure payment processing. Here are some of the key benefits of implementing global payment systems in healthcare:

- Improved Cash Flow and Reduced Payment Delays

A global payment solution like PAYNOVA by HelixBeat can help streamline the payment process, ensuring faster transaction processing and quicker reimbursements, thus improving cash flow. By automating transactions and reducing manual steps, PAYNOVA minimizes administrative delays, allowing healthcare providers to focus on what matters most—patient care.

- Increased Patient Payment Flexibility

A global payment gateway offers patients a variety of payment methods, including credit/debit cards, digital wallets, and bank transfers, which enhances their convenience and reduces missed payments. The ability to accept multiple payment types not only helps patients choose their preferred payment method but also increases the likelihood of on-time payments. With PAYNOVA, healthcare providers can offer flexible payment options to patients across different regions, improving both patient satisfaction and financial efficiency.

- Enhanced Patient Experience

The patient’s experience doesn’t end with care delivery; it also extends to billing and payment. Global payment solutions allow patients to view, pay, and manage their medical bills easily through patient portals. Solutions like PAYNOVA offer user-friendly, secure patient-facing portals that allow patients to track their payment history, set up automatic payments, and make online payments. This level of transparency and convenience leads to higher patient satisfaction and builds trust with healthcare providers.

- Seamless Integration with Healthcare Systems

Global payment solutions, such as PAYNOVA, can be seamlessly integrated with Electronic Health Records (EHRs) and Practice Management Systems (PMS), enabling automatic updates of payment statuses in patients’ medical records. This integration helps ensure accuracy and reduces administrative burdens. By consolidating all payment data into one platform, healthcare providers can maintain accurate billing and reduce the risk of errors.

- Compliance with Local and International Regulations

Different countries have varying regulations regarding payment security, data privacy, and taxation. Global payment solutions help ensure that healthcare providers comply with local and international laws. PAYNOVA adheres to stringent regulations, such as HIPAA in the U.S. and GDPR in the EU, ensuring that all financial transactions meet the highest security standards. This compliance not only helps healthcare providers avoid penalties but also enhances patient trust in the system.

- Cost Efficiency with Low Transaction Fees

One of the benefits of using a global payment solution is the ability to reduce transaction fees. PAYNOVA offers competitive rates, allowing healthcare providers to reduce the cost burden of payment processing. Low transaction fees are significant for small and mid-sized healthcare organizations, as they help improve profitability while ensuring secure and seamless payment processes.

Streamline Your Payment Processing with PAYNOVA Today

Best Practices for Implementing a Global Payment System

Here are some best practices to consider when setting up a payment gateway that meets both your clinic’s and your patients’ needs:

- Choose the Right Payment Gateway

Selecting the right payment system is crucial to meeting the unique needs of your clinic and patients. Look for a payment processor that seamlessly integrates with your existing EHR (Electronic Health Record) and PMS (Practice Management System). This integration minimizes manual work, reduces errors, and improves overall efficiency.

Also, please make sure the payment gateway can handle multi-currency transactions, especially if you serve international patients or have locations in different countries. This allows you to accept payments from a diverse patient base without worrying about currency conversions or hidden fees.

- Ensure Data Security

In healthcare, patient data security should be a top priority. Your payment system must comply with the Health Insurance Portability and Accountability Act (HIPAA) to protect patient confidentiality and prevent breaches. A HIPAA-compliant payment system guarantees that all patient financial data is securely encrypted during transactions, ensuring both data privacy and compliance with industry regulations.

Furthermore, choose a payment gateway that meets PCI-DSS (Payment Card Industry Data Security Standard) standards to ensure that payment transactions are protected from fraud and hacking attempts. By choosing a secure payment system, you can build trust with your patients and protect their sensitive information.

- Offer Multiple Payment Options

Patients today want flexibility when it comes to paying for their healthcare services. Providing multiple payment options not only enhances the patient’s experience but also increases the likelihood of on-time payments. Offer a variety of payment methods that patients are comfortable with, such as credit/debit cards, mobile wallets, and bank transfers.

Providing mobile payment services is especially beneficial for patients who prefer to make payments from their smartphones, avoiding the need to visit the clinic in person. By offering a range of payment options, you increase convenience for your patients, reduce the chances of missed payments, and boost overall payment collection.

To Sum It Up

The global payment landscape for healthcare providers can be complex, but with the right payment processor, such as PAYNOVA, clinics can significantly reduce the challenges they face. From multi-currency support to real-time processing, PAYNOVA streamlines payments, ensuring that healthcare providers receive their reimbursements quickly and securely.

Moreover, with HIPAA and PCI-DSS compliance, PAYNOVA guarantees the safety of sensitive patient data. For healthcare organizations seeking to enhance their payment processing, minimize administrative burdens, and deliver a superior patient experience, PAYNOVA is the ideal solution.

Request a Free Demo of PAYNOVA Now and Improve Your Payment Efficiency

FAQs

- What is the best payment gateway for healthcare?

PAYNOVA is a HIPAA-compliant payment processor that offers low transaction fees and easy integration with EHR and PMS systems.

- How does PAYNOVA help small clinics with global payments?

PAYNOVA provides multi-currency support, enabling small clinics to easily process international payments without incurring high fees.

- Is PAYNOVA compliant with HIPAA regulations?

Yes, PAYNOVA is fully HIPAA-compliant and ensures secure payment processing for patient data.

- Can PAYNOVA integrate with existing healthcare systems?

Yes, PAYNOVA seamlessly integrates with EHR and PMS, streamlining billing and payment processes.

- What payment methods does PAYNOVA support?

PAYNOVA supports credit cards, mobile wallets, bank transfers, and other payment methods for patient convenience.

- How does PAYNOVA improve clinic profitability?

By offering lower transaction fees, faster payment processing, and automated billing, PAYNOVA helps clinics boost profitability.

- What is the biggest challenge in global payment processing?

Managing cross-border payments and ensuring regulatory compliance are the main challenges, which PAYNOVA helps address seamlessly.

- How does PAYNOVA enhance patient experience?

PAYNOVA offers patient-facing portals, clear itemized billing, and multiple payment options, improving transparency and satisfaction.

- Does PAYNOVA support recurring payments?

Yes, PAYNOVA can automate recurring payments for patients with long-term care or subscription plans.

- Can PAYNOVA handle insurance preauthorization?

Yes, PAYNOVA integrates with healthcare systems to handle insurance preauthorization and verification in real-time.

- How can PAYNOVA reduce administrative burden?

PAYNOVA automates payment reconciliation, billing, and insurance claims, reducing manual administrative tasks.

- Can I try PAYNOVA before committing?

Yes, PAYNOVA offers a free demo to help you experience its features and capabilities before making a decision.