Global payment processing plays a crucial role in facilitating seamless financial transactions between healthcare providers and patients across international borders. However, navigating the complexities of global payment systems can be challenging due to issues like currency conversion, regulatory compliance, fraud risks, and delayed reimbursements.

For healthcare organizations seeking to deliver seamless services to their international patients, understanding the key challenges and selecting the appropriate payment solutions is crucial. This blog will examine the impact of global payment processing on healthcare, highlighting the primary challenges and how robust solutions, such as PAYNOVA, can streamline payment processing and improve overall efficiency.

Table of Contents

What is Global Payment Processing?

Global payment processing refers to the system that allows businesses and healthcare providers to process financial transactions across different countries and currencies. It involves handling payments from various sources, such as insurance companies, patients, and third-party payers. This system ensures that payments are securely processed and that funds are transferred quickly, regardless of the geographical location.

In the healthcare industry, global payment processing allows providers to accept payments from international patients, process insurance claims across borders, and ensure timely reimbursements. It simplifies complex billing structures, helping healthcare organizations maintain financial stability while providing a seamless payment experience for their patients.

Key Challenges in Global Payment Systems Today

- Currency Conversion and Exchange Rate Fluctuations

One of the most significant challenges in global payment systems is managing currency conversion and exchange rate fluctuations. As healthcare providers accept payments from patients around the world, they face the complexity of converting payments into the local currency. This process can be time-consuming, and fluctuations in exchange rates can result in discrepancies in the amount received, which in turn impact revenue. A global payment processor that offers seamless multi-currency support and transparent exchange rates is crucial to mitigating this challenge. By providing automatic currency conversions at competitive rates, providers can ensure accurate and timely payments, minimizing the risk of financial loss.

- Compliance with International Regulations

Different countries have different regulations regarding financial transactions, including strict data privacy laws and tax regulations. For instance, GDPR in Europe and PCI-DSS in the U.S. impose specific requirements on how sensitive data is handled. Healthcare providers operating in multiple countries or treating international patients must ensure that their payment systems comply with both local and global regulations. Non-compliance can result in hefty fines, reputational damage, and loss of patient trust. This challenge can be addressed by selecting a payment processor that is designed to comply with both regional and international regulations, ensuring that all financial transactions meet the necessary legal standards without disrupting operations.

- Fraud and Security Risks

The rise in online payments has also led to an increase in security concerns. Healthcare providers are prime targets for cybercriminals because they process sensitive financial and medical data. Fraud risks are heightened in global payments due to the complexity of cross-border transactions and the challenges associated with tracking international transactions. Payment processors must implement robust fraud detection systems and encryption protocols to safeguard patient data and payment information. A solution that offers real-time fraud prevention, two-factor authentication, and end-to-end encryption can mitigate the risk of data breaches, safeguarding both healthcare providers and patients.

- Delayed Payments and Slow Reimbursement Cycles

Healthcare providers often experience delays in payments from insurance companies, especially when dealing with cross-border claims. Many countries have different reimbursement timelines, and international insurers may take weeks or even months to process claims. These delayed payments can severely impact cash flow, creating challenges for healthcare providers to manage operational expenses. By automating insurance claim processes and integrating payment solutions with Electronic Health Records (EHRs) and Practice Management Systems (PMS), healthcare providers can expedite the reimbursement process, thereby reducing delays and ensuring timely payments from insurers.

- Complex Billing Structures

Healthcare providers often deal with complex billing structures, particularly when multiple payers are involved, including patients, insurance companies, and government programs such as Medicare and Medicaid. Each payer has its own billing codes, policies, and requirements. As a result, healthcare providers must manage multiple systems to handle each payer’s needs, which is time-consuming and prone to errors. A solution that integrates various payment systems with EHR and PMS can streamline the billing process, ensuring that billing codes and insurance details are accurately processed, reducing administrative overhead, and improving the overall efficiency of payment collections.

- Handling International Payment Methods and Standards

Another challenge that healthcare providers face when dealing with global payments is the variety of payment methods preferred by patients from different countries. While some patients prefer credit/debit cards, others may opt for mobile wallets, bank transfers, or digital payment systems. Each country also has different standards for payment security, which can complicate the acceptance of payments. A flexible payment gateway that supports multiple payment methods, including mobile wallets and ACH payments, allows healthcare providers to offer convenience to patients while ensuring secure transactions that align with international payment standards.

- Poor Patient Understanding of Medical Bills

Patients often struggle to understand the complexity of their medical bills, especially when it comes to cross-border billing. Language barriers, different healthcare systems, and variations in billing practices can lead to confusion, delayed payments, or even disputes. Clear, itemized bills that are easy to read and understand can help bridge this gap. Implementing a patient portal that enables patients to access and pay their bills easily can enhance transparency and streamline communication, thereby reducing billing errors and improving payment rates.

Top Payment Processors for Healthcare

- Centralized Payment Processing:

- A specialized payment gateway enables healthcare providers to enhance their billing efficiency by integrating all payments, whether from insurance, patient self-pay, or third-party payers, into a single, unified system. This minimizes administrative challenges and facilitates easier reconciliation.

- Multiple Payment Methods: Patients can use various payment options, including credit/debit cards, bank transfers, and digital wallets. Providing multiple payment methods enhances convenience for patients and reduces the likelihood of missed payments.

- Improving Cash Flow Faster Payment Collection:

- A dedicated system speeds up payments by ensuring timely, automated transactions, thereby eliminating the delays associated with manual billing processes. This helps healthcare providers maintain a steady cash flow, which is crucial for operations, especially in a system where insurance reimbursements can be slow and unpredictable.

- Recurring Payments and Payment Plans: For patients on payment plans or those who need to cover significant out-of-pocket expenses, the system can automatically handle recurring payments, thereby reducing the likelihood of default.

- Ensuring Compliance with Healthcare Regulations

- HIPAA Compliance: The U.S. healthcare system mandates strict privacy standards under HIPAA. A specialized healthcare payment gateway ensures that patient financial data is encrypted and handled in accordance with these regulations, thereby protecting against data breaches and penalties.

- PCI-DSS Compliance: Healthcare providers manage sensitive payment information, making PCI-DSS compliance essential. A dedicated payment gateway secures all card transactions, reducing fraud risk and maintaining patient trust.

- Handling Complex Billing Structures

- Integration with Healthcare Systems: Healthcare billing is complex due to the involvement of multiple players like insurance companies, government programs (Medicare, Medicaid), and patients. A dedicated gateway can integrate seamlessly with Electronic Health Record (EHR) and Practice Management Systems (PMS), automatically pulling relevant data to generate accurate bills and handle co-pays, deductibles, and insurance payments efficiently.

- Insurance Preauthorization and Verification: Integrated payment gateways can check insurance coverage and handle preauthorizations in real-time, reducing delays for patients and ensuring that providers are promptly informed about covered services.

- Enhancing Patient Experience Patient Portals:

- Numerous specialized payment gateways feature patient-focused portals that enable individuals to view and pay their bills, monitor their payment history, and set up automated payments. This promotes transparency and offers convenience, thereby enhancing the overall patient experience.

- Transparent, Itemized Billing: Patients can see detailed bills that explicitly outline charges, which helps minimize confusion and disputes regarding medical billing — a frequent problem in the U.S. healthcare system.

- Managing Multiple Revenue Streams Third-Party Integrations:

- Healthcare providers typically have various revenue sources (such as insurance reimbursements, patient self-pay, and collaborations with labs and pharmacies). A dedicated payment gateway enables providers to manage these sources within a unified system, ensuring that payments are automatically assigned to the corresponding department or service.

- Cross-Provider Collaboration: Healthcare providers collaborating with labs, pharmacies, and specialists can utilize a payment gateway to facilitate seamless inter-provider payments. This streamlines the complexity of billing across different entities, enhancing efficiency.

- Improving Financial Reporting and Analytics Real-Time Data

- A dedicated payment system equips healthcare providers with up-to-the-minute financial data, allowing them to enhance financial forecasting and manage cash flow more proficiently.

- Comprehensive Reporting: Providers can retrieve in-depth reports on patient payments, insurance reimbursements, outstanding balances, and revenue cycles, which assist in strategic planning and help pinpoint bottlenecks in payment processes.

Why Security and Compliance Matter in Global Payments

Security and compliance are critical factors when it comes to global payment processing in healthcare. With sensitive patient information and financial data being processed, healthcare providers must ensure that all payment systems adhere to strict regulations to protect against fraud and data breaches.

- HIPAA Compliance

The Health Insurance Portability and Accountability Act (HIPAA) mandates strict data protection standards for healthcare providers. Payment processing systems must comply with HIPAA to ensure patient data privacy and security.

- PCI-DSS Compliance

The Payment Card Industry Data Security Standard (PCI-DSS) ensures that payment processors adhere to security standards when handling credit card payments. Compliance with PCI-DSS is essential for preventing fraud and protecting patient payment data.

- Cross-Border Data Regulations

Different countries have different regulations regarding data privacy. For example, the General Data Protection Regulation (GDPR) in Europe imposes strict guidelines on how healthcare providers should manage and protect personal data. A robust global payment processing solution must navigate these regulations while ensuring smooth transactions.

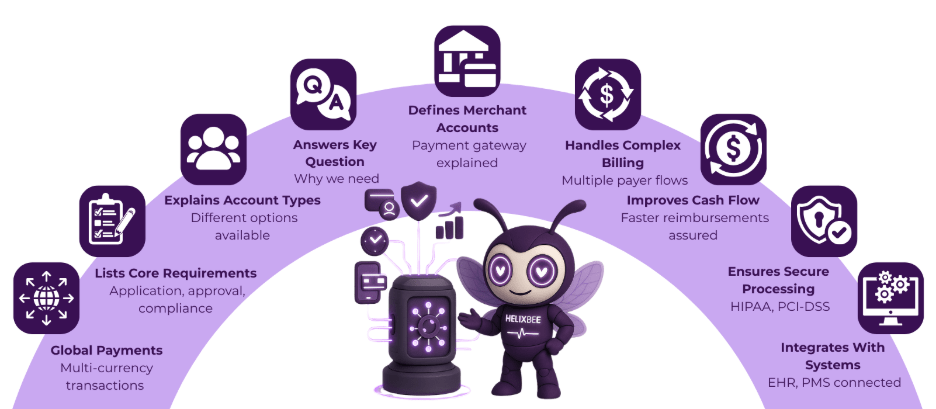

How PAYNOVA by HelixBeat Solves Global Payment Processing Issues

PAYNOVA offers a comprehensive payment solution that addresses the major challenges of global payment processing for healthcare. Here’s how PAYNOVA solves these issues:

- Seamless Cross-Border Payment Processing

PAYNOVA’s system supports multiple currencies, reducing the complexities of currency conversion for international transactions. It also integrates with international payment methods, ensuring that providers can accept payments globally.

- Integrated Compliance

PAYNOVA is fully HIPAA and PCI-DSS compliant, ensuring that patient payment data is always secure. This compliance protects healthcare providers from legal liabilities while ensuring patient trust.

- Real-Time Insurance Verification

PAYNOVA offers real-time insurance verification, reducing the delay in cross-border insurance claims processing. This feature ensures faster reimbursements and less administrative burden.

- Streamlined Billing Systems

By integrating with EHR and PMS systems, PAYNOVA simplifies billing across multiple payers, including insurance companies, government programs, and patient self-pay, improving operational efficiency.

CTA: [See How PAYNOVA Can Simplify Your Global Payments]

Closing Thoughts

The complexities of healthcare payments, from navigating insurance claims to managing patient self-payments, can overwhelm healthcare providers and hinder financial efficiency. B2B payment companies like PAYNOVA offer a solution by providing seamless payment processing that integrates with EHR and PMS systems, reducing administrative burdens and ensuring secure, timely payments. By adopting payment solutions for healthcare, providers can improve cash flow, streamline billing processes, and enhance the patient’s experience.

Choosing the right global payment processing platform ensures that your practice remains compliant with industry regulations, reduces the risk of fraud, and provides an easy-to-use platform for patients to manage their payments. With PAYNOVA, clinics and healthcare providers can simplify their payment workflows, ensure fast payment collection, and focus more on delivering quality care to their patients.

📌 CTA: [Explore PAYNOVA Features and Boost Your Clinic’s Efficiency →]

FAQs

- What is a merchant account?

A merchant account is a specialized bank account that enables businesses, including healthcare providers, to accept payments via credit/debit cards, ACH payments, and more.

- Why do healthcare providers need a merchant account?

A merchant account helps healthcare providers securely process payments, streamline billing, and ensure a smooth transaction experience for both patients and insurance providers.

- What are ACH payments?

ACH payments are electronic payments processed directly from a patient’s bank account, often used for recurring billing or insurance reimbursements.

- What are the benefits of using ACH for healthcare payments?

ACH payments are cost-effective, fast, and secure, helping healthcare providers manage patient payments efficiently while reducing transaction fees.

- How do merchant accounts integrate with healthcare systems?

Merchant accounts integrate with healthcare systems by automatically syncing patient billing data with the payment processing system, ensuring accurate and efficient payment management.

- Is PAYNOVA HIPAA-compliant?

Yes, PAYNOVA by HelixBeat is HIPAA-compliant, ensuring that all patient payment data is processed securely and in accordance with industry regulations.

- Can PAYNOVA handle recurring billing?

Yes, PAYNOVA supports recurring billing, making it ideal for practices that require regular payments for ongoing patient care.

- What types of payment methods does PAYNOVA support?

PAYNOVA supports credit cards, debit cards, ACH payments, and mobile wallet payments, offering flexibility to patients and providers.

- How does PAYNOVA improve revenue cycle management?

PAYNOVA streamlines payment processing, reduces administrative burden, and speeds up payments, improving cash flow for healthcare providers.

- What is the best merchant account for small healthcare practices?

PAYNOVA by HelixBeat is an excellent choice for small healthcare practices, offering low transaction fees, flexible payment options, and seamless integration with healthcare systems.

- Can PAYNOVA integrate with my existing healthcare systems?

Yes, PAYNOVA integrates seamlessly with EHR and PMS systems, simplifying the billing and payment process for healthcare providers.

- How does PAYNOVA ensure secure payment processing?

PAYNOVA uses advanced encryption and security protocols to protect patient data, ensuring that all transactions are secure and compliant with HIPAA.