What happens when a single payroll error snowballs into tax penalties, compliance violations, and employee dissatisfaction? For many entrepreneurs and business leaders, this is not a distant worry but an everyday risk. Payroll is more than salary disbursement—it’s a legally sensitive function that demands both precision and compliance. That’s where a robust payroll management system like Synergy becomes indispensable.

Synergy, developed by Helixbeat, brings together payroll automation, compliance monitoring, and workforce insights in one platform. Whether you are managing a small team or a large enterprise, Synergy ensures payroll accuracy while helping your business adapt to India’s evolving labor and tax regulations.

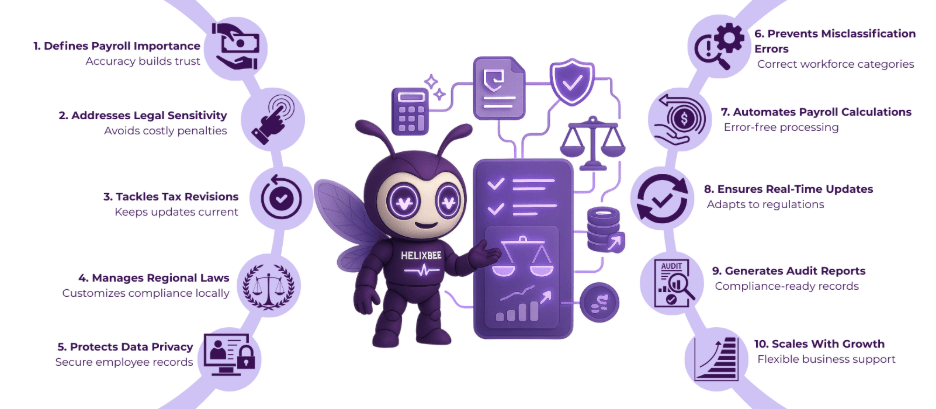

In this blog, we will explore how compliance requirements are changing, why businesses struggle with payroll, and how the right payroll management system can safeguard accuracy while giving leaders peace of mind.

Table of Contents

Why Payroll Accuracy Matters More Than Ever?

Payroll isn’t just about money; it is about compliance, employee trust, and business sustainability.

Legal sensitivity: Payroll errors can trigger tax fines, statutory non-compliance, and lawsuits.

Employee morale: Late or incorrect salary payments reduce trust and increase attrition.

Financial risk: Wrong calculations of PF, gratuity, or tax deductions can drain resources.

A modern payroll management system, especially one like Synergy, minimizes these risks by automating calculations, integrating statutory updates, and generating accurate payslips instantly. Unlike outdated methods or free payroll software with limited features, Synergy is a payroll management software solution designed to scale with compliance needs, making it the ideal HR payroll software in India for businesses navigating India’s complex labor and tax regulations.

Key Compliance Challenges in Payroll Today

The legal landscape in India is constantly evolving, making payroll compliance harder for businesses.

Frequent Tax Revisions

Government notifications often update PF, ESI, TDS, and other tax structures. Without automation, HR teams struggle to keep track of changes. A payroll management system like Synergy can help keep up with these revisions efficiently.

Regional Labor Laws

India’s workforce spans multiple states, each with unique laws. A payroll management software solution like Synergy customizes compliance for region-specific rules, ensuring businesses stay compliant across various jurisdictions.

Data Security & Privacy

Sensitive employee data must be handled securely. HR payroll software in India like Synergy ensures data encryption and access control, reducing risks of breaches and protecting employee privacy.

Employee Misclassification

Incorrectly classifying employees as contractors or vice versa can result in legal issues. With automated HR workflows, Synergy reduces classification errors, ensuring that all employees are properly classified according to legal requirements.

In short, payroll compliance is no longer a manual checklist—it requires technology-driven intervention. Relying on free payroll software may not provide the robust features needed to navigate the complexities of compliance.

The Challenges Businesses Face Without the Right Payroll Management Software Solution

Ensuring Accuracy and Compliance with a Payroll Management System

A payroll management system is the backbone of compliance in today’s businesses.

Automated Payroll Calculations

Synergy’s payroll management software solution auto-calculates salaries, deductions, overtime, and bonuses. This reduces manual errors and ensures compliance with statutory deductions, making payroll more accurate and efficient.

Real-Time Updates for Legal Changes

Whenever tax slabs or laws change, Synergy updates calculations automatically. Unlike generic free payroll software, Synergy ensures that updates are timely and regionally accurate, keeping businesses compliant with the latest regulations.

Geofencing for Compliance

Synergy goes beyond salary by ensuring employees work from authorized locations. For businesses with field staff, geofencing strengthens compliance with attendance and location policies, making sure employees are where they’re supposed to be.

Attendance & Leave Integration

Payroll accuracy depends on attendance and leave data. Synergy’s attendance and leave management ensures payroll reflects real working hours without discrepancies, providing a seamless and accurate payroll management process.

Audit-Friendly Reports

Synergy’s reporting system generates detailed compliance-ready reports for audits. This makes statutory inspections smooth and stress-free, allowing businesses to stay compliant without added stress.

The Challenges Businesses Face Without the Right Payroll Management Software Solution

Let’s look at some real scenarios where businesses falter.

| Challenge | Impact | How Synergy Helps |

| Manual payroll | Salary errors, delays | Automates entire payroll process |

| Free payroll software | Limited compliance features | Offers compliance-ready, scalable solution |

| Complex tax laws | Missed deductions, penalties | Auto-updates tax and deduction rules |

| Multi-location workforce | Regional compliance confusion | Location-based holiday & labor law lists |

| Employee dissatisfaction | Attrition, disputes | Transparent pay slips & real-time updates |

With Synergy, companies eliminate these roadblocks by using a single payroll management system that integrates HR, compliance, and payroll accuracy. As an advanced payroll management software solution, Synergy also serves as the ideal HR payroll software in India, addressing the complexities of India’s labor and tax regulations.

The Unique Benefits of Synergy in Payroll Compliance

Not all payroll solutions are created equal. Here’s why Synergy (HRMS by HelixBeat) is the preferred payroll software in India:

Payroll System Made for India: Tailored to handle Indian tax laws, PF, and ESI compliance.

All-in-One HR Payroll Software in India: Combines payroll, attendance, leave, expense, and compliance features in one.

Scalable for All Businesses: Whether a startup with 10 employees or an enterprise with 10,000, Synergy adapts.

Expense & Shift Management: Goes beyond payroll, helping industries with travel, sales, and 24/7 shifts stay compliant.

Peer Connect & Task Management: Enhances collaboration, ensuring HR compliance extends into performance tracking.

Synergy isn’t just a payroll tool—it’s a payroll management system that supports growth while keeping businesses compliant.

Wrapping Up

Ensuring payroll accuracy and compliance is not optional—it’s a necessity for businesses in India navigating frequent legal changes. From managing attendance to generating audit-ready reports, a payroll management system like Synergy simplifies every aspect of HR and payroll operations. Unlike free payroll software that lacks compliance depth, Synergy offers automation, scalability, and compliance features tailored to Indian businesses. For entrepreneurs and decision-makers, investing in Synergy means fewer risks, higher accuracy, and more confident HR operations.

FAQs

1. What is the role of a payroll management system in compliance?

It ensures accurate salary calculations, automated deductions, and real-time updates aligned with legal requirements.

2. What happens if payroll compliance is ignored?

It can lead to penalties, lawsuits, and reputational damage.

3. Is HR payroll software in India suitable for small businesses?

Yes, solutions like Synergy are scalable, making them ideal for startups as well as large enterprises.

4. Can payroll software in India help reduce employee disputes?

Absolutely. Transparent pay slips and automated processes minimize errors and miscommunication.

5. Can payroll management software solution like Synergy generate reports?

Yes, Synergy creates compliance-friendly reports for audits, attendance, and payroll.

6. Is Synergy user-friendly for HR teams?

Yes, it is designed with simple workflows, reducing training time and increasing adoption.