Administrative costs in healthcare are notoriously high. In the United States, administrative functions account for 25% of total health expenditures, and without intervention, these costs are projected to reach $2.2 trillion by 2035, equating to roughly $6,400 per capita.

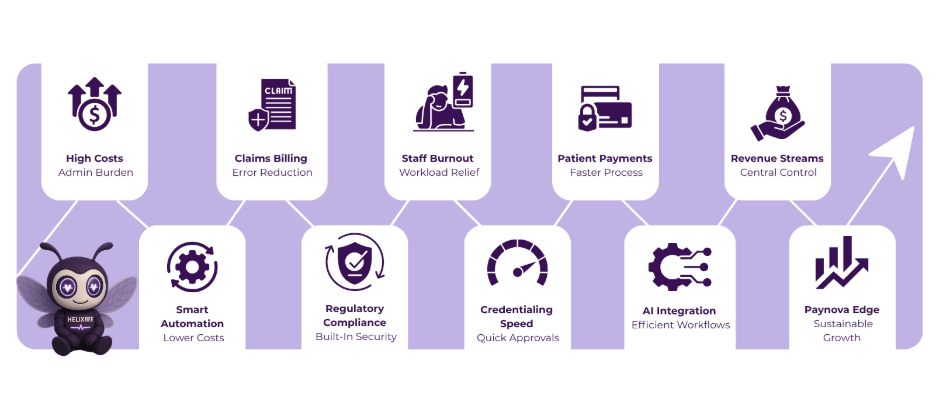

Hospitals and clinics are struggling to manage these expenses, with nearly two-thirds of physicians citing administrative work as their top source of burnout. Non-clinical staff are similarly affected, with 45% reporting work overload and 32% considering leaving their positions. The result is not just burnout but also a strain on hospital finances, operational inefficiencies, and reduced patient care quality.

Payment processing services like Paynova are designed to alleviate these burdens. By automating and streamlining payment workflows, hospitals can reduce administrative overhead, improve cash flow, and optimize staff resources.

Table of Contents

The Growing Administrative Burden in Healthcare

The U.S. healthcare system is complex, involving multiple payers, insurance companies, government programs like Medicare and Medicaid, and patients. Each party introduces layers of administrative work, including:

- Claims submission and processing: Hospitals must manage multiple payers and navigate intricate coding systems. Errors or incomplete submissions often lead to denials, requiring staff intervention.

- Insurance verification: Incorrect or outdated insurance information can delay payments and frustrate patients and providers alike.

- Patient billing and collections: Follow-ups for co-pays, deductibles, and out-of-pocket payments consume significant staff hours.

- Credentialing and licensing: Providers often spend months obtaining necessary approvals, while administrative staff manually manage updates across multiple databases.

- Regulatory compliance: HIPAA and PCI-DSS requirements add layers of complexity to even routine administrative processes.

These burdens are not merely operational headaches—they are major cost drivers. According to Oliver Wyman analysis, nearly $450 billion can be saved over a decade by streamlining administrative processes.

Administrative Costs: The Financial Implications

Administrative inefficiencies are expensive. A significant portion of these costs comes from:

- Back-office operations: Human resources, accounting, and legal functions in healthcare are nearly double the cost of similar functions in other industries.

- Manual claims and billing processes: Hospitals spend millions annually reconciling claims, correcting errors, and following up on unpaid balances.

- Redundant workflows: Multiple departments often perform overlapping administrative tasks, increasing labor costs.

Investing in smart payment processing services can reduce these costs by automating and consolidating workflows, enabling staff to focus on patient care rather than paperwork.

How Payment Processing Services Reduce Administrative Burden

1. Streamlining Claims and Billing

Claims and billing are among the most labor-intensive tasks in healthcare. Hospitals handle submissions to multiple payers, verify coverage, and correct errors, often manually. Healthcare payment processing through Paynova integrates seamlessly with EHR and PMS systems to:

- Automatically generate accurate patient bills.

- Verify insurance coverage in real-time.

- Reduce claim denials caused by incomplete or incorrect documentation.

This automation decreases staff hours spent on billing errors and follow-ups, reducing overall administrative costs.

2. Reducing Staff Workload and Burnout

Administrative burden contributes directly to burnout. By implementing payment processing services, hospitals can:

- Automate low-value tasks such as prior authorization submissions, billing inquiries, and insurance follow-ups.

- Reallocate staff from repetitive work to patient-facing roles.

- Reduce errors that require manual correction, saving time and improving staff morale.

Lower burnout rates result in reduced turnover, saving hospitals recruitment, training, and overtime costs.

3. Improving Patient Payment Processes

Patient billing is a major administrative challenge. High-deductible plans and complex coverage rules often delay payments. Payment processing services allow hospitals to:

- Offer mobile payment services and patient portals for self-service bill payments.

- Enable recurring payments and flexible payment plans.

- Reduce manual follow-ups and disputes over billing.

A more efficient payment system frees staff from repetitive tasks and reduces the risk of unpaid balances, which directly impacts hospital cash flow.

4. Centralizing Revenue Streams

Hospitals often manage multiple revenue streams, including self-pay, insurance reimbursements, partnerships with labs, and third-party services. Fragmentation increases administrative complexity.

By using a best payment processor for small business like Paynova:

- All revenue streams are consolidated into one system.

- Payments are automatically allocated to the correct department.

- Reconciliation is simplified, reducing labor hours and errors.

Centralization of revenue management not only improves efficiency but also provides better financial oversight and reporting.

5. Automation Reduces Costs Across the Board

Many administrative tasks in healthcare are repetitive and low-value but require significant human resources. Examples include:

- Checking claim status

- Entering billing information

- Following up on payment disputes

- Handling refunds

Payment processing services automate these processes, reducing the need for manual labor. This not only lowers costs but also minimizes errors, leading to faster reimbursements and fewer denied claims.

6. Compliance Without Adding Administrative Burden

HIPAA and PCI-DSS compliance are mandatory but managing them manually adds cost. A dedicated healthcare payment processing platform:

- Ensures secure and encrypted payment transactions.

- Provides automated compliance checks and reporting.

- Includes fraud detection to protect sensitive patient data.

By embedding compliance into the system, hospitals can reduce administrative oversight while avoiding penalties and breaches.

7. Reducing Complexity in Credentialing and Licensing

Credentialing and licensing processes are another source of administrative inefficiency. Physicians often wait months for approvals, and hospitals manually update multiple systems.

Payment processing services like Paynova can:

- Digitize credentialing and licensing submissions.

- Enable real-time updates to provider information.

- Reduce redundant administrative tasks across multiple departments.

Streamlining these processes saves time, reduces staffing costs, and speeds up provider onboarding.

8. Leveraging Smart Technology for Efficiency

Modern hospitals can reduce administrative overhead by leveraging technology alongside payment processing services. Key strategies include:

- Integrating AI-assisted claims submission and verification.

- Providing patient portals for self-service billing and appointment management.

- Automating repetitive data entry tasks.

Studies show that even small improvements in efficiency can save hundreds of billions of dollars over time. By automating administrative processes, hospitals reduce labor costs, minimize errors, and accelerate cash flow.

9. Potential Cost Savings

Oliver Wyman analysis highlights that administrative costs in healthcare can be significantly reduced by focusing on:

- Streamlined billing and claims management

- Improved insurance verification

- Simplified credentialing and licensing

- Reduced back-office redundancies

Hospitals that adopt payment processing services can save nearly 15% of back-office costs, translating into billions of dollars when scaled across large health systems. These savings allow hospitals to invest more resources in patient care rather than administrative tasks.

Conclusion

Administrative burden and associated costs are critical challenges in modern healthcare. From manual claims processing to fragmented revenue management and complex compliance requirements, hospitals spend billions on tasks that do not directly benefit patient care.

Payment processing services like Paynova transform these workflows by:

- Automating billing, claims submission, and reconciliation.

- Reducing staff workload and burnout.

- Offering self-service options through mobile payment services.

- Centralizing multiple revenue streams.

- Ensuring compliance without adding labor costs.

By reducing administrative burden, hospitals can optimize operational efficiency, improve financial sustainability, and redirect resources toward patient care. Investing in a dedicated healthcare payment processing system is no longer optional—it’s essential for hospitals seeking to thrive in a complex and expensive healthcare environment.

Paynova empowers hospitals to reduce administrative costs, streamline workflows, and achieve improved financial and operational outcomes, while enhancing patient satisfaction and staff efficiency.

FAQs

1. What are payment processing services in healthcare?

Payment processing services automate billing, claims, and patient payments, reducing administrative workload and improving efficiency in hospitals.

2. How does Paynova reduce administrative costs for hospitals?

Paynova streamlines billing, automates insurance verification, and centralizes revenue streams, cutting back-office labor and overhead expenses.

3. Can patients pay bills using mobile payment services?

Yes, Paynova supports mobile payment services, allowing patients to pay securely via apps, digital wallets, or recurring payment plans.

4. Why is healthcare payment processing complex?

Multiple payers, insurance plans, co-pays, and deductibles create administrative complexity that requires specialized systems to manage efficiently.

5. How does Paynova ensure compliance with regulations?

Paynova is HIPAA and PCI-DSS compliant, encrypting sensitive patient data while automating secure payment processing.

6. Is Paynova suitable for small healthcare providers?

Yes, Paynova is one of the best payment processors for small businesses, providing scalable solutions that reduce administrative burden