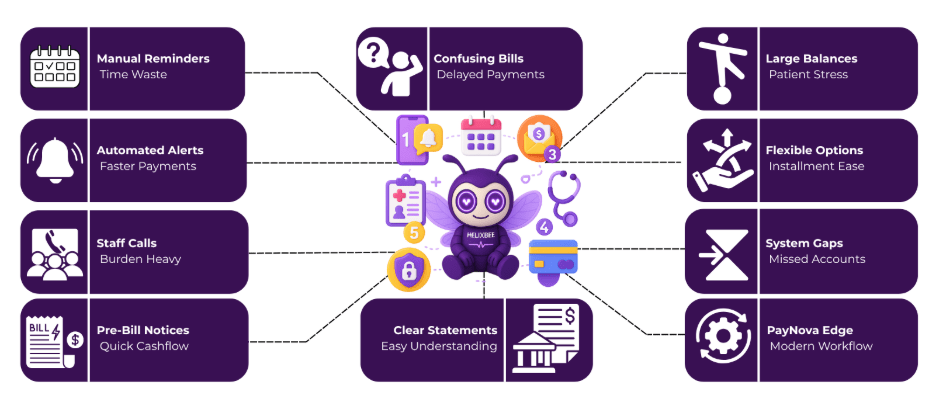

Searching for the best online payment gateway for your clinic? Payment collection is a common issue for many healthcare providers. Outdated systems lead to delays in insurance reimbursements and patient payments, which strain cash flow and complicate finances.

Patients often find billing information unclear, which can cause confusion and dissatisfaction. A reliable payment gateway can help resolve these issues. By simplifying payment processes and offering flexible options, clinics can enhance revenue cycles and improve patient experience. PAYNOVA by HelixBeat is designed for healthcare providers, helping small clinics stay competitive with low transaction fees, secure transactions, and real-time payment tracking.

Table of Contents

Key Features of the Easiest Payment Gateway

Preferring an efficient payment solution is essential for small clinics, as it enables a seamless patient experience and ensures timely payments. Here’s what to look for when choosing a payment gateway for your healthcare practice:

- Automated Insurance Verification

Streamline the patient onboarding process by automating insurance verification. This feature helps ensure that the patient’s insurance information is validated in real time, reducing administrative errors and speeding up the payment process. With automated verification, healthcare providers can verify eligibility, coverage details, and co-pays, ensuring that all necessary information is captured before any services are rendered. This leads to fewer claim denials and faster reimbursements.

- Multipayer Support

The easiest payment gateways support multiple payment systems, enabling you to handle payments from various sources, including credit cards, insurance companies, and direct patient payments. This flexibility ensures that both patients and providers have options for making and receiving payments, leading to enhanced convenience and a broader reach. With multipayer support, you can accommodate the needs of diverse patient demographics, improving their overall experience.

- Automated Claims & Faster Reimbursements

By automating claims processing, the payment gateway minimizes human errors and ensures that claims are submitted accurately and promptly. This feature reduces the waiting time for reimbursements, improving cash flow for healthcare providers. Automated claims reduce the time spent on administrative tasks, allowing your team to focus on more critical aspects of patient care. As a result, healthcare providers receive reimbursements more quickly, which helps stabilize their finances and reduce administrative burdens.

- Support for Telehealth & Remote Care Payments

With the growing trend of telehealth, the easiest payment gateway offers seamless integration with telemedicine platforms, allowing for easy payments for remote consultations and digital healthcare services. This feature supports payment for virtual visits, e-prescriptions, and online medical services, enabling healthcare providers to serve patients regardless of location. It ensures that remote care payments are processed securely and efficiently, offering a consistent experience for both providers and patients.

- Patient-Centric Portals

Patient-centric portals allow patients to view their payment histories, check their balances, make payments, and manage their billing preferences directly through an intuitive interface. These portals empower patients by giving them complete control over their payment experience. It enhances transparency, reduces confusion about billing, and improves overall patient satisfaction. With easy access to statements and payment options, patients are more likely to make timely payments.

- Simplified Refunds & Dispute Management

The easiest payment gateways simplify the process of issuing refunds and resolving disputes, making it easier for healthcare providers to manage patient concerns. When a patient needs a refund, it can be initiated quickly through the automated system of the gateway. Additionally, dispute management tools provide an efficient way to handle chargebacks and payment disputes, ensuring a smoother process that minimizes administrative burden and protects the interests of both the provider and the patient.

- Fraud Prevention & Secure Transactions

Security is a top priority for any payment system, especially in healthcare, where sensitive patient data is involved. The most secure payment gateway utilizes advanced encryption protocols and multi-factor authentication to prevent unauthorized access and protect against fraud. It also monitors for unusual activity, flagging potential fraudulent transactions in real-time. With these robust security measures in place, both healthcare providers and patients can feel confident that their financial transactions are safe and secure.

CTA: Secure Payments, Healthier Cash Flow” highlights the dual benefits of financial security and improved cash flow, which are crucial for healthcare providers.

Top 10 Best Online Payment Gateway Options for Healthcare & Wellness Clinics

Below are the top 10 payment gateway options for clinics in 2025, each offering unique features created to manage the needs of healthcare providers.

1. PAYNOVA by HelixBeat

- Best for: small to medium-sized healthcare and wellness clinics.

- Key Features:

- Tiniest transaction costs and adaptable payment options (credit cards, mobile wallets, bank transfers).

- Seamless integration with EHR and PMS for automated billing

- HIPAA-compliant and PCI-DSS certified for secure transactions

- Real-time payment tracking and automated payment reminders

- Benefits: Simplifies payment collection, reduces administrative workload, and ensures patient data protection.

CTA: Get a Free Demo of PAYNOVA

2. Stripe

- Best For: Clinics with high transaction volumes or multiple locations

- Key Features:

- Interchange-plus pricing for transparent fees

- Accepts credit cards, digital wallets, and bank transfers

- API integration with other healthcare management systems

- Global payment acceptance with multi-currency support

- Benefits: Ideal for clinics that require a highly scalable and customizable payment solution.

3. Razorpay

- Best For: India-based healthcare providers

- Key Features:

- Accepts credit cards, wallets, UPI, and net banking

- Supports international transactions with competitive fees

- Automated payment reconciliation to reduce administrative effort

- Provides real-time analytics to track payment performance

- Benefits: Ideal for Indian clinics seeking an affordable, user-friendly solution with multiple payment options.

4. PayPal

- Best For: International clinics and telehealth providers

- Key Features:

- Multi-currency support for global payments

- Secure and easy-to-use interface

- Integration with various EHR and telehealth platforms

- Fraud prevention tools and buyer/seller protection

- Benefits: Ideal for clinics serving patients from diverse countries, this platform provides a trusted solution for online payments.

5. Square

- Best For: Small clinics and startups

- Key Features:

- Portable credit card processing for in-person and online payments

- Simple pricing structure with no monthly fees

- Integration with Google Pay and Apple Pay for mobile payments

- Patient self-checkout and auto-payment setups

- Benefits: A simple and cost-effective solution for smaller clinics that need mobile payment flexibility and ease of use.

6. CCAvenue

- Best For: Indian healthcare providers with a global patient base

- Key Features:

- Supports various payment options, such as credit cards, debit cards, digital wallets, and online banking.

- Real-time fraud prevention and chargeback management

- Integration with Indian and international payment platforms

- Multi-currency support for international clinics

- Benefits: An excellent choice for Indian clinics dealing with local and international payments, offering a secure and reliable solution.

7. PayU

- Best For: Clinics focusing on the Indian market

- Key Features:

- Low transaction fees and easy integration with healthcare software

- Accepts all major credit cards, debit cards, and UPI payments

- Automatic payment reminders for patients

- Fraud protection and data encryption to secure payments

- Benefits: Ideal for small to medium-sized clinics in India, PayU simplifies the payment process while keeping costs low.

8. 2Checkout (Verifone)

- Best For: International clinics offering telehealth or remote care services

- Key Features:

- Global payment processing with support for multiple currencies

- Subscription billing options for ongoing treatments or telehealth services

- Fraud prevention and security protocols like PCI-DSS compliance

- Comprehensive reporting tools for tracking payment performance

- Benefits: Ideal for clinics offering telemedicine services to international patients, facilitating seamless global payment collection.

9. Authorize.Net

- Best For: U.S. clinics with complex billing needs

- Key Features:

- Flexible payment options, including credit cards, eChecks, and Apple Pay

- Automated recurring billing for patients with long-term care plans

- Integration with PMS and EHR systems

- Real-time payment reporting and analytics

c. Benefits: Ideal for U.S.-based clinics dealing with complex patient billing and insurance claims, offering seamless billing automation.

10. Worldpay

- Best For: Clinics with a global reach and large patient volumes

- Key Features:

- Accepts payments from global customers and supports multiple currencies

- Subscription-based billing for telemedicine services

- Advanced fraud detection and compliance tools

- Comprehensive reporting and analytical tools for improved financial oversight.

- Benefits: Ideal for larger clinics that require a comprehensive payment solution with multi-currency support and advanced fraud prevention capabilities.

Comparison Table of Top 5 Healthcare Payment Platforms

| Payment Gateway | Payment Methods | EHR/PMS Integration | Compliance | Best For |

| PAYNOVA | Credit Cards, Wallets, Bank Transfers | Yes | HIPAA, PCI-DSS | Small Clinics |

| Stripe | Cards, Wallets | Yes | PCI-DSS | High-Volume Clinics |

| Razorpay | Cards, Wallets, UPI | Yes | PCI-DSS | India-based Clinics |

| Square | Cards Only | Limited | PCI-DSS | Small Clinics, Startups |

| PayPal | Cards, Wallets | Limited | PCI-DSS | International Clinics |

Benefits of Using the Best Payment Gateway for Small Businesses

- Streamlining Payments and Billing

- Centralized Payment Processing

A dedicated payment gateway simplifies the billing process by merging all types of payments, insurance, self-pay, and third-party payers, into a unified, comprehensive system. This minimizes administrative workload and makes reconciliation more straightforward.

- Multiple Payment Methods

Patients have the option to pay through various methods, such as credit/debit cards, bank transfers, and digital wallets. Offering multiple payment options improves patient convenience and reduces the likelihood of missed payments.

- Improving Cash Flow

- Faster Payment Collection

A dedicated system accelerates payment processing by automating transactions and minimizing delays associated with manual billing methods. This ensures steady cash flow, which is vital for healthcare operations, especially when dealing with slow insurance reimbursements.

- Recurring Payments and Payment Plans

For patients on payment plans or those with high out-of-pocket expenses, the system automatically manages recurring payments, reducing the likelihood of payment defaults.

- Ensuring Compliance with Healthcare Regulations

- HIPAA Compliance

Healthcare providers are required to comply with strict privacy regulations under HIPAA. A payment gateway designed for healthcare ensures that all patient financial data is encrypted and handled securely, safeguarding both patients and providers from potential data breaches and penalties.

- PCI-DSS Compliance

Ensuring compliance with PCI-DSS is crucial for securing card transactions. Dedicated payment gateways uphold stringent security standards to minimize fraud risks and foster patient trust.

- Handling Complex Billing Structures

- Integration with Healthcare Systems

Healthcare billing can be complicated due to the involvement of insurance companies, government programs (like Medicare and Medicaid), and patients. A specialized gateway integrates with Electronic Health Record (EHR) and Practice Management Systems (PMS), automating bill generation and streamlining payments for co-pays, deductibles, and insurance reimbursements.

- Insurance Preauthorization and Verification

Integrated payment gateways can verify insurance coverage and process pre-authorizations in real-time. This reduces patient delays and ensures healthcare providers are quickly informed about the covered services.

- Enhancing the Patient Experience

- Patient Portals

Numerous reliable payment gateways offer portals for patients, allowing them to access and manage their bills, view their payment history, and set up automatic payments. This fosters transparency and enhances convenience, ultimately leading to a more positive overall experience for patients.

- Transparent, Itemized Billing

Patients can easily view detailed, itemized billing that breaks down charges, reducing confusion and disputes over medical bills —a common issue in healthcare systems across the U.S.

Factors to Consider When Choosing a Healthcare Payment Platform

Here are some critical factors to keep in mind when evaluating payment gateways for your clinic or practice:

- Integration with EHR/PMS

The ideal payment platform should easily integrate with your existing Electronic Health Record (EHR) and Practice Management Systems (PMS). This ensures that patient billing, insurance claims, and payment information are automatically synchronized, reducing manual data entry and minimizing the risk of errors. An integrated system allows for streamlined workflows, enabling healthcare providers to focus on patient care rather than managing complex administrative tasks.

- Compliance with HIPAA and PCI-DSS

Since healthcare providers handle sensitive patient data, it’s essential to select a payment gateway that complies with HIPAA regulations. The platform should ensure that all patient payment information, including credit card details, is securely encrypted and stored, preventing unauthorized access. Non-compliance could lead to significant fines and reputational damage.

- PCI-DSS Compliance for Payment Security:

Ensuring the payment gateway is PCI-DSS (Payment Card Industry Data Security Standard) compliant is crucial for safeguarding credit card transactions. The PCI-DSS sets the standard for the secure processing of card payments and reduces the risk of fraud. A PCI-compliant system ensures that all card information is transmitted and stored securely, protecting both the clinic and the patient.

- Affordable Transaction Fees

High transaction fees can quickly add up and eat into your clinic’s revenue. It’s essential to choose a payment platform with transparent and low transaction fees to ensure your clinic can process payments cost-effectively. Look for platforms that offer flexible pricing plans that are tailored to the size and scale of your practice. For smaller clinics or non-profit healthcare providers, affordability is key to ensuring that payment processing doesn’t become a financial burden.

- Customer Support

When dealing with financial transactions, prompt resolution of issues is critical. Look for a payment processor that offers 24/7 customer support, ensuring that any payment-related problems can be addressed at any time. Whether it’s technical issues, integration concerns, or payment disputes, responsive support ensures minimal disruption to your clinic’s operations and enhances patient satisfaction.

Closing Thoughts

Selecting the right healthcare payment platform is crucial for optimizing clinic operations and reducing administrative burdens. With PAYNOVA, healthcare providers can streamline payment collection, enhance patient engagement, and improve financial management.

PAYNOVA by HelixBeat effortlessly integrates with EHR/PMS systems, ensuring smooth and efficient workflows. It meets HIPAA and PCI-DSS compliance standards, offering top-tier data security for both patients and providers. Delivering low transaction fees, excellent support, and a wide range of payment options, PAYNOVA enables clinics to remain cost-effective while enhancing the patient’s experience.

By managing common challenges such as delayed payments, complex billing, and insurance problems, PAYNOVA provides the ultimate solution to enhance payment collections and clinic profitability.

CTA: [Try PAYNOVA for Streamlined Payment Processing Now →]

FAQs

What is the best payment gateway for healthcare providers?

PAYNOVA offers low fees, flexible payment options, and integration with healthcare systems, making it ideal for healthcare providers.

How does PAYNOVA improve patient engagement?

Through patient portals, clear billing statements, and multiple payment methods, PAYNOVA enhances transparency and patient satisfaction.

Can PAYNOVA integrate with existing EHR systems?

Yes, PAYNOVA seamlessly integrates with EHR and PMS systems for smooth billing processes.

What payment methods does PAYNOVA support?

PAYNOVA supports credit cards, bank transfers, and mobile wallets like Google Pay and Apple Pay.

How does PAYNOVA ensure security and compliance?

PAYNOVA is fully HIPAA-compliant and follows PCI-DSS standards, ensuring secure payment processing.

Is PAYNOVA easy to use for patients?

Yes, patients can easily make payments through mobile apps, online portals, and automatic payment setups.

What are the transaction fees for PAYNOVA?

PAYNOVA offers affordable transaction fees, typically around 1.5% + ₹3 per transaction.

How does PAYNOVA benefit small clinics?

PAYNOVA streamlines payment processing, reduces administrative tasks, and offers flexible payment options to improve cash flow.

Can PAYNOVA handle international payments?

Yes, PAYNOVA supports global transactions, making it ideal for international patient payments.

Does PAYNOVA offer 24/7 customer support?

Yes, PAYNOVA provides 24/7 customer support for troubleshooting and inquiries.

How does PAYNOVA handle recurring payments?

PAYNOVA allows patients to set up recurring payments, ensuring timely payments for ongoing treatments.

What makes PAYNOVA different from other payment processors?

PAYNOVA integrates with EHR/PMS, offers low fees, and provides an easy-to-use patient portal for better patient engagement.