Key Takeaways

- The healthcare industry loses over $40 billion annually due to invoicing issues and $6 billion to payment errors.

- Manual processes, paper checks, and outdated financial systems create delays, errors, and inefficiencies in vendor reconciliation.

- Automating B2B healthcare payments streamlines vendor reconciliation, procurement, and payment approvals.

- Real-time digital payment systems improve cash flow forecasting, transparency, and reconciliation accuracy.

- B2B payment companies are evolving into strategic partners that drive trust, operational efficiency, and financial control.

Managing a large hospital network or a chain of healthcare facilities is a complex challenge. Every day, thousands of patients receive care, and hundreds of suppliers—from medical device manufacturers to pharmaceutical companies—require timely payments. Layer onto this the intricate network of insurance partnerships: multiple private insurers covering diverse patient plans, government programs like Medicare and Medicaid, and patients’ co-pays, deductibles, and out-of-pocket expenses.

Every invoice, payment, and insurance claim must be reconciled with precision. Even a small mistake can trigger delayed vendor payments, disrupt critical supply deliveries, create disputes with suppliers, and strain relationships. Cash flow gaps become frequent, making operational planning and scaling difficult, while manual coordination with insurers slows reimbursements.

Finance teams often spend hours—or even days—manually matching invoices to purchase orders and verifying insurance claims. These inefficiencies cost the healthcare industry billions annually: $40 billion from invoicing issues and $6 billion from payment errors, highlighting the urgent need for automated, reliable payment and reconciliation solutions.

Table of Contents

The Challenge: Inefficient Vendor Reconciliation in Healthcare

Vendor reconciliation is the backbone of healthcare finance. It ensures that every invoice matches the purchase order and payment, creating accuracy across the supply chain. However, most healthcare organizations still rely on:

- Manual invoice processing with high risk of errors

- Paper checks, which can get lost or delayed

- Multiple payment sources, including insurers, government programs, and patients

- Spreadsheets for reconciliation, prone to discrepancies

These outdated practices create delays in vendor payments, strain relationships, and disrupt procurement. Hospitals and clinics can see supplier lead times stretch up to six months, and resolving errors can take weeks.

By leveraging B2B payment

companies solutions like PayNova, healthcare providers can digitize vendor reconciliation, ensuring accuracy, efficiency, and predictable cash flow.

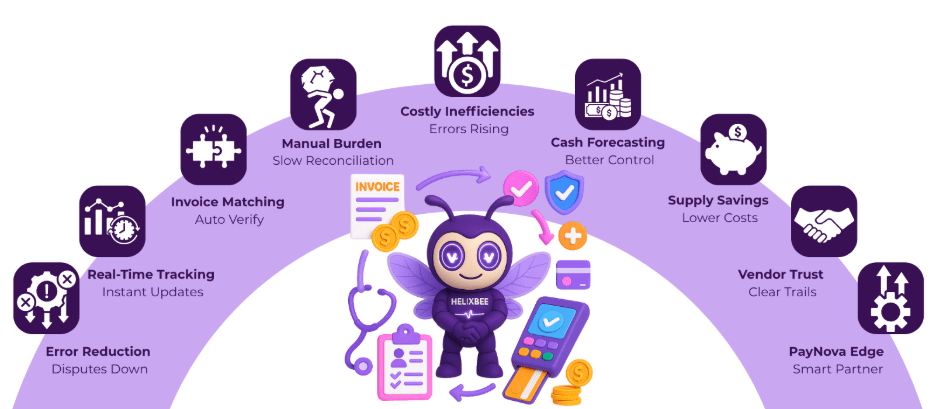

How B2B Payment Companies Automate Vendor Reconciliation

A major advantage of modern B2B payment companies is automating the reconciliation process. Here’s how it works for healthcare providers:

- Automatic Invoice Matching: PayNova automatically matches vendor invoices with purchase orders and payments, eliminating hours of manual verification.

- Real-Time Payment Tracking: Every transaction is logged and updated instantly, giving finance teams visibility into which payments are pending, completed, or disputed.

- Error and Dispute Reduction: Automation reduces human errors that often lead to late or incorrect payments, thereby minimizing disputes and administrative follow-ups.

- Centralized Vendor Data: All vendor accounts, invoices, and payment histories are maintained in one system, simplifying audits and reporting.

- Integration with EHR and ERP Systems: PayNova syncs seamlessly with existing Electronic Health Record (EHR) and Enterprise Resource Planning (ERP) systems, ensuring vendor reconciliation is accurate across all platforms.

By automating vendor reconciliation, B2B payment companies not only save time but also prevent financial leaks and improve supplier trust.

Improving Cash Flow Through Streamlined Vendor Payments

Cash flow is critical in healthcare, where delays in vendor payments can interrupt procurement of essential supplies. B2B payment companies like PayNova enable healthcare organizations to:

- Forecast cash flow more accurately with real-time data

- Execute faster payments to vendors using ACH, virtual cards, or digital wallets

- Anticipate payment bottlenecks before they affect operations

- Manage recurring payments and payment plans to vendors, reducing defaults and disputes

Automated reconciliation ensures that every invoice is verified and every payment is accounted for, allowing CFOs and controllers to manage cash efficiently.

Reducing Costs and Errors in the Supply Chain

Outdated payment processes are costly:

- $40 billion lost annually due to invoicing issues

- $6 billion lost to payment errors

- 85% of healthcare purchases still rely on paper checks

B2B payment companies lower these costs by:

- Eliminating manual invoice entry and reconciliation errors

- Reducing reliance on paper checks through cheap payment gateway solutions

- Improving accuracy in vendor reconciliation, cutting down on disputes and delayed payments

By adopting automated payment platforms for small businesses, even smaller clinics and suppliers can benefit from efficient reconciliation and reduced administrative costs.

Building Transparency and Trust in Healthcare Payments

Trust is essential not only between doctors and patients but also across the vendor network. Automated reconciliation through B2B payment companies like PayNova provides:

- Digital audit trails for every transaction

- Timestamped approvals, ensuring accountability

- Clear reporting of outstanding, completed, and disputed payments

This transparency strengthens vendor relationships, reduces errors, and provides confidence that payments are accurate and timely.

Why Healthcare Needs Specialized B2B Payment Companies

Generic payment systems may handle basic invoicing, but healthcare requires:

- Compliance with HIPAA and PCI-DSS for secure transactions

- Integration with EHR and PMS systems for accurate reconciliation

- Automated insurance verification and claims processing

- Patient and vendor portals for transparency and communication

Specialized healthcare payment companies like PayNova ensure that reconciliation and payments are not just accurate but also compliant, secure, and scalable.

Case Study: Modernizing Vendor Reconciliation

Traditional vendor reconciliation in healthcare looks like this:

- Receive a paper invoice via email or fax

- Manually enter data into spreadsheets

- Send checks to vendors, often delayed

- Resolve errors and disputes over weeks

With PayNova:

- Invoices are automatically digitized and matched to purchase orders

- Approvals occur in-platform without manual intervention

- Payments are executed instantly via ACH or virtual cards

- Vendors receive digital receipts for reconciliation

The result: faster payment cycles, fewer errors, predictable cash flow, and a reduction in administrative burden.

The Future of Healthcare Payments

As the healthcare sector embraces digital transformation, B2B payment companies are no longer just financial tools—they are strategic partners. Benefits include:

- Automated vendor reconciliation

- Improved cash flow and financial forecasting

- Reduced processing costs and disputes

- Scalable solutions for growing healthcare networks

By offering cheap payment gateway options and supporting payment platforms for small businesses, companies like PayNova make sophisticated reconciliation tools accessible to organizations of all sizes.

Conclusion

Healthcare finance teams face complex challenges in vendor reconciliation, cash flow management, and payment accuracy. Manual processes, paper checks, and outdated systems cost billions each year.

B2B payment companies like PayNova transform these pain points into opportunities by automating vendor reconciliation, ensuring real-time visibility, and providing secure, scalable payment solutions. With PayNova, healthcare providers can reduce errors, cut costs, improve supplier relationships, and focus on delivering quality patient care.

In a sector where timing and precision matter, B2B payment companies are essential partners for operational success, financial efficiency, and trust-building across the healthcare supply chain.

FAQs

- What are B2B payment companies in healthcare?

B2B payment companies provide platforms and solutions that help healthcare providers automate payments, reconcile invoices, and coordinate with insurance partners efficiently.

- What is PayNova in healthcare payments?

PayNova is a specialized B2B payment gateway designed for healthcare, allowing automated processing of vendor payments, insurance claims, and patient-related transactions.

- How do B2B payment companies improve vendor reconciliation?

They automate invoice matching, track payments in real time, reduce errors, and centralize data, ensuring every payment aligns with purchase orders and insurance claims.

- Can PayNova help improve cash flow for healthcare organizations?

Yes. PayNova enables real-time tracking of payments, automates recurring transactions, and reduces delays, helping healthcare providers maintain steady cash flow.

- Does PayNova comply with healthcare regulations?

Yes. PayNova ensures HIPAA and PCI-DSS compliance, securely managing sensitive patient and financial data.

- Can small healthcare providers benefit from B2B payment solutions like PayNova?

Absolutely. Many payment platforms for small businesses, including PayNova, offer scalable and affordable tools to simplify vendor reconciliation, reduce errors, and streamline payments.