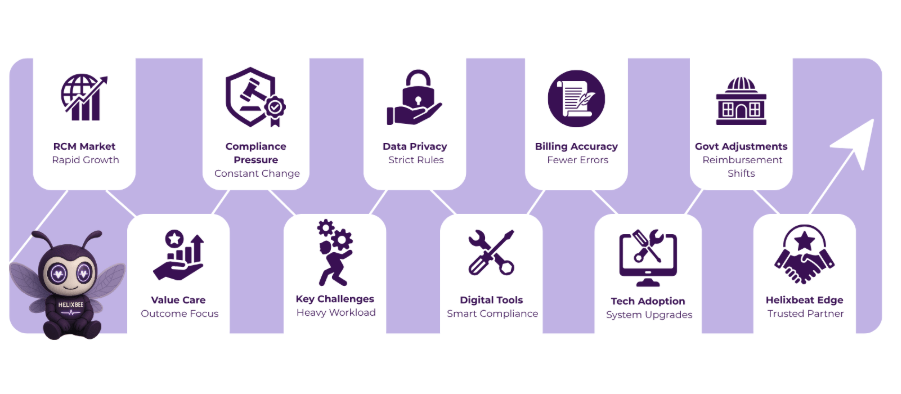

The global revenue cycle management (RCM) market is expected to reach $115.7 billion by 2027, growing at a rate of 10.1% each year. As more healthcare organizations seek efficient RCM services, new regulations are creating big challenges. In fact, 85% of healthcare organizations say staying compliant with these ever-changing rules is one of their biggest difficulties.

The problem is clear: as regulations become increasingly complex, RCM businesses must keep pace with changes quickly or risk facing delays, higher costs, and penalties for non-compliance.

The good news is there’s a solution. By adopting digital transformation—using tools like automated billing systems, AI-driven analytics, and cloud-based platforms—RCM businesses can stay on top of regulations and run more smoothly. Partnering with an experienced RCM business that uses the latest technology can help companies stay compliant and work more efficiently.

Table of Contents

RCM Business Overview

The RCM business (Revenue Cycle Management) focuses on managing the financial process of healthcare services, from the moment a patient schedules an appointment to the final payment being received. It involves a series of steps, including patient registration, insurance verification, medical billing, coding, and collections. The primary goal of RCM is to ensure healthcare providers receive timely payments for their services through efficient revenue cycle management services.

This process requires accuracy, compliance with regulations, and efficient management of financial transactions to prevent delays or denials in payments. As healthcare regulations continue to evolve, RCM businesses must adapt their strategies and technologies to stay compliant while optimizing revenue collection for healthcare providers.

Impact of New Regulations on RCM Business

With healthcare regulations constantly evolving, RCM businesses are facing increasing pressure to stay compliant while maintaining operational efficiency.

1. Increased Compliance Requirements

New regulations, such as updated coding standards and stricter billing guidelines, have increased the complexity of the RCM process. Healthcare organizations must invest in staying up-to-date with these changes to avoid errors in billing and claims submissions. Failure to comply can lead to delayed payments or penalties, affecting cash flow and operational efficiency.

In fact, 71% of healthcare providers report that regulatory compliance is one of their biggest operational challenges.

2. Stricter Data Privacy and Security Regulations

As healthcare data becomes more digital, regulations like HIPAA have become even more stringent. RCM businesses must ensure that patient information is handled securely, with proper encryption, access controls, and audit trails. Non-compliance with these privacy standards can lead to hefty fines and a loss of trust from both patients and providers.

The U.S. Department of Health and Human Services reported over $13.2 million in HIPAA penalties in 2020 alone.

3. Impact on Billing and Coding Practices

Changes in billing and coding requirements, such as the shift to ICD-10 codes or updates to Medicare and Medicaid reimbursement rates, require RCM businesses to constantly train staff and update systems. These updates can create challenges in terms of time and resources, especially for smaller healthcare providers who may struggle with the additional burden.

Around 20% of medical claims are denied due to billing and coding errors, which significantly impact RCM efficiency. This highlights the importance of accurate RCM in medical billing to ensure that claims are processed smoothly and reimbursements are received on time.

4. Government Reimbursement Adjustments

Government programs like Medicare and Medicaid frequently adjust their reimbursement structures. RCM businesses need to monitor these changes closely, as they can impact revenue collection and reimbursement timelines. New regulations may require the submission of additional documentation or proof of service, which can delay payment cycles.

In 2020, Medicare reimbursement changes affected over 45 million beneficiaries, making accurate RCM processes essential to avoid revenue loss.

5. Adoption of Value-Based Care Models

Regulations are increasingly shifting towards value-based care, where providers are reimbursed based on patient outcomes rather than the volume of services delivered. RCM businesses must adapt to this new model by ensuring that payment structures and documentation align with outcome-based performance metrics. This requires changes in billing systems and more sophisticated data tracking to prove the quality of care provided.

Studies show that 50% of healthcare providers have already started or are planning to transition to value-based care models, increasing the need for RCM systems that can support outcome-based reimbursement.

Challenges RCM Businesses Face Under New Compliance Rules

As new compliance rules continue to evolve, RCM businesses face significant challenges in adapting their processes to stay in line with regulations. These challenges can disrupt operations, increase costs, and lead to inefficiencies in revenue cycle management.

1. Increased Administrative Workload

New regulations often require additional paperwork, documentation, and reporting, leading to an increased administrative burden. This not only takes up valuable time but also increases the likelihood of errors, which can delay payments and affect cash flow.

2. Complex Training Needs

With constant changes in billing codes, coding practices, and regulatory frameworks, RCM businesses must frequently update their training programs. This can be resource-intensive and time-consuming, requiring ongoing investment in staff education to ensure compliance.

3. High Risk of Claim Denials

New compliance rules often result in more stringent documentation requirements, leading to an increased risk of claim denials. RCM businesses must ensure that claims are properly coded and supported by sufficient documentation to prevent delays in reimbursements.

4. Technology and System Upgrades

To remain compliant, RCM businesses must frequently upgrade their systems and technology. Whether it’s adopting new billing software, enhancing cybersecurity protocols, or integrating new compliance features, these upgrades require significant investment and can disrupt ongoing operations.

As the healthcare sector becomes more regulated, RCM businesses must continuously adapt to avoid these challenges and ensure smooth, compliant operations.

The Role of Digital Transformation in Staying Compliant

Digital transformation plays a crucial role in helping RCM businesses stay compliant with evolving regulations by streamlining processes and minimizing errors.

- Automated Billing Systems help ensure that billing codes are up-to-date and accurate, reducing the risk of compliance violations.

- AI-Driven Analytics provides insights into claim patterns, helping identify potential errors before they result in denials.

- Cloud-based Platforms offer secure data storage, making it easier to manage sensitive patient information while complying with data privacy regulations.

- Real-Time Reporting Tools ensure that RCM businesses can track and meet compliance requirements promptly, avoiding costly penalties.

- Integrated Software Solutions streamlines communication across departments, ensuring that all teams are aligned on compliance protocols.

By adopting these digital tools, RCM businesses can maintain high standards of compliance while improving operational efficiency.

Stay Ahead of Regulations with Helixbeat Digital Transformation Services

Helixbeat digital transformation services help RCM businesses stay compliant with changing regulations by leveraging the latest technology to streamline their processes. We make processes such as billing, coding, and claim submissions easier and more accurate, thereby reducing the risk of mistakes and ensuring compliance with new regulations. With our automated systems and real-time data analysis, your business can stay compliant without wasting time.

We also focus on keeping patient data safe and secure, following strict regulations like HIPAA. With Helixbeat’s digital transformation solutions, your RCM business can quickly adapt to new rules, improve efficiency, and handle the revenue cycle smoothly. As one of the top revenue cycle management companies, we’re committed to optimizing your operations and ensuring you’re always compliant. Contact us now.

FAQ

1. What is Revenue Cycle Management (RCM)?

RCM refers to the process of managing the financial aspects of healthcare services, from patient registration to payment collection. It includes everything from billing and coding to insurance verification and collections.

2. How do new regulations affect RCM businesses?

New regulations can increase the complexity of billing, coding, and documentation processes, requiring businesses to stay updated on compliance standards to avoid penalties and ensure timely payments.

3. Why is digital transformation important for RCM businesses?

Digital transformation helps RCM businesses streamline their processes, improve accuracy, enhance data security, and stay compliant with evolving regulations, leading to better operational efficiency and reduced risk of errors.

4. How can AI improve the RCM process?

AI can analyze large amounts of data to identify patterns, predict claim denials, and recommend improvements. It helps in reducing human error, speeding up processing, and ensuring more accurate billing and coding.

5. What role does data security play in RCM compliance?

Data security is crucial in RCM compliance, especially with sensitive patient information. Ensuring that data is protected according to regulations like HIPAA helps avoid penalties and builds trust with patients and healthcare providers.