Picking the best online payment gateway for your hospital might seem like just another item on your to-do list, but it’s a decision that can make or break your patient experience and billing efficiency. We understand: between juggling patient care, insurance hassles, and an endless stream of administrative tasks, payment processing may not feel like a top priority.

But the truth is, the right gateway can save your team hours of stress, improve cash flow, and even help patients feel more confident and cared for.

Too often, hospitals end up choosing solutions that aren’t designed for healthcare, or they focus only on cost and overlook what really matters: security, compliance, and ease of use. In this blog, we’ll walk you through the most common mistakes hospitals make when choosing a payment gateway online—and how to avoid them.

Let’s help you find the easiest payment gateway online that truly fits your hospital’s needs.

Table of Contents

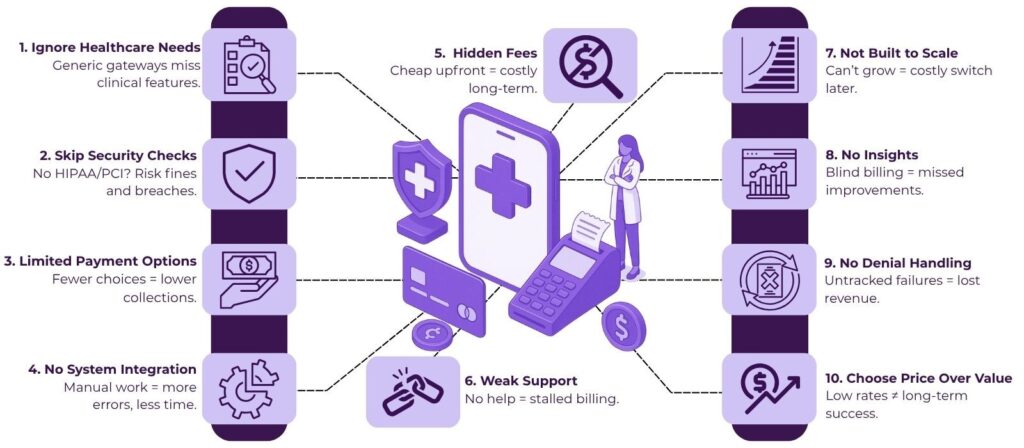

1. Overlooking Healthcare-Specific Requirements

Mistake: Treating healthcare payments like retail

Many hospitals make the mistake of selecting a generic payment service that works well in retail but falls short in a clinical setting. Healthcare billing isn’t just transactions—it includes co-payments, varied payer sources, claim submissions, recurring treatment plans, and insurance pre-authorization.

Why it matters

A best online payment gateway that’s not built for healthcare can frustrate patients—and staff alike—due to poorly handled insurance billing, opaque patient charges, and compliance risks.

Solution

Prioritize the best online payment gateway solutions that offer healthcare features like insurance verification, co-pay handling, EHR/PMS integration, and advanced reconciliation tools. Don’t mistake convenience for full compliance or optimal functionality.

2. Ignoring Compliance Standards and Security

Mistake: Neglecting HIPAA and PCI-DSS

Security is non-negotiable in healthcare. Yet, many administrators assume that any payment gateway online automatically takes care of compliance. HIPAA (for patient data) and PCI-DSS (for card data) have distinct requirements, and one does not guarantee the other.

Why it matters

Breach or non-compliance can lead to heavy fines, data breaches, patient mistrust, and damage to your hospital’s reputation.

Solution

Ensure your gateway is certified for both HIPAA and PCI-DSS, uses encryption, tokenization, fraud detection, and conducts regular audits. Seek the easiest payment gateway online with a reputation for fool‑proof compliance and a track record in healthcare.

3. Not Evaluating Payment Methods and Patient Convenience

Mistake: Offering too few payment options

A provider might only accept credit cards or only work on desktop terminals. In an age of smartphones, tablets, and digital wallets, limited payment methods frustrate patients and reduce collections.

Why it matters

Missed payments don’t just impact cash flow—they also affect patient satisfaction and loyalty.

Solution

Choose a best online payment gateway that supports credit/debit cards, mobile wallets like Apple Pay, ACH, bank transfers, and even recurring installment options. Plus, look for who offers best payment gateway for small business to ensure the flexibility rightly scaled for your hospital’s size.

4. Failing to Check Integration Capabilities

Mistake: Treating the gateway as a standalone tool

Standalone gateways may process payments, but that’s not enough. A disjointed system requires manual reconciliation, causes data delays, and increases error rates.

Why it matters

Without smooth integration, billing teams waste time entering data between systems—time that could be better spent on patient care or follow-up.

Solution

Opt for the best online payment gateway that integrates with your EHR, PMS, telehealth platforms, and billing software, automating claim verification, posting, patient notifications, and reporting.

5. Underestimating Transparency in Fees

Mistake: Not digging into pricing structure

Gateways can appear cheap upfront but embed hidden fees—tiered rates, setup charges, cancellation penalties, penalties for low volume, and chargebacks.

Why it matters

Unexpected fees can negate advantages and erode cost savings over time.

Solution

Select transparent providers that disclose setup fees, monthly fees, transaction fees, chargeback fees, and PCI compliance charges. Compare these costs using real-world transaction volumes before choosing your best online payment gateway.

6. Overlooking Customer Support and Training

Mistake: Prioritizing price over partnership

After implementation, you’ll need support. Hospitals often lack in-house experts to troubleshoot integration issues or resolve batch processing errors.

Why it matters

Delayed resolutions cost time and money—and deter billing effectiveness.

Solution

Aim for a payment partner known for excellent support—24/7 help desks, fast ticket resolution, dedicated managers, and training. The best online payment gateway for small businesses becomes one you can count on when technology hiccups.

7. Overlooking Scalability for Growth

Mistake: Focusing only on current needs

Many hospitals only evaluate gateways based on current transaction volumes. What happens when you open another clinic or expand services like telehealth?

Why it matters

You may end up with a system that can’t handle your future needs—forcing re-procurement and reimplementation.

Solution

Choose a gateway that supports future growth, multi-location operations, virtual visits, and higher transaction volume. The best online payment gateway for your current hospital should also cater to tomorrow’s expansion plans.

8. Not Examining Reporting and Analytics

Mistake: Treating payments as a black box

The easiest payment gateway should offer more than swipes—it should provide insights: Which payment methods are most popular? Which appointments turn into payments fastest? Where are the bottlenecks?

Why it matters

Without analytics, you can’t identify and improve inefficiencies in revenue cycle management.

Solution

Select a gateway that delivers robust, real-time dashboards and analytics. This enables smarter decision‑making, revenue forecasting, and resource allocation.

9. Disregarding Denial Management and Follow-Up

Mistake: Assuming payments always process cleanly

Payments aren’t always processed, especially in healthcare. Insurance claims get denied; patients miss payments; chargebacks happen.

Why it matters

These issues cost money, and many hospitals do not proactively track or follow up.

Solution

Look for a gateway that integrates denial tracking workflows, automated follow-ups, reminders, and reconciliation tools. Partnering with top-tier providers ensures fewer dropped accounts and more consistent cash flow.

10. Choosing Based on Low Rates Alone

Mistake: Opting for “cheap” over quality

A provider offering low rates may lure you in—but comes short on support, compliance, integration, or future growth.

Why it matters

Over time, rate differences are outweighed by inefficiencies, fines, missed claims, and lost patient trust.

Solution

Choose the best online payment gateway driven by value—security, simplicity, service, compliance, and scale. You’ll save more in the long run.

Final Checklist: Questions to Ask

Before selecting the best online payment gateway, ensure your provider:

- Is HIPAA + PCI-DSS compliant

- Supports all major payment methods

- Offers EHR/PMS and telehealth integration

- Discloses a transparent fee structure

- Delivers reliable 24/7 customer support

- Includes analytics dashboards and reporting

- Provides denial management and billing follow-up tools

- Scales with your growth plans

- Offers secure mobile and online portals

Why PAYNOVA Is the best payment online gateway for Your Hospital

Choosing the best online payment gateway isn’t just about processing transactions—it’s about solving real problems in your hospital’s billing system. PAYNOVA is purpose-built to do exactly that.

- Healthcare-Centric Features

PAYNOVA understands the unique needs of hospitals. It offers real-time insurance eligibility checks, claims automation, and seamless integration with your existing EHR and PMS systems—reducing billing errors and saving hours of manual work.

- Full Compliance and Security

Compliance is a must in healthcare. PAYNOVA is fully HIPAA and PCI-DSS compliant, using encryption and fraud detection tools to keep both patient and payment data safe from breaches.

- Flexible Payment Options

Whether it’s card, bank transfer, wallet, or recurring plans—PAYNOVA gives patients the flexibility to pay how they want, improving collections and satisfaction.

- Transparent Pricing

No surprises. PAYNOVA offers straightforward, customizable pricing with no hidden fees, helping you control costs while scaling with your hospital’s growth.

- 24/7 Support and Training

Need help? Our expert support team is available around the clock to troubleshoot, train your staff, and make sure everything runs smoothly.

- Scalable and Smart

From small clinics to large health networks, PAYNOVA grows with you. Its real-time dashboards and analytics help you track collections, insurance reimbursements, and patient payments effortlessly.

- Denial Management Made Easy

PAYNOVA’s built-in workflows handle claim denials, track re-submissions, and send reminders—so nothing falls through the cracks.

Final thoughts

Choosing the best online payment gateway for your hospital is not just a tech decision—it’s a strategic investment in patient care, operational efficiency, and revenue health. Avoid these common mistakes and opt for a platform that’s secure, compliant, reliable, and built with your hospital’s current and future needs in mind.

When your patients have the best experience, and your billing runs smoothly, everyone wins—inside your hospital and beyond.

Takeaway:

The best online payment gateway helps hospitals improve billing, compliance, patient satisfaction, and growth. By avoiding common selection errors, you ensure that payments enhance—not hinder—your mission to care.

Want help evaluating gateways or implementing PAYNOVA? Let’s connect.

FAQs: Choosing the Best Online Payment Gateway for Your Hospital

1. What is the best online payment gateway for hospitals?

The best online payment gateway should offer healthcare-specific features like insurance verification, HIPAA compliance, flexible payments, and EHR integration.

2. Why can’t hospitals use regular retail payment gateways?

Retail gateways lack healthcare functions like claims handling, co-pay support, and regulatory compliance. Hospitals need specialized features to manage complexity.

3. What makes PAYNOVA different from other gateways?

PAYNOVA is healthcare-first: it supports real-time insurance checks, denial management, HIPAA/PCI-DSS compliance, and integrates with EHR/PMS systems.

4. Does the payment gateway need to be HIPAA and PCI-DSS compliant?

Yes. Compliance protects patient and payment data, avoids legal risks, and builds patient trust. Always choose a provider that meets both standards.

5. Can a hospital use the same gateway for telehealth payments?

Yes. The best online payment gateway should support mobile, virtual, and in-person payments across all services, including telehealth.

6. How do hidden fees impact payment gateway decisions?

Hidden setup, chargeback, or tiered pricing fees can inflate costs over time. Always ask for full transparency in pricing before choosing a gateway.

7. What’s the easiest payment gateway for growing hospital networks?

Look for a solution like PAYNOVA that is scalable, integrates with multiple systems, and offers robust analytics for expanding healthcare operations.